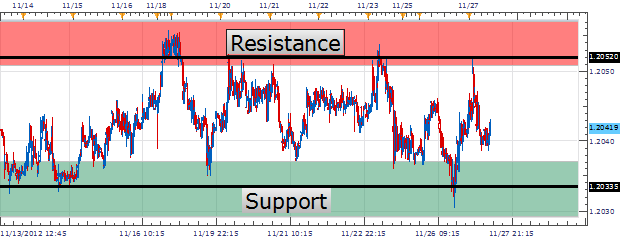

Traders tend to focus on trending markets but between times of directional moves, traders may find periods where currencies trade virtually sideways. These periods are known as ranging markets and are usually defined on a graph by identifying horizontal levels of support and resistance. Below we can see an example of a defined 20 pip range range on the EURCHF 30min graph. Overhead resistance has been found by matching a series of market highs near 1.2050. Support is conversely found by matching a series of lows near 1.2030. With these areas defined we can then proceed with a trading plan to buy and sell at these specific pricing points. To better time our entries today we will be turning to RSI and its overbought and oversold levels.

(Createdby Walker England)

RSI is a versital indicator and can be used in both trending and range bound market conditions. However during ranging market conditions, we want to time our entries when support / resistance points line up with RSI and overbought / oversold conditions. Timing is key, and we can see on the graph below that the previous trading signal allowed us to sell resistance as RSI moved from overbought levels. A s price declines traders can look for a fresh signal to buy the EURCHF at support if RSI becomes oversold.

Unlike trend traders, range traders enjoy participating in a market without a clear market bias. Traders can continue to buy and sell between support and resistance levels until price breaks through the levels mentioned above. Since there is always a possibility of a breakout, it is impartive that range traders use a stop when trading. An easy way to set these orders it to place stops outside of support when buy or resistance when selling. Even though the EURCHF has a small range, using these levels can still allow a trader to employ a positive Risk/Reward ratio.

(Created by Walker England)

Using the RSI with the chart mentioned above, my preference is to sell the EURCHF on a return from overbought levels near 1.2050 or better. New orders can target range support at 1.2030 with stops placed outside of resistance as described above. Targets should be placed near support looking for approximately 20 pips of profit while extrapolating a 1:2 or better Risk/Reward level.

Alternatives include price breaking out of the mentioned range.

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.