Struggling right now? It happens to the best. Check out these four core ideas to help boost your Confidence as a Trader.

AUDNZD trading bias is for more weakness, in-line with macro breakdown

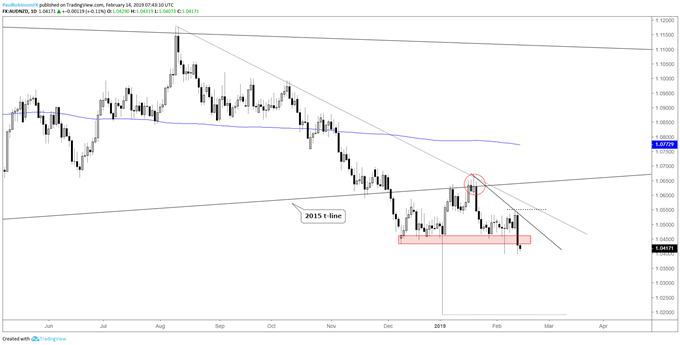

AUDNZD was stuck in a narrowing trading range (wedge) from early 2015 up until it broke in December. The break was initially clean, but then the Jan 2 flash-crash put a bit of a wrinkle into the short-term outlook. Since then we’ve seen a ‘repairing of the chart’ and retest and failure of the underside trend-line of the long-term wedge, further confirmation of the breakdown in December.

This has the broader forces in favor of shorts and if the wedge is to fully play out then this will be the case for quite some time. With that in mind, looking for shorter-term bearish set-ups should put one in-line with the path of least resistance.

Looking for Trading Forecasts and Education to assist you in your trading? We’ve got you covered on the DailyFX Trading Guides page.

AUDNZD Weekly Chart (Wedge broken, big-picture bias is lower)

NZD’s rip yesterday took out the corrective price action in AUDNZD we’d been discussing in recent webinars, also pushing it below most of the lows since December. Staying below the thicket of lows up to around 10470 keeps pressure on the pair in the near-term. It will be important for price to stay below this week’s high of 10546 to maintain a clean bearish bias. Initially, the first target will be the flash-crash low at 10192, but ultimately looking for a move to the 2015 low just above parity and worse.

AUDNZD Daily Chart (Near-term support breaking)

***Updates will be provided on these ideas and others in the trading/technical outlook webinars held on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX