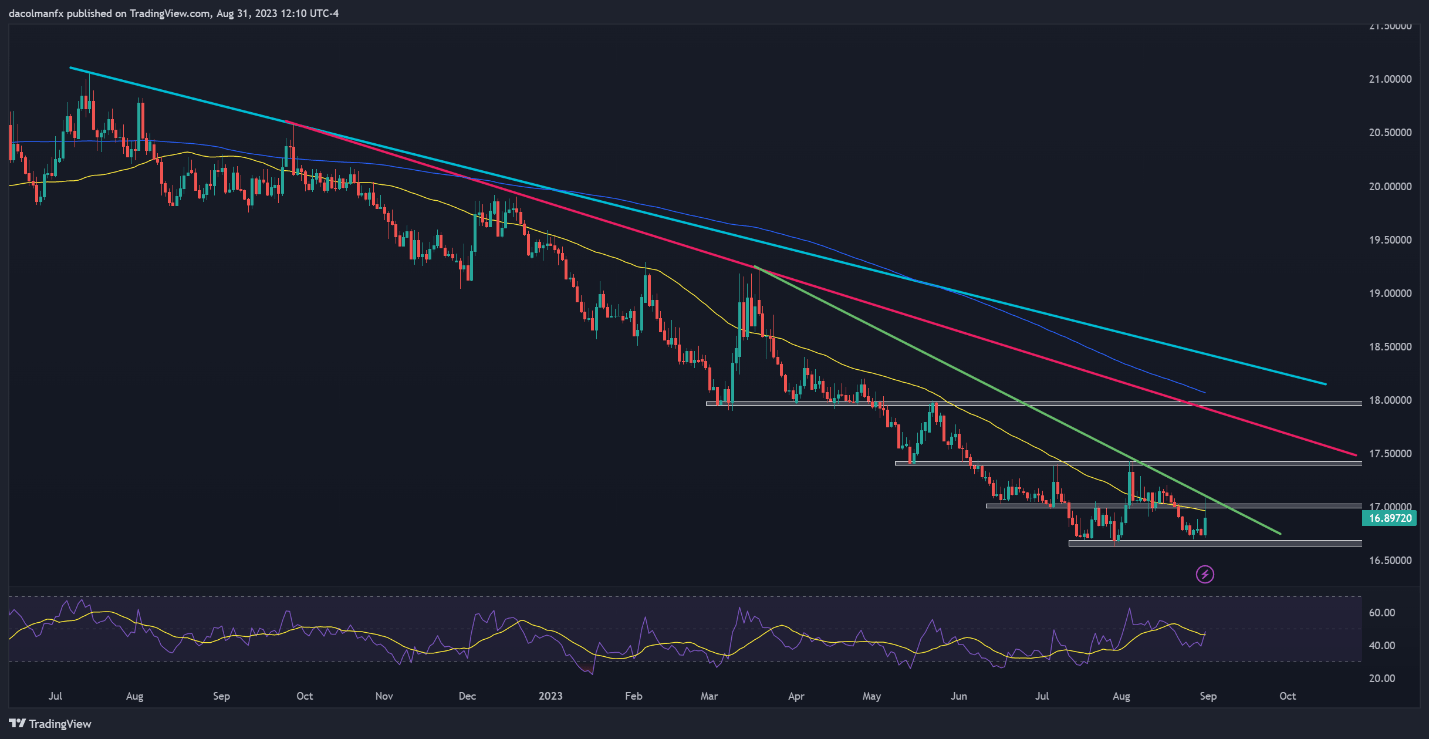

USD/JPY TECHNICAL ANALYSIS

USD/JPY (U.S. dollar – Japanese yen) rallied strongly from mid-July through late August, but its bullish momentum has begun to fade over the past few sessions after prices failed to clear channel resistance at 147.35. Following this rejection, the pair has transitioned into what appears to be a consolidation phase, marked by reduced volatility and predominantly indecisive market movements.

Despite range-bound trading in recent days, USD/JPY remains firmly biased to the upside, evident from the consistent pattern of higher highs and higher lows this year. As such, bulls may soon regain control of the market and gather the necessary impetus to push the exchange rate above overhead resistance at 147.35. This could rekindle buying interest, opening the door to a move towards 149.00.

On the flip side, if sellers resurface and trigger a large selloff, initial support is located at 144.55. Prices may be able to establish a base in this region on a pullback, but in the event of a breakdown, downward pressure could intensify, setting the stage for a drop towards 143.85. On further weakness, the focus shifts to the 50-day simple moving average, followed by 141.75.

