Trade size is an important aspect of every trading plan. Traders quickly forget this to their own peril. Many traders are not reaching their trading goals because their trade size was too large for their account equity which leads to reluctance of letting go of losing trades.

This article will present an easy way to determine what trade size is appropriate for your account.

When trade size gets out of hand and too large, all the analysis in the world is worthless. The risk can quickly outweigh the benefits. Because of this, having a formula to manage your risk is of extreme value for your trading career. If you’re not a math major, no worries at all. A simple formula is provided at the end of the article for you apply moving forward.

Here is a visualization of the risk you take based on your trade size from Mark Douglas’ Trading in the Zone. To borrow his analogy on trade size, imagine there is a large valley much like the Grand Canyon that you are about to cross. The width of the bridge you will cross is directly related to the number of lots you will trade. As you can imagine, if you’re about to cross the Grand Canyon on a 10 lane highway bridge, you’re not going to fear walking across. You know the potential of pain is small because the bridge below you is steady. Now, the larger trade size you open in relation to your account, the smaller the road below you shrinks. Using the utmost leverage available, you’re essentially walking a tight rope. As you can imagine, the smallest fluctuation in the market can throw you over board.

Now, let’s walk through the application in finding the right trade size for you.

*Examples below will be filtered through the eyes of a $10,000 account with 2% max trade risk rule to determine trade size.

Here are the two aspects you’ll need to answer before determining appropriate trade size:

- Percent risk you’re willing to accept per trade –We recommend less than 2%

- Where do you want your stop in terms of pips

Percent risk you’re willing to accept

This will have nothing to do with the market and everything to do with your account balance. You determine your risk, not the market. Your money management system will tell you where to get out of every trade. We recommend you limit your risk per trade to less than 2% of your account equity. Noting this before you enter a trade is being proactive and will prevent you from increasing your exposure based on how good a set up looks to you. All good traders look to limit risk and most poor traders neglect this.

Many good traders will keep a trade journal that will have their current account equity updated and how much they should risk on any one trade. Our $10,000 account example with the 2% max trade risk tells us that before we look at the charts, we are only willing to lose $200 on a single trade. For most traders, this relieves stress by itself.

Converting that risk into Trade Size

Now that we know how much is at risk, we next decide the best trade size for us based on our pip based exit. Here is a simple formula to use to determine your trade size:

Proper Trade Size Formula:

Your three inputs will be your account balance, what percentage you want to risk, and the number of pips you are willing to allow the market to go against you before you exit the trade.

Account balanceX% risked / stop loss distance in pips = maximum value per pip

Using our example above and plugging into the formula, here are the three inputs.

Account balance = $10,000

Percent Risk = 2%

Stop loss distance = 100 pips

Plugging them into the formula:

$10,000 X 2% / 100 pips = $2 per pip

If you want a larger trade size, we recommend you find another trade that better suits your account size or add more funds to your account.

Why do we advise limiting your trade size?

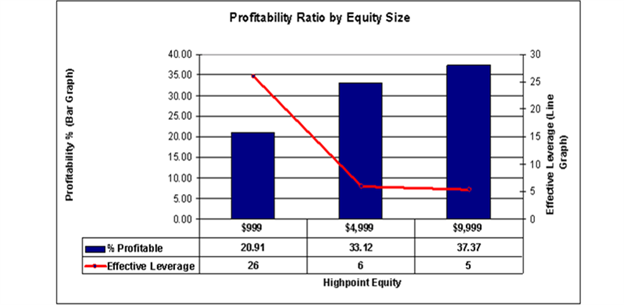

DailyFX recently went through 12 million live trades to find the common traits of our successful clients. Leverage was a main focus because many traders know what amount of leverage is available but few knew what was amount was best. Many new and inexperienced traders over expose themselves and when the market went against them, a large percentage of their account dissipated. Successful traders in our study consistently stayed under 10 X effective leverage and were often closer to 5 times effective leverage.

Here is a graph from the study to show you profitability percentage and it’s correlation to lower effective leverage.

(Graph courtesy of DailyFX, Traits of Successful Trader: How Much Capital Should I Trade Forex With?)

We encourage you to always define risk specific to your account and limit your leverage to assist in the longevity and success of your trading business.

Next: What is Rollover? (46 of 48)

Previous: The Importance of Stops

---Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@DailYFX.com.