Euro, EUR/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- Euro plunges most since early October on US CPI data

- In response, retail traders boosted upside EUR/USD bets

- Prices also rejected the key falling trendline from July

The Euro plunged over 0.8 percent against the US Dollar on Thursday after a higher-than-expected US CPI report boosted Treasury yields. That was the worst single-day drop since early October. EUR/USD’s drop pushed retail traders to boost upside exposure, which can be seen by taking a look at IG Client Sentiment (IGCS). The latter tends to function as a contrarian indicator. With that in mind, will the Euro continue lower from here?

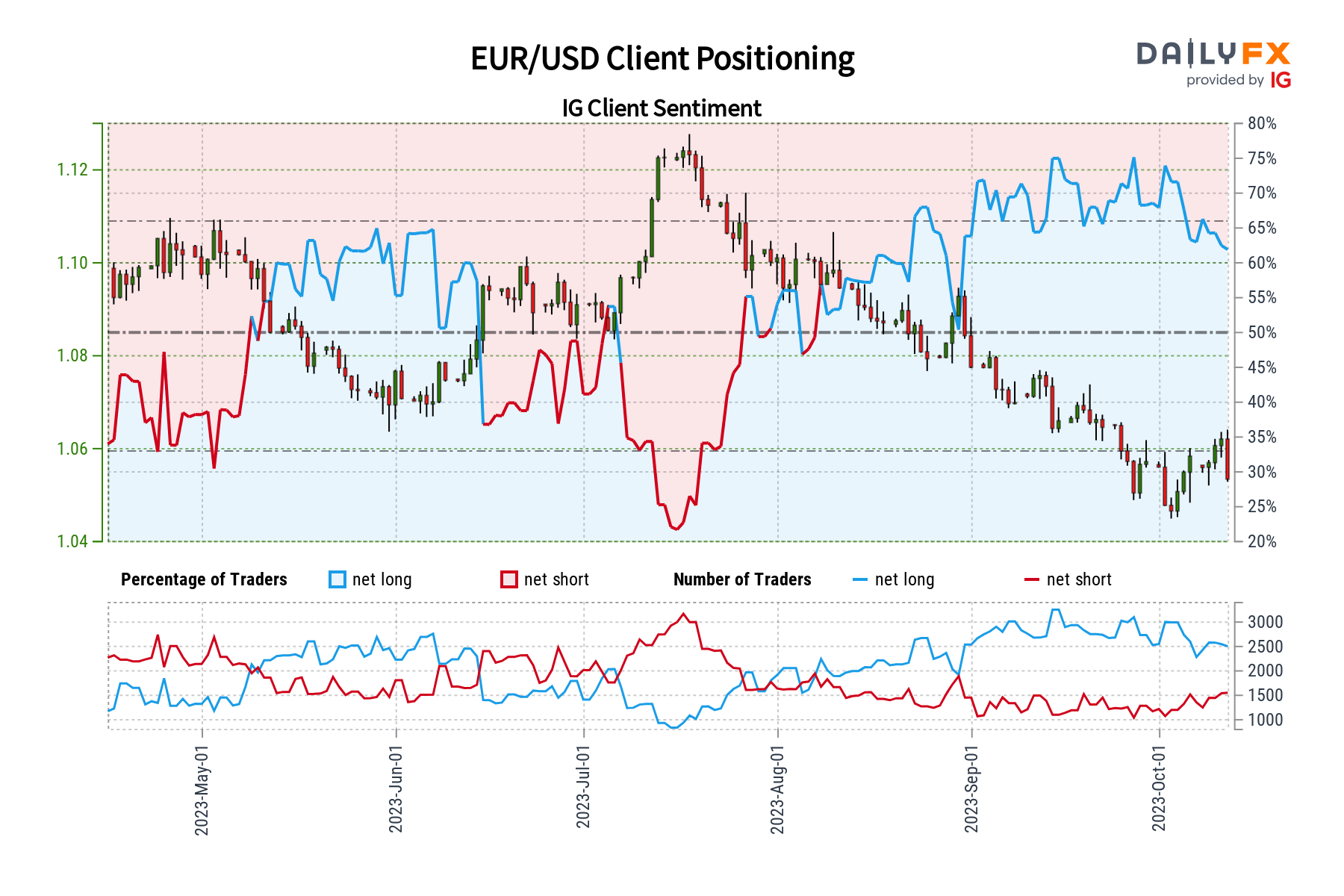

EUR/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 69% of retail traders are net-long EUR/USD. Since most of them remain biased higher, this continues to hint that prices may fall down the road. This is as upside bets increased by 10.46% and 5.62% compared to yesterday and last week, respectively. With that in mind, the combination of overall exposure and recent changes offers a stronger bearish contrarian outlook.