Decode market moves and stay ahead of USD/JPY trends. Download the sentiment guide to understand how positioning data can offer clues about the market direction

| Change in | Longs | Shorts | OI |

| Daily | -6% | -3% | -3% |

| Weekly | 7% | 3% | 3% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

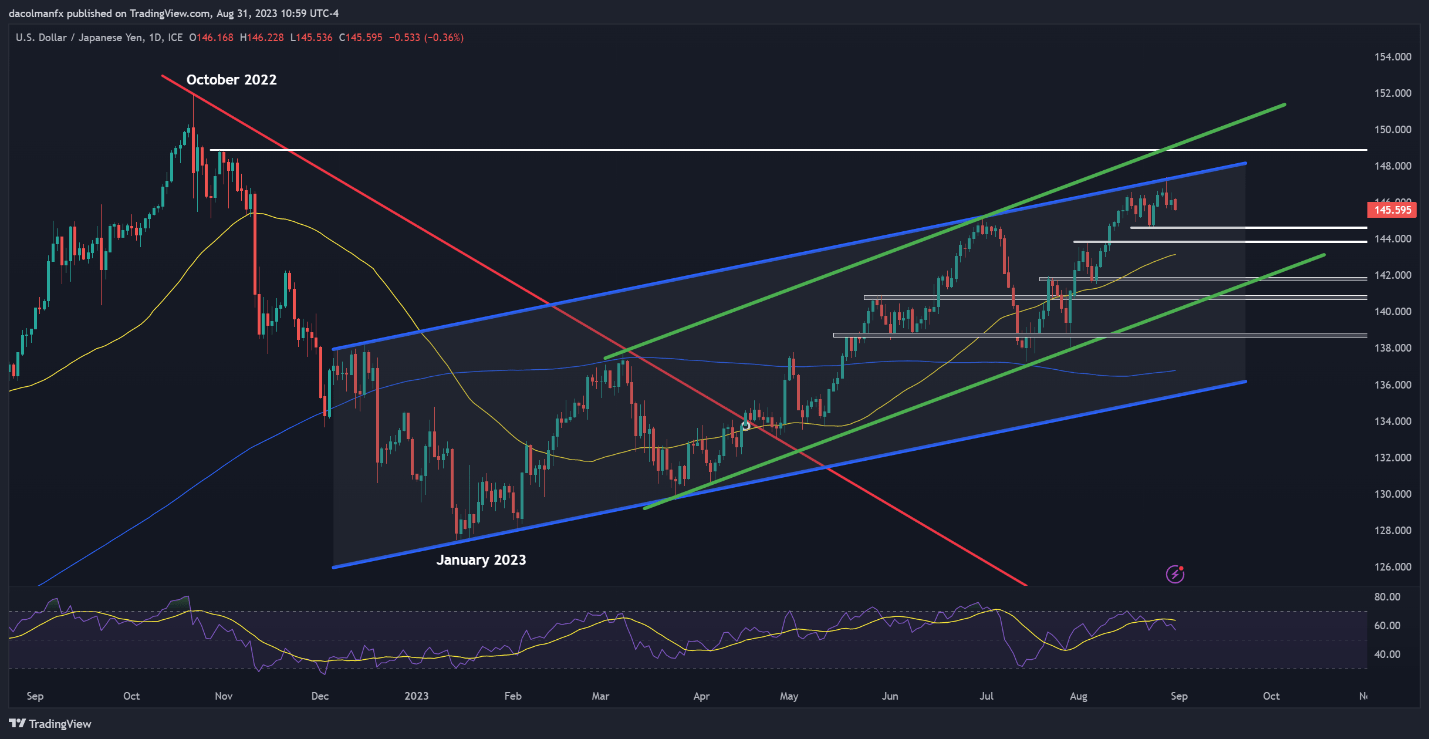

USD/CAD TECHNICAL ANALYSIS

USD/CAD (U.S. dollar – Canadian dollar) also staged a solid advance from the middle of last month through this week, but the pair stalled and began to shift lower following an unsuccessful attempt at breaking overhead resistance, stretching from 1.3640 to 1.3670. After this setback, prices have drifted towards the 1.3500 handle, a key support to keep an eye on in the coming days.

For guidance on the near-term outlook, it is important to watch how prices behave around the 1.3500 psychological level heading into the weekend. A rebound off this technical floor would likely attract new buyers, potentially leading to a revisit of this month’s peak. On further strength, the bulls may become emboldened to initiate a bullish assault on 1.3700, followed by 1.3850.

In contrast, if USD/CAD breaches support at 1.3500 decisively, bearish pressure could gather force, creating the right conditions for a pullback toward the 200-day simple moving average. This technical indicator could stop sellers in their tracks, but in the event it doesn’t, it may be time for the bulls to throw in the towel ahead of a possible drop towards 1.3400.

