GBP/USD Analysis

- Dollar drives GBP/USD higher ahead of crucial UK CPI print next week

- GBP/USD technical levels to watch as new ground is broken above 1.3000

- Sentiment data hints at a bullish continuation as retail sentiment bets on a reversal

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Dollar Drives GBP/USD Higher Ahead of Crucial UK CPI Print

Cable’s recent performance contrasts with what we saw in the days after last month’s Bank of England surprise 50 basis point hike. Back then prices eased as traders took stock of what a step up in interest rates means for the broader economy as more and more homeowners are due to see their fixed rate mortgage periods come to an end.

The new bullish revival is largely due to the sizeable USD selloff that has transpired after a string of encouraging inflation data out of the US. This week traders were filled with more conviction that last May’s lower print was not a one off, sending the dollar sharply lower.

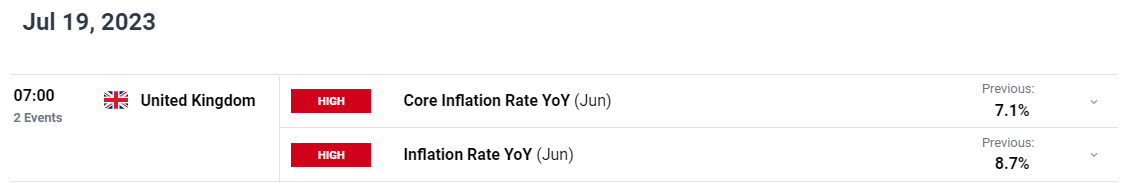

Next week the outlook for cable becomes rather complicated as UK inflation data is due on Wednesday morning. UK core inflation, unlike its US counterpart, has actually seen price pressures accelerate despite the Bank of England’s hawkish stance. Pressure is mounting on Governor Andrew Bailey who has often stated that inflation will fall sharply from Q2 onwards. It hasn’t. Instead, widespread price pressures have gained momentum, offering sustained support for the pound.

