Talking Points

- Today’s AUDUSD trading range measures 56 pips

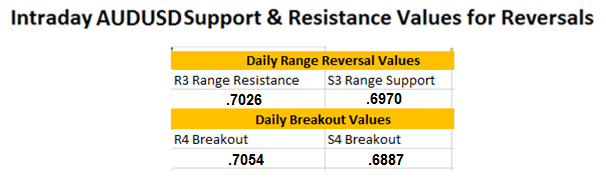

- R3 range resistance is found at .7026

- Bearish breakouts begin under .6943

AUDUSD 30Minute Chart

(Created using Trading View Charts)

Looking for more FX Reversals? Sign up for my email list here: SIGN UP HERE

The AUDUSD is threatening to breakout to new weekly lows this Thursday. As of the US Open the pair has already tested the S4 Camarilla pivot, found at a price of .6943. In the event that the pair trades below this value, it would be considered a bearish breakout. So far, the AUDUSD has declined in the three previous trading sessions, and a breakout here would be the third bearish breakout in the four previous trading sessions. If prices continue to decline, traders may use a 1x extension of today’s 56 pip range to measures a preliminary pricing target. As measured from the S4 Camarilla Pivot, this places initial targets at a price of .6887.

Alternatively, if prices re-enter into today’s trading range, starting at the S3 pivot found at .6970, it may open up the pair to a potential price reversal. This scenario includes prices attempting to move through values of resistance including the R3 range resistance pivot found at a price of .7026. A full bullish reversal would also be considered if prices broke above the R4 pivot at .7054. In either reversal scenario, the current short term bearish momentum would be invalidated. At which point, trend traders should at least temporarily consider putting any sell based positioning on hold.

Need help identifying short term values of support and resistance? Learn to use Camarilla pivots in your trading! To get started learning more about pivots, and how to identify intraday price reversals, continue your education with DailyFX HERE.

Once you are ready to get started, register for a FREE Forex demo with FXCM. This way you can practiceyour day trading techniques while watching Forex pairs in real time.

Previous Market Setups

EURUSD Trades to Range Support

GBPUSD Attempts 3rd Bullish Breakout

EURGBP Continues to Trade in Range

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email instructor@dailyfx.com.

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)