Talking Points

- The RSI Oscillator measures current Forex price strength using previous closing prices

- The Forex closing price is the most important as it reflects money being transferred from losers to winners

- Usually traders look for RSI to move below 30 and back above for a buy signal.

However, an RSI move above 50 is also used to signal a buy as well

RSI is versatile and popular trading indicator used by Forex traders to identify when a currency pair is oversold or overbought. When a Forex currency pair is overbought, it is like a racecar whose engine is red-lining as it is being pushed to the limit by its driver. Eventually, if the driver does not let up off of the accelerator, the engine blows up and the car slows down to a standstill. Currency pairs can continue to make new highs even though they are in an overbought condition as traders continue to bid a currency pair up. RSI is like the tachometer on a car’s dashboard that monitors this momentum.

As traders, we want to join strong trends and catch them in their earliest stages for maximum profit and minimum risk. Forex traders can accomplish both tasks by looking for RSI turning points at 30, 50 and 70. Typically, Forex traders will look for RSI to move down below the 30 horizontal reference line indicating selling momentum is at its peak. Next, they will wait for RSI to move back above the 30 reference line indicating that the oversold condition has passed and the last buyers have been flushed out of the market. This is a clear buy signal as each previous closing price is higher than the one preceding it.

On the other hand, Forex traders looking to short a currency pair will wait for RSI to move above the 70 reference line indicating an overbought condition. As the Forex short-seller is forced out of the market, RSI moves back below the 70 reference line generating a sell signal. Each previous closing price is lower than the one preceding it showing that sellers are taking control.

There is an alternate way that RSI generates a buy and sell signals. When both RSI crosses above the 50 horizontal reference line and price is rising, a buy signal is generated. Also, when price is falling and RSI is crossing below 50 horizontal reference line, a sell signal is generated.

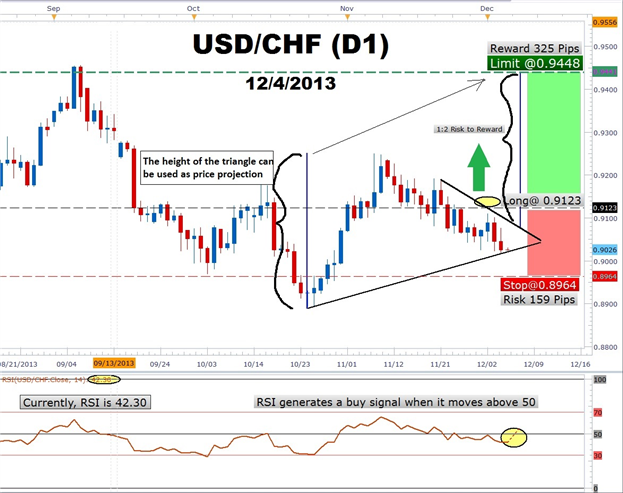

Learn Forex: USDCHF Forex Triangle with RSI

(Chart Created using Marketscope 2.0 charts)

In the example above, USDCHF is trapped in range between 0.9450 and 0.8900. Currently, USDCHF is nearing the bottom of its range and forming a triangle on the daily chart. Though USDCHF has been declining since peaking at the beginning of November in the 0.9250 area, RSI has hugged the bottom of the 50 reference line. A breakout is near and Friday’s US Employment number may be the catalyst that propels USDCHF higher.

Forex traders can look to the RSI indicator for a buy signal. A buy signal would be generated if RSI moved above the 50 horizontal reference line while price is also moving out of the triangle clearing the last swing high near 0.9120. A 1:2 risk reward target of 0.9448 fits in with the range. This long setup would be invalid if price takes out the October lows near 0.8900.

Using RSI can help confirm price pattern breakouts and alert traders when a Forex currency pair is ready to make its next move. RSI can help you avoid the bull and bear traps set with false breakouts. May the Momentum Be With You!

---Written by Gregory McLeod Trading Instructor

To contact Gregory McLeod, email gmcleod@dailyfx.com.

To be added to Greg’s e-mail distribution list, please click here.

Follow me on Twitter @gregmcleodtradr.

This article showed you how to use RSI to trade USDCHF. I want to invite you to enroll in our free Trading with RSI Course to further your understanding of RSI Sign our Guestbook to gain access to this course that will help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate. Register HERE to start your Forex learning now!