Customize and filter live economic data via our DailyFX economic calendar

GBP/USD Technical Considerations

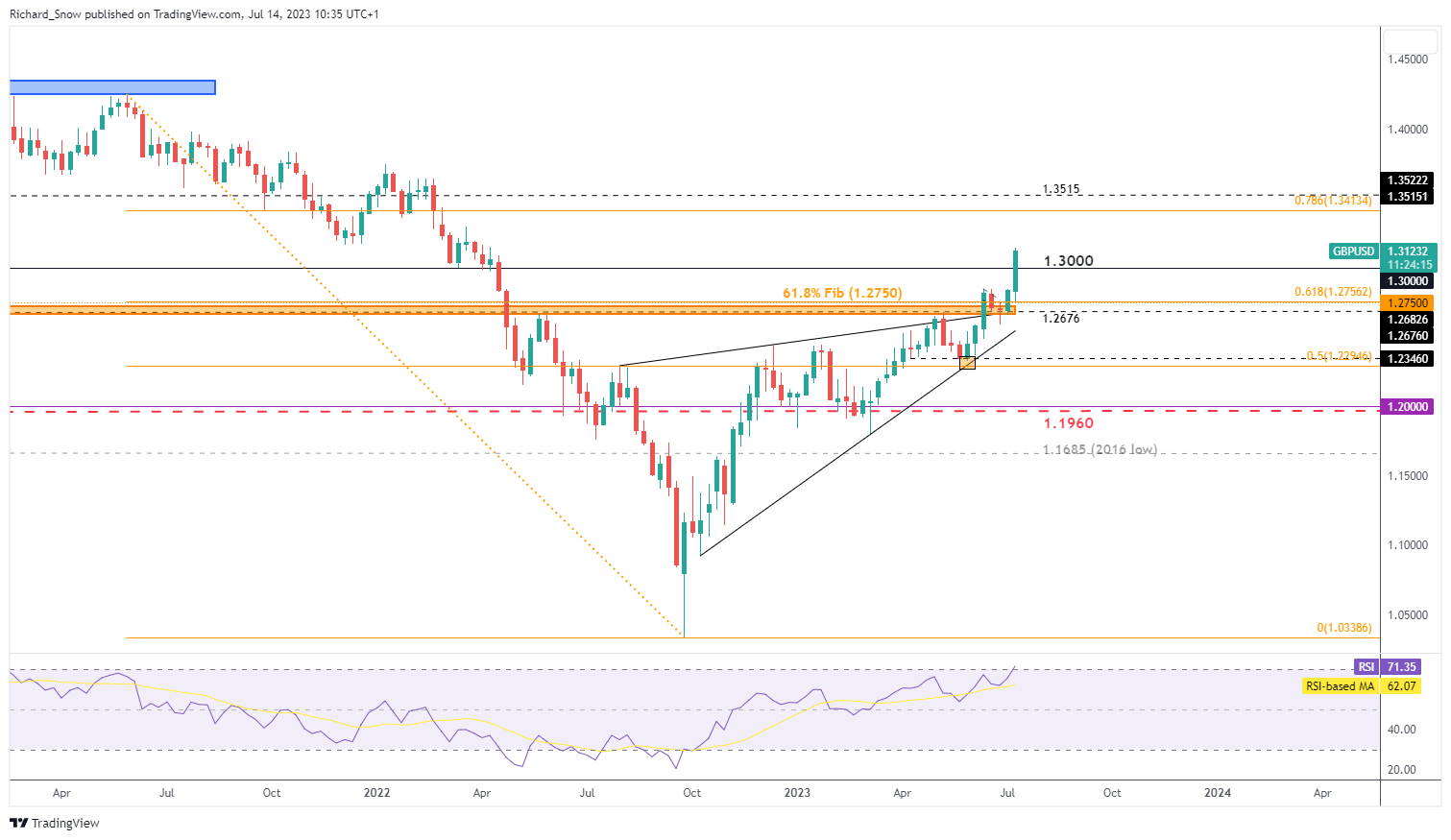

The weekly GBP/USD chart shows the recent bullish advance and how significant it is in a broader context. Prices had been trading within a rising wedge formation, achieving a close above trendline resistance and now on track to build on the move by closing above 1.3000. Kee in mind the exponential rise and how it places the pair into overbought territory on the longer time frame.

GBP/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

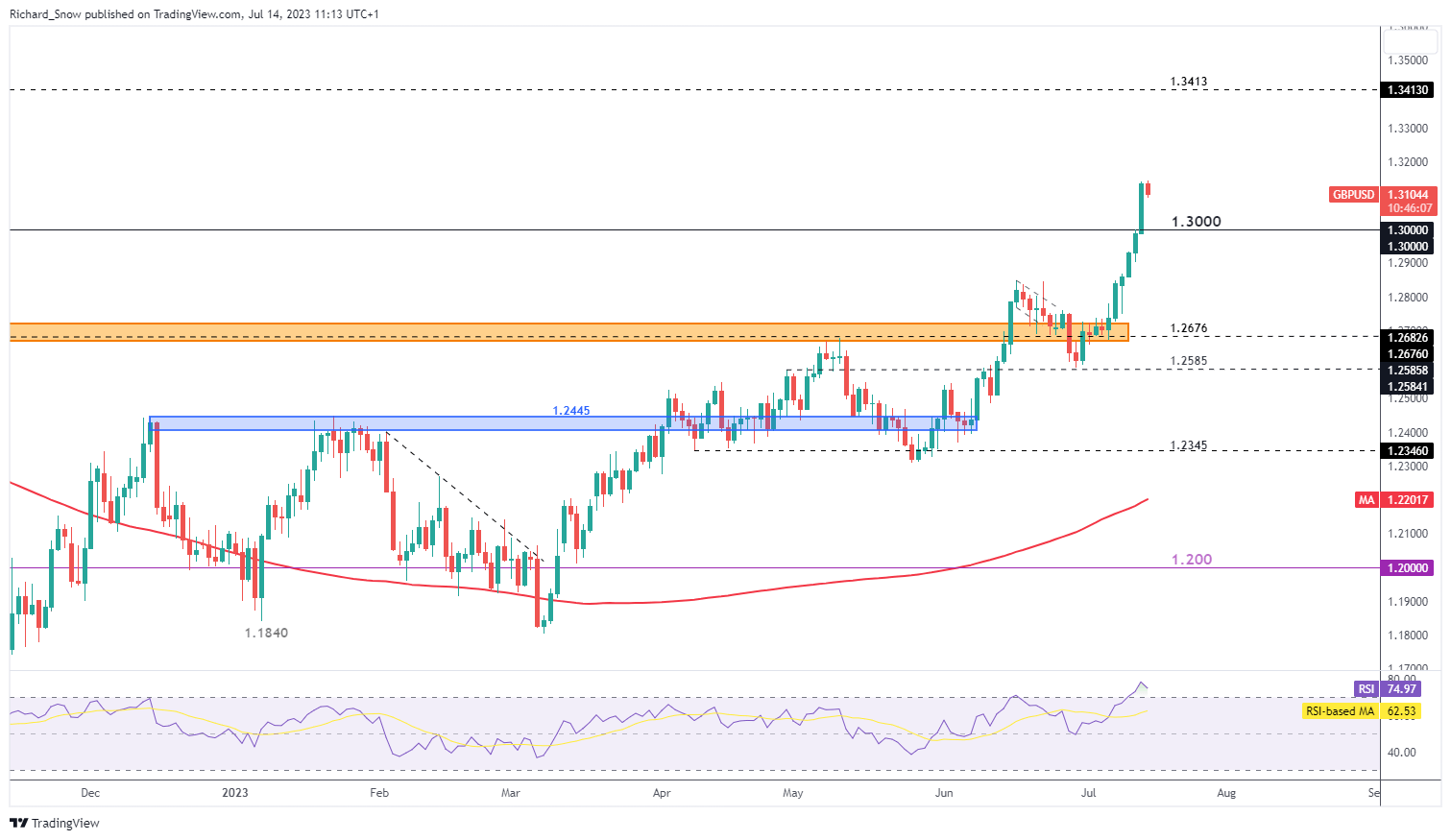

The daily chart reveals the steepness of the ascent, which appears to have cooled in today’s London trading session unsurprisingly seeing that the pair enters overbought territory on both the daily and weekly time frames.

