Fibonacci retracements are a tool used in financial markets to find points of support and resistance on a price chart. These levels are found by first pinpointing a high and low of a assets original price move. Retracements denote the percentage price rebounds (retraces) from these extreme points on the graph.

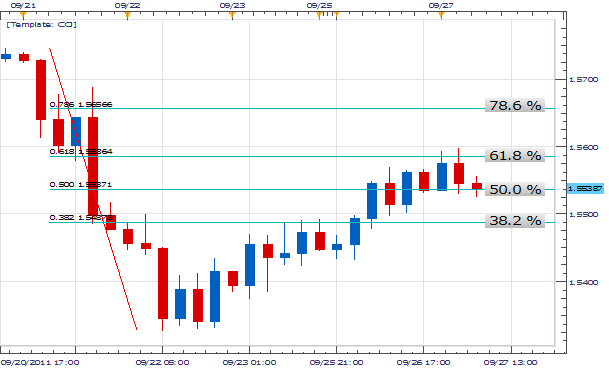

Fibonacci retracements of 23.6%, 38.2%, 50%, 61.8% and 78.6% are often used in financial markets. Visually these points are represented on the graph by horizontal lines denoting support and resistance levels. Traders may use these lines in a variety of ways. Traditionally, traders begin to look for price to move from these levels back into the direction of the initial trend.

(Created using FXCM’s Marketscope 2.0 charts)

Fibonacci retracement levels can be found on a variety of charts and time frames. As well, retracement levels can be used by trend traders or breakout traders. Trend traders often use Fibonacci retracements in conjuncture with other forms of technical analysis such as trend lines and oscillators for timing market entries. The Chart below demonstrates how a Fibonacci retracement may match up with a strong trend line. As price rallies to the 61.8% mark, we may wait to use a cross on the CCI (Commodity Channel Index) to execute and enter into our trade.

(Created using FXCM’s Marketscope 2.0 charts)

The following setup is an example of trading with the trend. We are looking to sell the GBP/USD in the direction of our longer term trend line, once price has tested resistance at our designated Fibonacci level. As you continue to trade markets, you will notice that price rarely moves in one direction and retracements may take time to develop. However, knowledge of Fibonacci Retracements is a great way for the patient trader to enter in with longer term market movements.

Additional Resources

Using Trend Lines as Support and Resistance

Never Trade without a Protective Stop

Walker England contributes to the Instructor Trading Tips articles.To receive more timely notifications on his reports, email instructor@dailyfx.com to be added to the distribution list.