Talking Points

- Crude Oil Prices Bounce from Support at $46.00

- Historical Bearish Price Distributions Begin at $46.85

- If you are looking for more trading ideas for oil, check out our Trading Guides

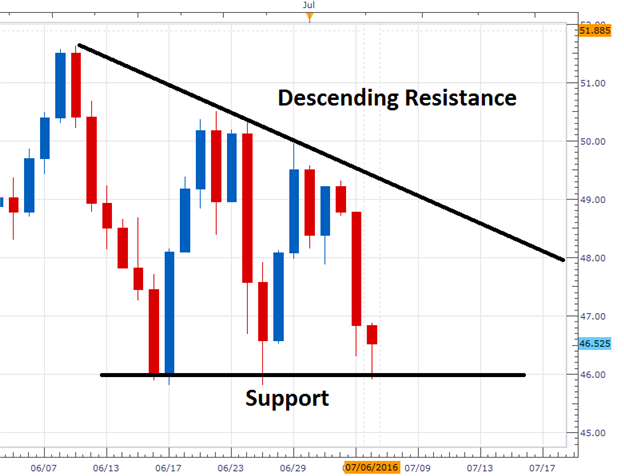

WTI Crude Oil Prices have bounced off of key support this morning near $46.00. With prices failing to breakout lower, it suggests that Crude Oil prices may be rebounding inside of a consolidating triangle. As trading continues however, traders should continue to monitor this value. A move below support would suggest a resumption of the 2016 bear trend. Alternatively, if prices rebound further, it opens Crude Oil prices to test daily resistance under $4900

WTI Crude Oil Prices, Daily Chart

(Created by Walker England)

Displayed in the 5-minute chart below, Crude Oil prices can be seen trending higher off of the daily lows at $45.90. The GSI indicator has noted this short-term upswing, by highlighting a series of higher highs and higher lows printed in the last hour of trading. After reviewing 4,057,983 pricing points, GSI has indicated that price action has advanced a minimum of 15 cents in 71% of the 110 matching historical events. Traders looking for a return to the early bearish market conditions should watch for a move to the last historical bearish distribution found at $45.91. Prices only declined by 75 cents in 5% of matching events, but a move to this value would set Crude Oil up to trade towards a new daily low.

Want to learn more about GSI? Get started learning about the Index HERE.

Crude Oil 5 Minute GSI Chart

(Created by Walker England)

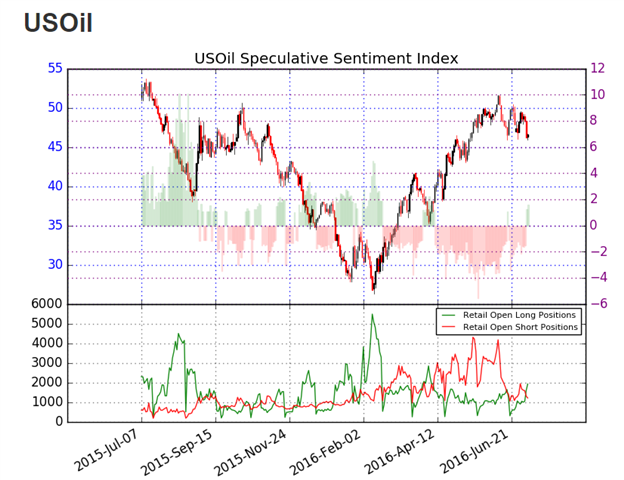

Sentiment for WTI Crude Oil (Ticker: USOIL) remains positive with SSI (speculative sentiment index) standing at +1.56. With 61% of positioning long, this may suggest that Crude Oil Prices may continue to trade lower. In the event of a further price decline, traders should look for SSI to extend to a positive extreme of +2.0 or greater. Alternatively, in the event that prices continue to trade higher, traders should watch for SSI to level out from extremes and move towards a more neutral value.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.