Talking Points

- EURUSD attempts to breakout over 1.1420

- Range resistance sits at 1.1377

- A decline exposes support at 1.1252

EURUSD 30Minute Chart

(Created using Trading View Charts: Click on the chart below to zoom in; after zooming in, press the play button towards the right to set the market in motion )

Looking for more FX Reversals? Sign up for my email list here: SIGN UP HERE

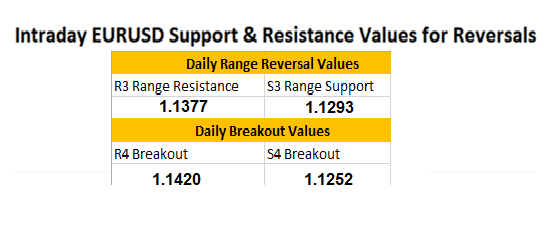

The EURUSD has attempted to breakout higher this morning, testing resistance found at today’s R4 Camarilla pivot at 1.1420. Price has now attempted to breakout a total of 3 times, and has so far failed to break above resistance in each approach. In the event that the EURUSD does break higher, the pair has the potential to close higher for the third time in four trading sessions this week. Traders following the trend can take a potential breakout as a bullish continuation signal, and look for opportunities to position themselves accordingly.

In the event that prices fall, and the EURUSD trades back below its R3 pivot at 1.1377, this would temporarily stall any bullish scenario. A move to this point would open the market up to a potential reversal for the pair. This would include a move through today’s 84 pip pivot range towards the S3 pivot found at 1.1293. A broader reversal would be extend through the S4 pivot found at 1.1252. A move to this point would have further bearish implications, as prices would be trading back below the weekly open.

Using Camarilla pivots is just one way to approach day trading. To help you get started in your trading pursuit, DailyFX hosts a variety of day trading webinars. To learn more and register for future events, see the webinar calendar listed HERE.

Previous Market Setups

GBPUSD Reaches Range Resistance

USDollar Attempts Breakout on News

EURJPY Fails to Breakout Higher

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email instructor@dailyfx.com.

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)