Talking Points:

- Longer-term moves capture price moves caused by fundamental shifts

- Prices are not random and outlier moves are often extended

- Money seeking the most favorable trade will often develop extended trends

- You need to be able to determine when to trade trends and when not to

Traders who look for a system that is low maintenance while allowing for access to nice market moves often turn to trend trading. Trend trading is a method that allows you to take advantage of the big market moves while ignoring the small moves in hopes of making money often capturing the big move. However, it’s important to note that this trend trading should only be utilized in trending markets and are best left alone when markets aren’t trending.

Learn Forex: Trend Following Is About Capturing the Big Moves

Presented by FXCM’s Marketscope Charts

Longer-term moves capture price moves caused by fundamental shifts

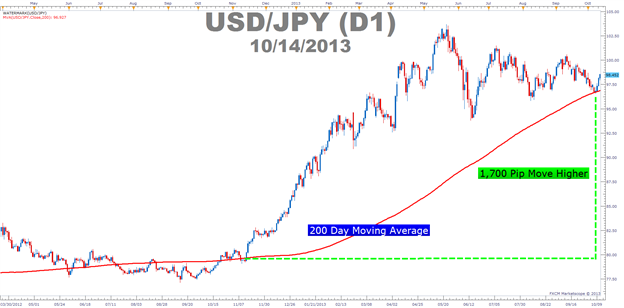

Price trends like the one seen above in the USDJPY pair is often influenced by Economic trends. The USDJPY is specifically being influenced by a plan of the Prime Minister of Japan to weaken the JPY and as an effect drive up both the USDJPY and Tokyo’s stock market the Nikkei 225. As you can imagine, economic trends take a while to develop and often persist until a shock to the system or an eventual decline of new buyers begins to see the trend to its end.

Many traders take a multi-faceted approach to the market. They do this by waiting for the technical picture or price action patterns to converge with the fundaments back-drop before taking a trade. As you can see from above, price moved above the 200-day simple moving average which is a technical buy signal as the Japanese government committed publicly weakening the JPY which helped push the USDJPY higher by over 1,700 pips in the last 12 months.

If this concept is confusing or if you don’t feel like you have the tools to trade like a professional, we’ve created a FREE certificate course here to help you understand the key concepts we believe a professional trader should know.

Prices are not random and outlier moves are often extended

When looking at a price chart unfold, there’s a constant feeling that haunts many traders. That feeling is that the rising trend that they just entered is about to be topping out or that buy trade they just exited as a loss is nearing the bottom of its move before moving higher. However, more often most traders would expect, there is an unusually large number of strong directional price moves especially at the last leg of a move.

Learn Forex: Moves Often Continue Past Market Consensus

Presented by FXCM’s Marketscope Charts

However, when you tend to embrace trend trading, this point of anxiety whereas you were likely trying to buy the bottom and sell the top has now become a favored point in your trading. I often share as one of my preferred that trading rules that stood the test of time price can often outlast your capital and its best to not fight the trend but rather join it. Naturally, a trend will eventually turn when the fundamental news (see #1) begins to change or when there are no longer enough buyers to push up prices to new heights but in the meantime, it’s much better to gain on the trend’s momentum that be opposing the momentum.

Money seeking the most favorable trade will often develop trends

Lately, I’ve been rather bullish on the Australian Dollar as it looks to me as the AUDUSD and AUDJPY has likely put in a bottom. However, beyond the technical argument, the yield is simply much better for the Australian Dollar than in other currencies and the map of the world is often a flow of investor funds seeking the best yield. As you can imagine, as this picture becomes clear to many, additional money will likely flow into the Australian dollar and continue the trend.

Learn Forex: AUD ties NZD as the Highest Interest Rate among Major Currencies

Presented by FXCM’s Marketscope Charts

Now, please understand, my view on the AUD is one that is temporary working but I don’t know if it will continue. A few things could offset this positive price action like a US default of its debt or a slowdown in Chinese demand and production. However, should things continue course and money continues to seek a safe yield like it traditionally has then the uptrend in the AUD is likely to continue.

You need to be able to determine when to trade trends and when not to

If a new trader came up to me and asked what one piece of advice I had for someone who wanted to trade trends, I would simply reply that make sure you are only trading when a clear trend is present. In other words, you will likely frustrate your efforts if you try and squeeze a trend out of a clear range. While this may appear as trite advice, it’s clear that a trend system will quickly run out of purchasing power if it enters in a sideways market that continues sideways.

Learn forex: USDJPY Should Only Be Entered on a Breakout if you’re Trend Following

Presented by FXCM’s Marketscope Charts

The purpose of trading breakouts is to enter on the resumption of the trend after the sideways price action has preceded. I recently wrote about polarity points on the charts and the concept goes that once a ceiling or floor in the market is broken, the role of that level is often flipped. Therefore, what was once a price ceiling becomes a price floor when broken and vice versa.

Closing Thoughts

You should now have a clearer understanding of why trends develop and why they can often last longer than many anticipate. As opposed to being frustrated by the presence of a trend, it’s often best to join the trend while it is in action. However, it is often best to wait for a breakout to make sure that you’re entering on the resumption of the trend so you don’t get caught up in the sideways price action that often develops after a big move and many of the traders in the prior trend are taking profits.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@dailyfx.com

To be added to Tyler’s e-mail distribution list, please click here.

As a dedicated FX Trader, would you like the following?

- Faster access to fundamental releases that is likely to move the markets

- Feedback on market movements in real time

- Real time Speculative Sentiment Index Readings

Our Real-Time DailyFX on Demand is a fee based service that gives you access to our professional trading staff from 6am – 2pm ET Every trading day so you can get feedback on your trade setups and ideas.