| Change in | Longs | Shorts | OI |

| Daily | 12% | -6% | 3% |

| Weekly | -1% | 4% | 1% |

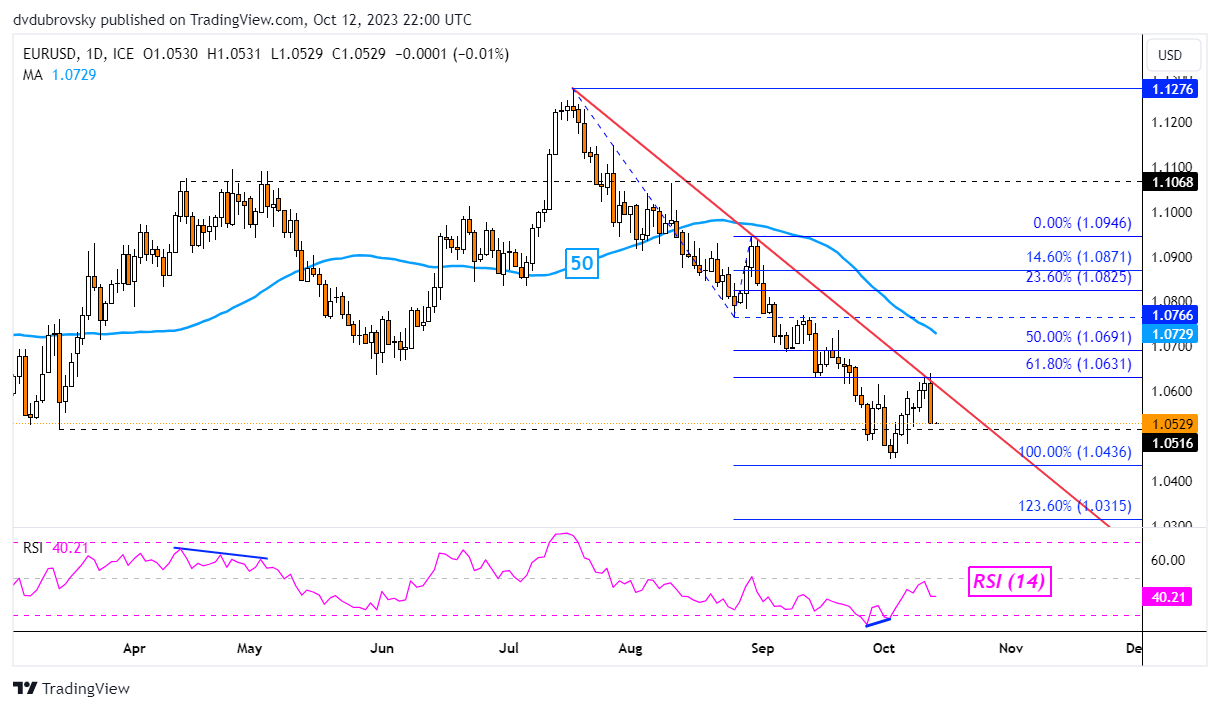

Euro Daily Chart

Focusing on the daily chart below, EUR/USD has turned lower following a rejection of the falling trendline from July. This has reinstated the broader downside focus following cautious gains since the beginning of this month. Now, immediate support is the March low of 1.0516. Below that is the 100% Fibonacci extension level of 1.0436.

Breaking lower opens the door to extending the broader downtrend, exposing the 123.6% Fibonacci extension level of 1.0315. On the other hand, a turn higher and push above the falling trendline would open the door to an increasingly bullish outlook. That exposes the 61.8% level of 1.0631.

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com