USD/JPY Analysis:

- USD/JPY makes modest gains after Japanese data dump

- 157.00 remains elusive for Dollar bulls

- FOMC minutes are up next

- Learn the ins and outs of trading USD/JPY - a pair crucial to international trade and a well-known facilitator of the carry trade

The Japanese Yen was weaker once again against the United States Dollar on Wednesday, a session which saw a raft of economic data releases from Japan, with weaker trade balance numbers taking the currency lower.

The overall Y462.5 billion ($2.96 billion) trade gap for April was much wider than forecast, with Yen weakness boosting the value of imported goods. Exports were up by 8.3% on the year, handily beating the March increase but still much less than the 11% rise economists had hoped for. Bellwether machine orders rose, but official forecasts suggest that they may not continue to do so.

The closely watched ‘Tankan’ business survey found sentiment in the manufacturing sector stable while optimism increased in the service sector.

Still raw data have little chance of affecting USD/JPY trade that much at present, even though the currency did tick lower in Asia.

Japan may have moved gingerly away from its long-held policy of ultra loose monetary policy, but Yen yields remain very low compared to other currencies.’ The Bank of Japan will move interest rates higher extremely gradually, giving the Dollar the monetary edge for the foreseeable future.

The authorities in Tokyo remain ready to intervene should they consider Yen weakness to be ‘disorderly,’ but the monetary disparity between the two countries makes that a hard case to make, and USD/JPY’s uptrend remains entrenched.

Markets remain convinced that the next move in US interest rates will be a cut, but they are resigned to seeing less action on this front than was hoped for at the start of this year. A September move is still thought likely, but it’s heavily dependent on the numbers released between now and then. There are plenty of them.

In terms of trading cues, Wednesday still has the minutes of the Fed’s last rate-setting meet in store. However, we’ve heard plenty from the US central bank since then, and the minutes may be too historic to affect trade much.

USD/JPY Technical Analysis

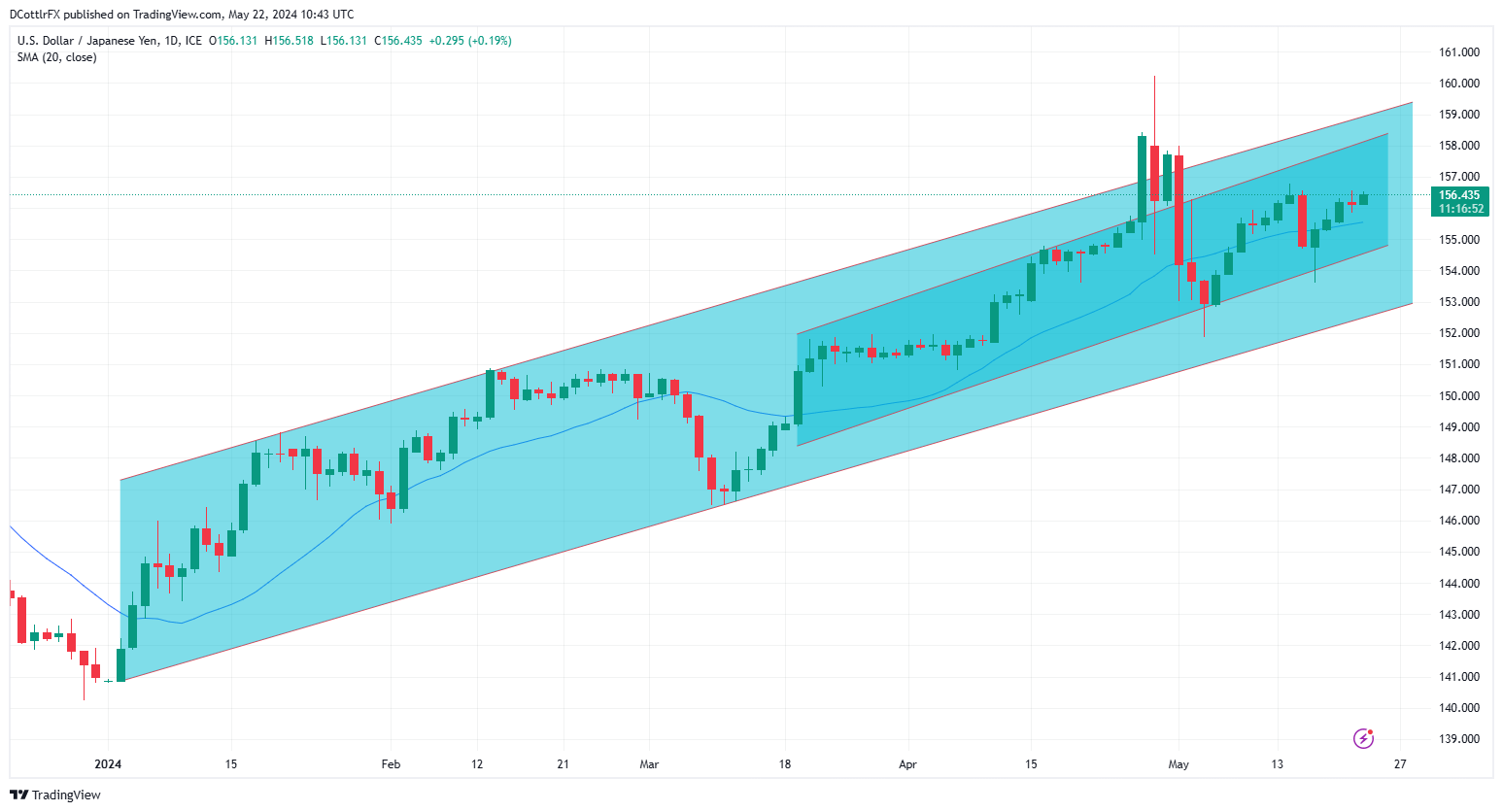

USD/JPY Daily Chart Compiled Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 6% | -1% | 0% |

| Weekly | 3% | 1% | 1% |

USD/JPY remains within a rather better-respected and narrower uptrend channel within the overall range seen since the pair bounced back in January. This narrower band has held on a daily closing basis since mid-March, except for the surge higher at the start of May which was curbed by intervention from the authorities in Tokyo.

It now offers support at 154.479 and resistance at 158.178, although the market is likely to be very wary of pushing that upper limit anytime soon, as that would probably post another intervention risk.

The pair’s 20-day moving average offers near-term support at 155.38.

--By David Cottle for DailyFX