Talking Points

-Elliott Wave Theory can provide clues to our location within the EURUSD trend

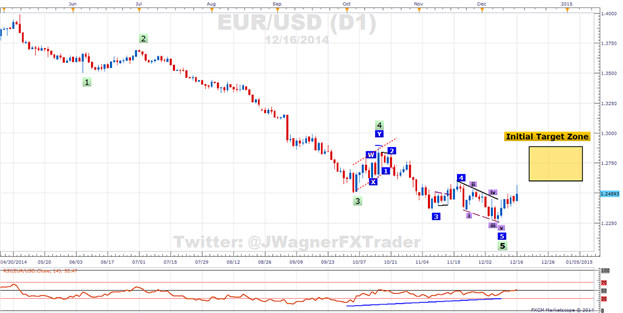

-EURUSD finished a proposed ending wave of an ending wave of an ending wave suggesting a multi-week low on December 8, 2014

-Initial target zone is as high as 1.2900

EUR/USD Daily Chart

(Created using FXCM’s Marketscope 2.0 charts)

To receive future articles via email on trading ideas using equal waves, Elliott waves and triangle patterns, click HERE and enter your email information.

Fibonacci Wave Ratio Analysis

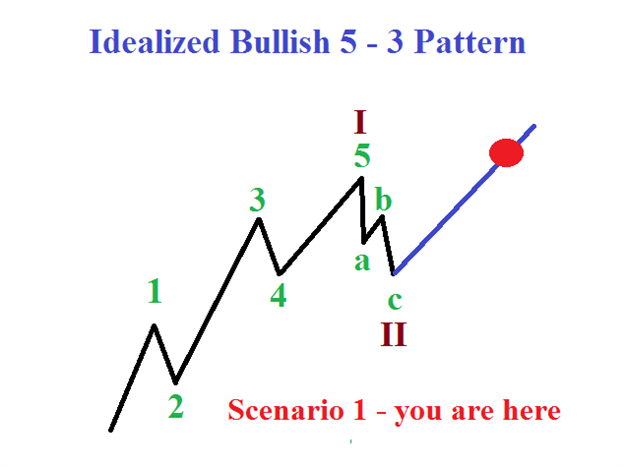

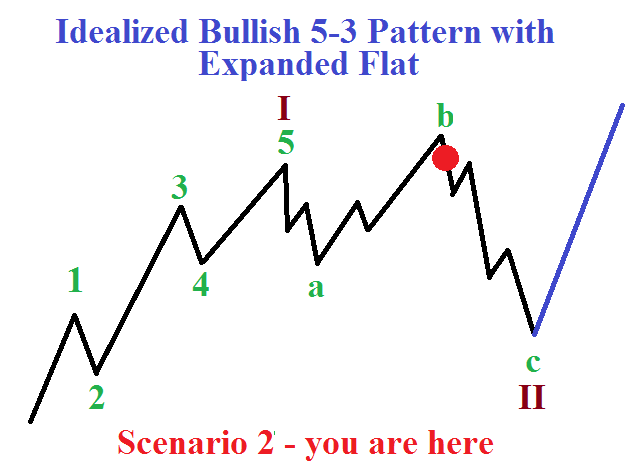

- 5 clear waves higher from the December 8 low suggests the shorter term trend has moved higher

- One scenario suggests an immediate thrust higher under a small wave 3 to 1.2765 (see video and scenario #1 below)

- A second scenario suggests a drop towards 1.2340-1.2370 with the movement since December 11 creating an expanded flat formation (see video and scenario #2 below)

Bottom line, look for opportunities to buy EUR/USD on a breakout higher above this morning’s high or on a dip near 1.2340-1.2370. A move below 1.2450 will begin to suggest a deeper dip is likely towards the 1.2340 area. The December 8 low is the risk level on a deeper dip.

If wave 3 unfolds, either immediately or next week, upside targets towards 1.2765 would be the initial step in a multi-week rally.

From a longer term perspective, wave 4 of the previous trend, meaning the green wave 4 often times acts like a magnet in counter trend rallies. Green wave 4 is near 1.2900 so there are a few pips available should the wave labeling be correct and a rally develop.

Suggested Reading: How to Spot and Trade a Reversal in Forex

Looking for strategies to trade EURUSD on breakouts higher? Need a strategy to capture the EURUSD shifting sentiment which typically comes near market turns? Check out the DailyFX Plus Breakout2 and Momentum2 strategies in Mirror trader.

Good luck!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

Interested in shorter term trading ideas? Check out DailyFX’s premium services. (Subscription credits are available to active and higher equity clients of FXCM.)

See Jeremy’s recent articles at his DailyFX Forex Educators Bio Page.

This article uses Fibonacci ratios to follow a pattern. To learn more about Fibonacci retracement ratios, register and take this free 20 minute on demand course. Register here.