Talking Points

- USDJPY opens in a 44 Pip Range

- Range Resistance Sits at 108.05

- Range Reversals Triggered Under 107.40

USDJPY 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

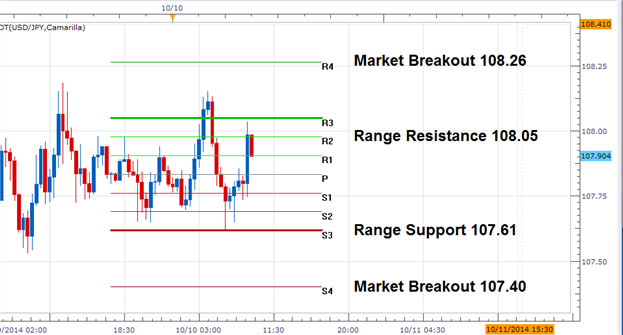

The USDJPY has opened Friday’s trading with price action moving inside of an established 44 pip range. As of today’s U.S. open price has traded through the range 3 times, and price is currently residing beneath range resistance. R3 resistance can be seen depicted above at a price of 108.05. In the event that resistance holds, reversal traders will use this value as a price ceiling while looking for opportunities to trade the USDJPY back towards range support now found at 1.6042.

In the event of increased volatility, traders may begin looking for a price breakout. If the USDJPY moves below the S4 Camarilla Pivot at 107.40, this would signal a shift towards Yen strength for the pair. Conversely, a rise in price above the R4 pivot at 108.26 would create a bullish reversal scenario, with prices trading towards higher highs. With either breakout scenario, current range bound market conditions would be considered concluded. At this point, traders can begin positioning with the markets new directional momentum.

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email instructor@dailyfx.com.

Contact and Follow Walker on Twitter @WEnglandFX.