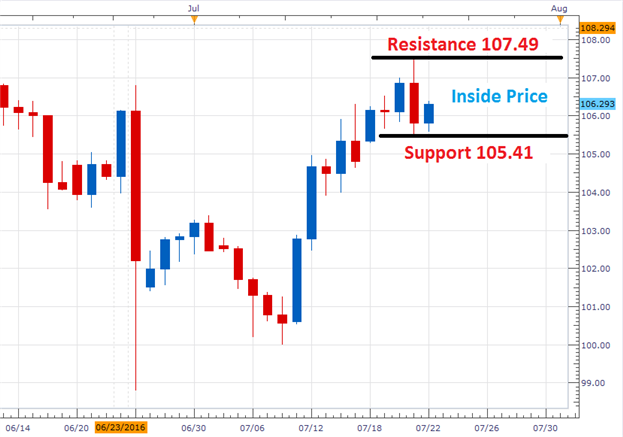

Market Condition: USD/JPY Pending Daily Breakout

Target 1: 1X ATR148 Pips

Target 2: 2x ATR296 Pips

Invalidation: Continued Consolidation

(Created using Marketscope 2.0 Charts)

Last week we discussed the emergence of an inside bar on the daily GBP/USD chart. Today, we have a similar pattern emerging as the USD/JPY is set to close the week with a consolidating inside bar. Using Thursdays’ daily candle as a reference, resistance for USD/JPY may be found at a price of 107.49. Support may be found at 105.41 by referencing Thursday’s low. If prices close the week between these values, traders may look for a potential breakout starting with next week’s open.

Traders should note that ATR for the daily USD/JPY graph measures at 148 pips. Traders may use a 1X ATR extension to find initial bullish or bearish breakout targets. 50% of daily ATR measures 74 pips and can be used to create a 1:2

Risk/Reward ratio for any attempted breakout.

In the event that prices fail to breakout, traders may elect to trade the continued consolidation between the previously mentioned values of support and resistance.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE