Talking Points:

- Trend traders can wait for swings against the trend before entry

- Pullbacks in price allow traders to buy the market at a lower price

- An identified swing high or low can be used for setting risk and taking profit

Traders should first look for market direction, before implementing their favorite trading strategy. If a market is trending, traders can wait for a market swing to provide excellent opportunities for placing new entries in the market. Today we will look closer at market swings and how they can be traded by trend traders.

What is a Market Swing?

A market swing is a direct reference to the price action being displayed on the graph. Since price rarely heads in one specific direction, a swing helps define the changes in price. A swing high is looking at the current high displayed on a graph, while a swing low represents the current outstanding low. Normally these swings also help define the trend, if the swing highs are getting higher and the lows are getting higher as well that is a sign of a strong uptrend.

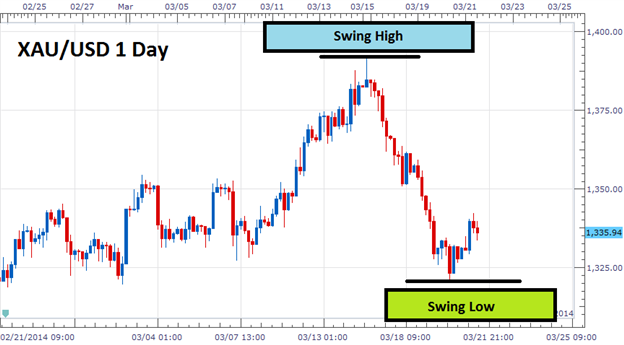

Below we can see an example of the swing high and swing low during an uptrend, on XAU/USD(Gold). Price has been trending upward culminating in price forming a swing high at $1,391.37. From this point, price has pulled back this week to form the current swing low in price which stands at $1,320.40. So now that you know how to spot a price swing, let’s look at how we can take advantage of them.

Learn Forex: Gold with Swing Highs and Lows

(Created using FXCM’s Marketscope charts)

Trading Retracements

Normally traders look to trade swings back in the direction of the trend. These swings against longer term momentum are known as retracements and can allow traders some excellent trading opportunities. Much like in the example with gold any pullback in an extended uptrend can be seen as an opportunity to buy into the market at a cheaper price.

To execute a retracement strategy on a market swing, traders will look for price to put in a new swing low in an uptrend. An entry can then be made when momentum returns back in the direction of the primary trend. Many traders prefer to use an oscillator to time this portion of their strategy by using an indicator such as CCI, MACD or RSI. Risk can also be contained using market swings. In our example stops can be set under the swing low. In the event a lower low is printed, our trend is at least temporarily concluded and all positions should be vacated.

Learn Forex: Entries Using a Swing

(Created using FXCM’s Marketscope charts)

Take profit levels in an uptrend can also be based around an identifiable swing high. As the trend resumes positions can be exited near the denoted point on the graph. Once the trade has concluded, traders can then wait for the next market swing to plan a new entry!

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com

Follow me on Twitter @WEnglandFX.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

Interested in learning more about Forex trading and strategy development? Signup for a series of free “Advanced Trading” guides, to help you get up to speed on a variety of trading topics.

Register here to continue your Forex learning now!