Gold (XAU/USD) Analysis, Outlook, and Charts

- Market pricing suggests that the Fed will start cutting interest rates in May next year.

- Updated economic forecasts on inflation, growth, and unemployment will be key going forward.

New to the Markets and Keen to Learn More? Download our Beginner's Guide Pack Below

Most Read: US Dollar on Edge Before Fed Decision, Technical Setups on EUR/USD and GBP/USD

The Federal Reserve is expected to leave interest rates untouched for the third meeting in a row later today as inflation in the US continues to fall. Chair Powell has remained adamant that the US central bank would hike rates if necessary over the past few meetings, and in other prepared commentary, but he may well ease back on this rhetoric today, suggesting that rates will be on their way down next year. The Fed has pushed back against market pricing of a series of rate cuts over the last few weeks and any change of course by the US central bank will be closely watched. Chair Powell will have the benefit of having seen the latest quarterly inflation, growth, and unemployment forecasts ahead of the policy decision, and these are likely to steer the meeting’s narrative. It is highly unlikely that Chair Powell will say when rate cuts will start next year, leaving himself and the Fed with maximum flexibility, but any hint will embolden bond traders and other rate-sensitive markets.

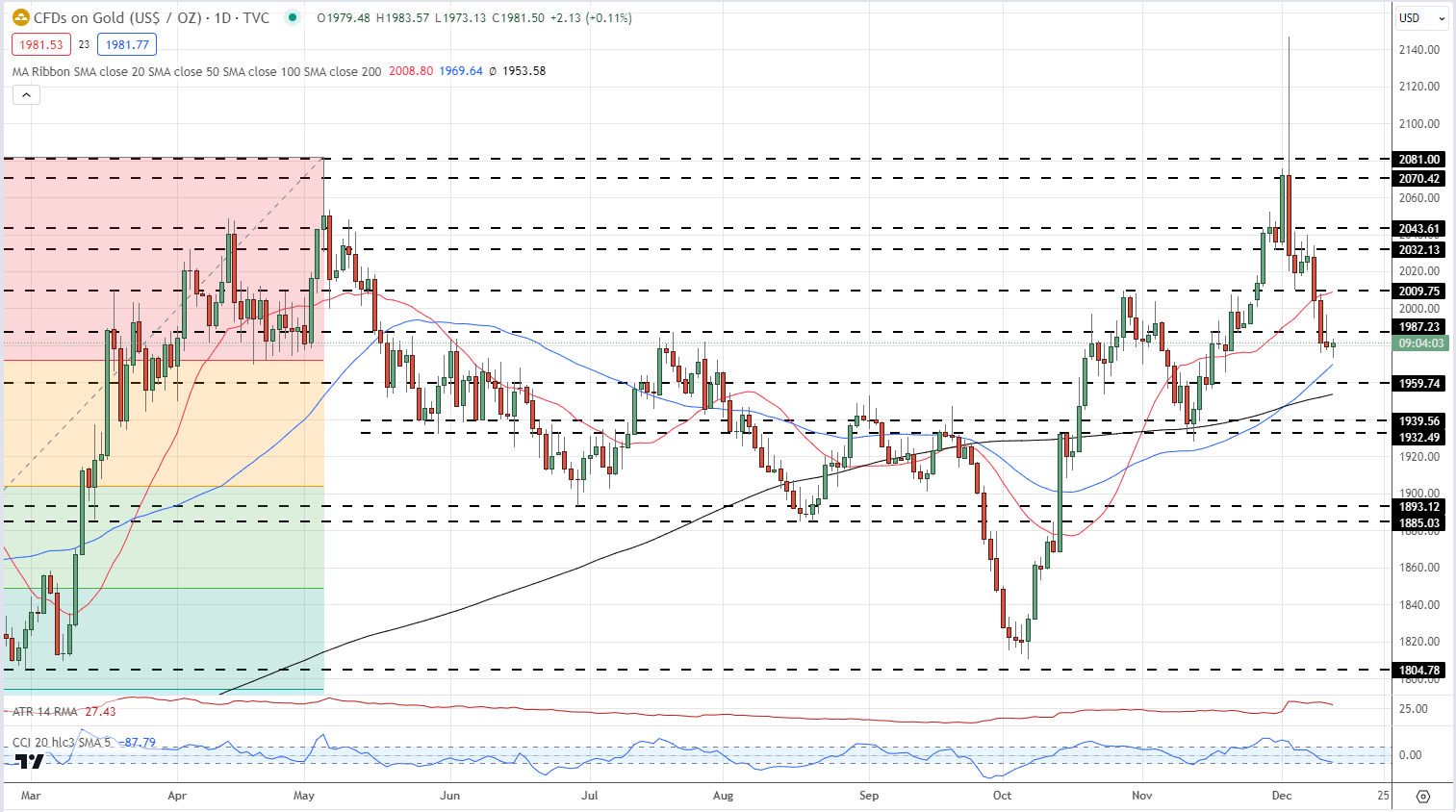

Against this background of lower US interest rates, gold should be pushing higher, but that is not the case. The precious metal has fallen away sharply after hitting a spike high of $2,147/oz. on December 4th.. and is back below the 20-day simple moving average (sma) and is currently testing the 50-day sma. Below here lies prior horizontal support at $1,960/oz. and the long-dated sma is currently at $1,953.5/oz. The recent pattern of higher lows and higher highs remains in place, adding a layer of support for gold, while the CCI indicator shows the precious metal as oversold.

Learn How to Trade Gold with our Complimentary Guide

Gold Daily Price Chart – December 13, 2023

Chart via TradingView

Retail trader data shows 62.17% of traders are net-long with the ratio of traders long to short at 1.64 to 1.The number of traders net-long is 6.42% lower than yesterday and 0.86% higher than last week, while the number of traders net-short is 2.44% higher than yesterday and 13.62% lower than last week.

See how changes in IG Retail Trader data can affect price action.

| Change in | Longs | Shorts | OI |

| Daily | -12% | 7% | -4% |

| Weekly | -6% | 3% | -2% |

Charts via TradingView

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.