Talking Points

- The AUDNZD remains in one of the markets strongest downtrends.

- Traders can judge trends by using the DMI indicator.

- With DMI – remaining dominant, traders will look for the downtrend to continue.

The first objective of a trend trading plan is to find market direction. There are a variety of methods for finding the trend however interpreting price action can often be difficult and sometimes misleading. To help simplify this process traders can use technical indicators to asssist in finding market direction..

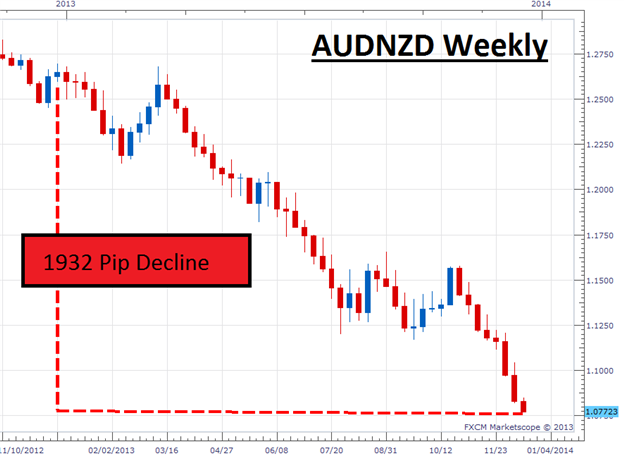

In todays example we will be looking at the AUDNZD currency pair whos weekly chart is pictured below. The pair has declined as much as 1932 pips from its December 12th, 2012 high, making it one of the markets strongest downtrends.Even with such strong movements, traders may question when the market is actually trending or when a retracement is occuring. To answer this question, today we will turn to the Directional Moving Index (DMI) indicator.

Learn Forex – AUDNZD Weekly Trend

(Created using FXCM’s Marketscope 2.0 charts)

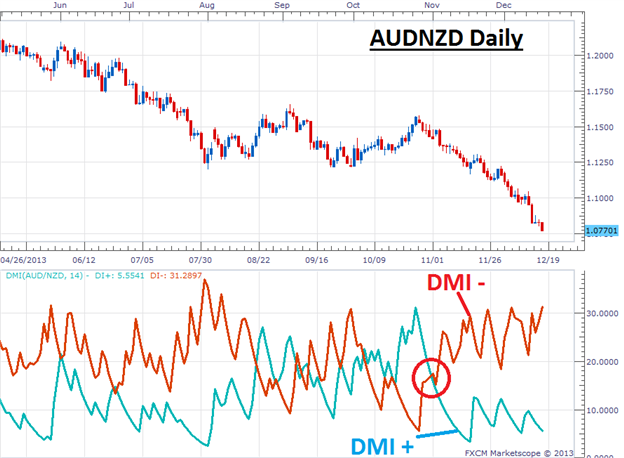

When placed on a chart the DMI indicator is comprised of two lines. The first line is the positive directional movement indicator (DMI+), with the second being a negative directional movement indicator (DMI-). Both lines run in a range between 0-100 to help identify which direction a currency pair is trending. The DMI + line is shown in green in the chart below, and as its name suggests, it helps track price in an uptrend. The DMI - line is depicted as a red line and measures the strength of the market in a downtrend.

Reading DMI is relatively straightforward. Traders will watch both lines oscillate between 0-100 and change their market preference as one line crosses above the other. So all traders have to do, to gauge the trend ,is to identify which DMI line resides above the other. As this line shows the markets underlying strength or weakness it is referred to as the dominant DMI line. In the chart below, DMI - has crossed above DMI +, making it the dominant DMI line and suggesting that the AUDNZD trend is down. If DMI + was the dominant line the opposite would be true. Traders would then conclude that the market was intending to move higher.

Learn Forex – AUDNZD with DMI

(Created using FXCM’s Marketscope 2.0 charts)

Using DMI as a reference my preference is to look for continued weakness in the AUDNZD moving into 2014. This will continue as long as DMI – remains above DMI + indicator lines. One way to trade this market bias is to look for breakouts toward lower lows. If DMI – increases in value, traders may look to employ a trend based trading strategy of their choice

An alternate scenario includes price moving to higher highs. If this occurs traders will be notified as the DMI + line will cross back above DMI -.

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX. To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

New to the FX market? Save hours in figuring out what FOREX trading is all about. Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!