Bulls may be looking for signs of a pullback towards 1.3000 before considering bullish continuation from such extended levels. 1.3000 represents a key psychological level of support with resistance all the way up at the 78.6% Fibonacci retracement of the 2021-2022 decline (1.3413). A hot inflation report next week supports upside potential while an encouraging move lower in core CPI, if large enough, could see the pair surrender a sizeable amount of the recent rise.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Sentiment Favours the Current Uptrend

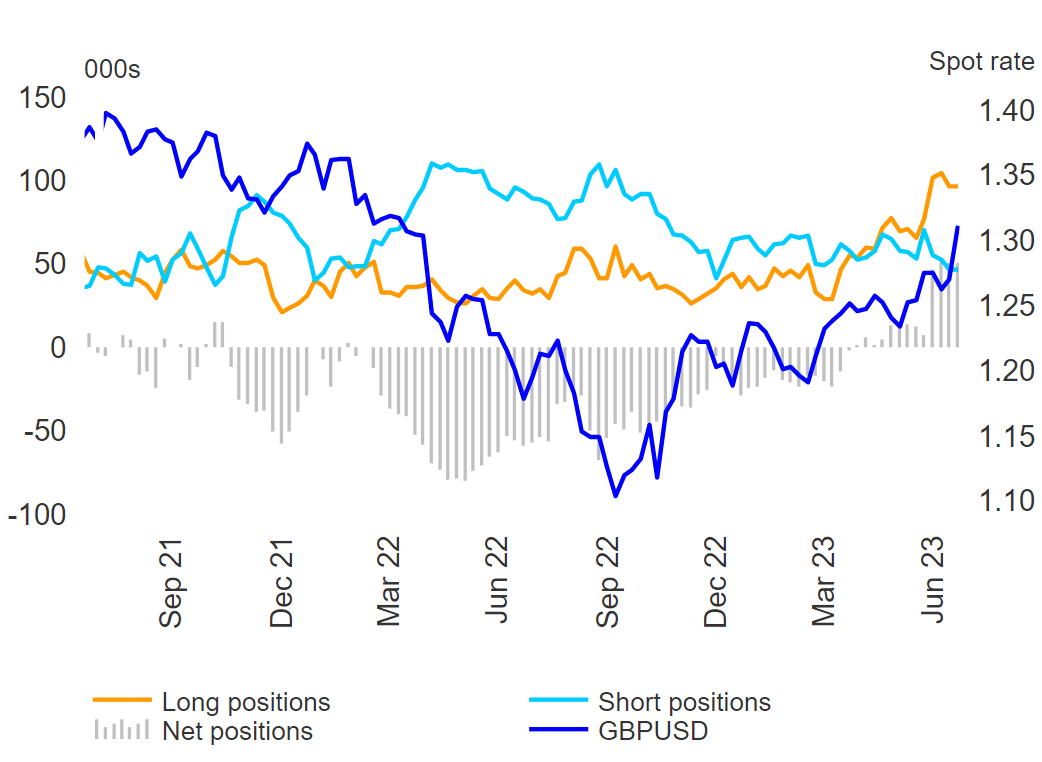

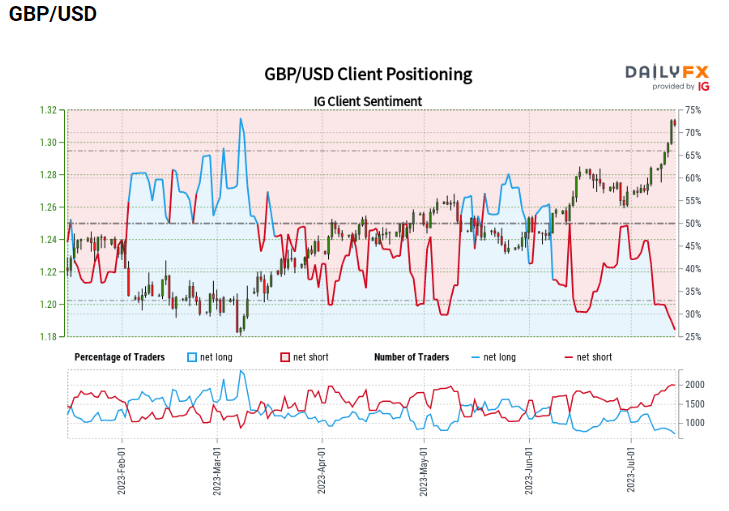

Large institutional speculators continue to position themselves in the direction of the trend while retail clients accumulate bets of a reversal. Net long positioning in sterling remains long.

Speculative positioning according to the commitment of traders report, CFTC

Source: CoT, CFTC, Refinitiv, prepared by Richard Snow

The contrarian indicator that is IG client sentiment, sees traders increase on the short side of cable, anticipating a reversal. This tends to be a challenging position to hold during extended rallies, much like what we are witnessing currently.

IG client sentiment data heavily stacked in favor of a reversal

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX