Talking Points:

- Fundamentals track economic changes

- Traders want to buy the currency with strong fundamentals

- Check the economic calendar for upcoming events

Trade analysis is normally grouped into two categories, Technical and Fundamental. Normally when developing a trading strategy, traders will choose one or even a combination of both forms of analysis when developing a trading plan. While its always important to know and understand key technical levels, it is also good to know what is fundamentally driving market price.

This series of articles is geared to better understating Fundamental trading, and how shifts in market data can affect market price. Today we will begin by reviewing exactly what fundamentals are and where we can find pertinent market data to make better trading decisions.

What is a Fundamental

So what is a market fundamental? A market fundamental is a piece of specific data or event that causes money to flow either in or out of an underlying asset. As a trader we attempt to find the strongest currency and pair it with a weaker one. This means when trading a fundamental strategy, we will be looking for a series of data points that makes one more attractive than the other.

Knowing this, traders should be factoring in things such as employment data, inflation, interest rates and even political turmoil before buying a particular currency. If the underlying fundamental data is improving or getting stronger we have found a candidate currency to buy relative to another with poor performance.

Economic Calendar

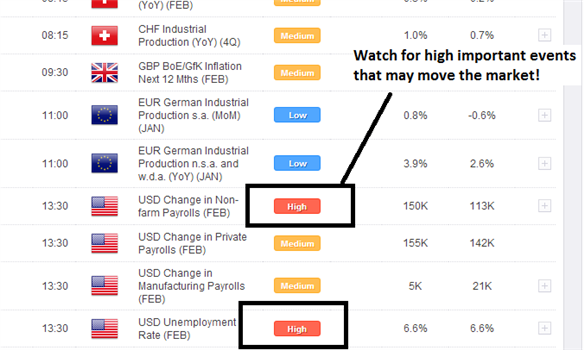

So now that you are a little more familiar with what a fundamental is, now we need to find all this data so we can make an educated trading decision. Every good fundamental trader should have access to an economic calendar. This is where we can see which data points are being released from week to week. DailyFX updates an economic calendar HERE providing insight into what day and time releases are held, along with past data and current expectations.

Traders should keep an eye on the calendar at all times, as data hits or misses expectations this will ultimately change our fundamental outlook on a currency.

Which Events to Track

The final question is which events we should follow. This is a fair question, because there is a slew of economic data released each week! To help make things easier, the high importance events have been marked on the economic calendar as depicted above. These are the events that our normally monitored by policy makers such as central banks and have the ability to immediately influence market price. While these events are certainly important, just watching events such as this week’s employment figures for the US may not give us an overall opinion of the market.

The key to trading fundamentals is to combine a variety of data points to then make an educated trading decision. As we continue our study of fundamentals we will take a look at the main influences on an economy and how they can mold our trading opinion.

Watch the Market

As a fundamental trader, it is important to know how different events affect the valuation of a currency. To follow along with the market, make sure to sign up for a Free Forex Demo account with FXCM. This will allow you to monitor, track and trade currencies in real time.

This will conclude our first look at Forex fundamentals. In our next edition, we will begin looking at capital flows and how they can affect price and our outlook on the market!

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information

New to the FX market? Save hours in figuring out what FOREX trading is all about. Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!