Leverage the power of positioning data to stay ahead of USD/CAD trends. Download the sentiment guide today. It is totally free!

| Change in | Longs | Shorts | OI |

| Daily | -3% | -6% | -5% |

| Weekly | 24% | -17% | -4% |

USD/CAD TECHNICAL CHART

USD/CAD Chart Prepared Using TradingView

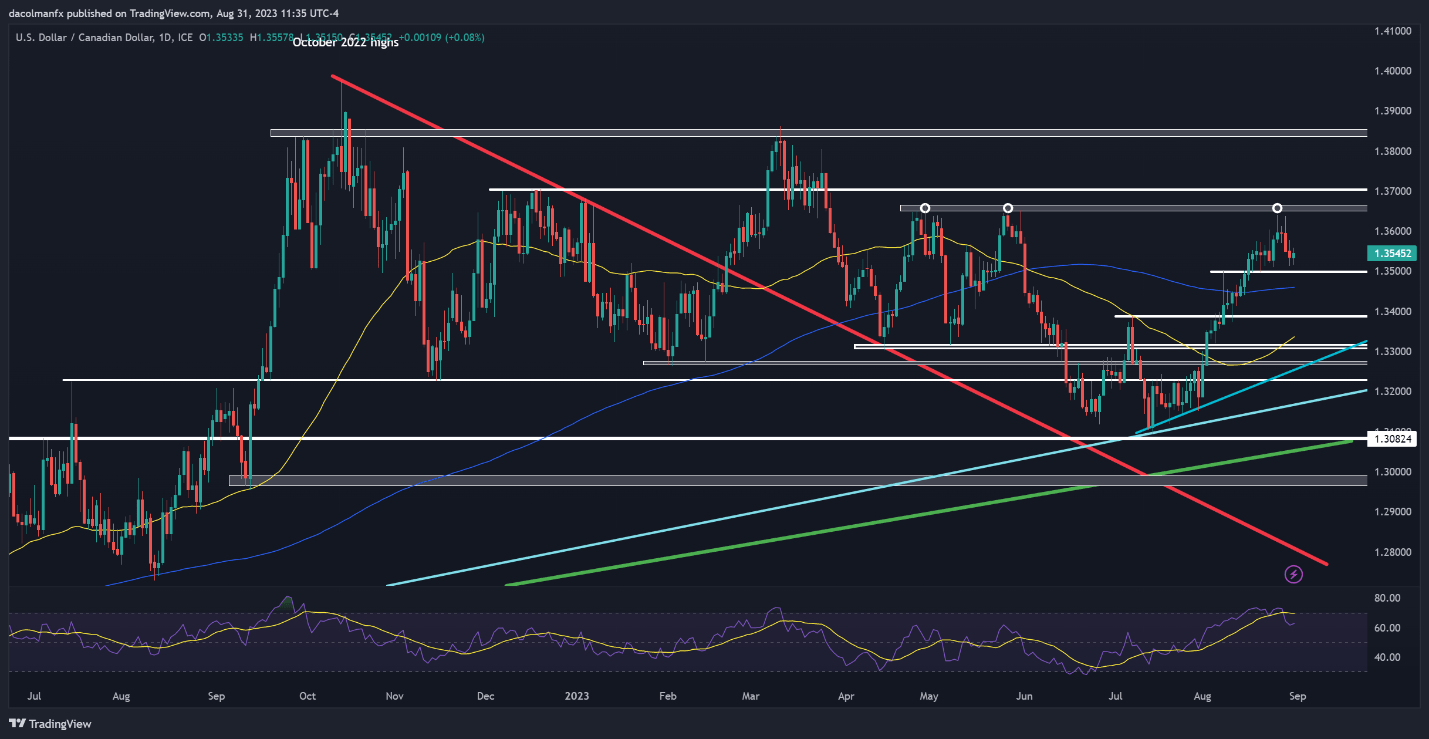

USD/MXN TECHNICAL ANALYSIS

The Mexican peso has strengthened dramatically against the U.S. dollar over the past year, supported in part by Banxico’s aggressive hiking campaign. By way of context, the monetary authority has delivered 725 basis points of cumulative tightening since June 2021 to curtail inflation, bringing its current policy rate to 11.25%, more than double that of the Federal Reserve.

Focusing on USD/MXN from a technical standpoint, the pair has fallen approximately 17% in the last 12 months, making impeccable lower highs and lower lows in the process, indicating strong bearish momentum. Despite the sustained downtrend, there are signs that the pair may be bottoming out. This is exemplified by several unsuccessful attempts to breach the support level at 16.70.

In the grand scheme of things, the underlying bias continues to be negative. However, should USD/MXN sustain and build upon its recent modest recovery from the 16.70 support zone, technical resistance is anticipated between 17.00 and 17.10. If this barrier is taken out, we could see a rally towards 17.40. Conversely, if sellers retake control of the market and drive prices below 16.70 decisively, the possibility of a decline towards the 16.00 threshold becomes more significant.

Interested in a longer-term view of the U.S. dollar? Download the quarterly trading guide for key insights and strategies!

USD/MXN TECHNICAL CHART