Article Summary: 2013 has brought mixed signals for the USDCHF. Traders will look to identify short term direction for scalping opportunities.

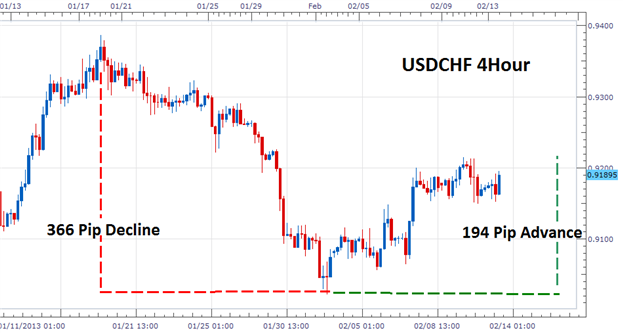

Finding a short term market bias for scalping can be difficult for traders. This is especially true if short term momentum differs from a long standing trend. The USDCHF 4Hour chart below is a great example of how these two trends can come into conflict.

Below we immediately see the USDCHF declining as much as 366 pips in the direction of the primary trend. Now price is currently advancing against that trend, moving 194 pips higher over the course of the last two trading weeks!

As scalpers the question is whether we should be looking to buy or sell the market. So which is it? One way we can further refine our outlook on the market is to continue our analysis by blocking off a 30 minute chart.

Learn Forex – USDCHF 4Hour Trend

(Created using FXCM’s Marketscope 2.0 charts)

USDCHF Building Blocks

One technique designed to identify short term momentum is to divide the previous week’s trading into two trading Blocks. This analysis is critical to scalpers to ensure that short term momentum is heading in a singular direction providing traders opportunities to trade with the trend. If both blocks indicate increasing prices, scalpers will look for the opportunity to buy the market. Conversely, if momentum is down in both pricing blocks traders will look to sell the market.

Below we can see the current USDCHF 30 minute chart divided into two pricing blocks. Block 1 begins on Wednesday the 6th and runs through Sunday the 10th. Block 1displayed strong upward momentum as price advanced to its high at .9203. Block 2 shows the continuation of an uptrend as price again broke to higher highs. To indicate a continued price advance both blocks have been painted in blue. As both blocks have been painted blue traders will look for the continuation of a bull trend on the USDCHF.

Learn Forex – USDCHF Building Blocks

(Created using FXCM’s Marketscope 2.0 charts)

It is important to notice that price at present has neither broken a new high or low relative to Block 2. At present prices our current price block will be painted yellow upon closing indicating market indecision. Scalpers can take advantage of a resumption of momentum if price begins to move higher and breakout through resistance. A break below support would indicate at least a short term reversal in our trend and a potential momentum shift on the USDCHF.

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information

Would you like a customized curriculum to walk you through Trading Education?

Take our Trader IQ quiz and receive a full lesson plan with numerous free resources t

o expand your information arsenal.

http://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2013/02/07/High_Probability_Breakout_Trading_in_Forex_2.6.html