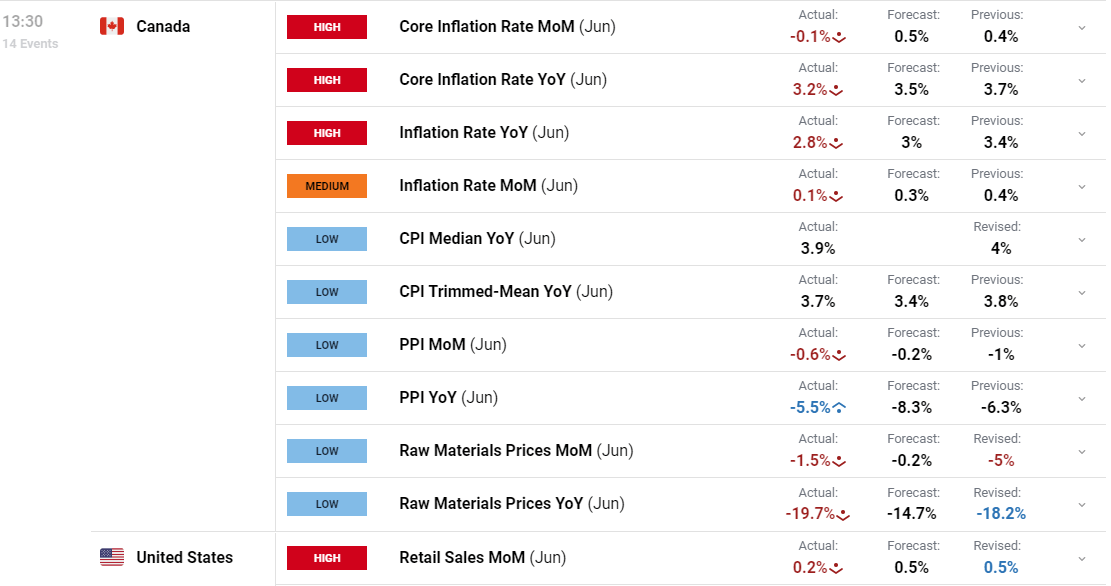

CANADA CPI KEY POINTS:

- Core Inflation Rate YoY (June) 3.2% Vs 3.5% Forecast.

- Inflation Rate YoY (June) 2.8% Vs 3% Forecast.

- Core Inflation Rate MoM (June) 0.1% Vs 0.5% Forecast.

- Money Markets see a 22% chance of a Bank of Canada rate hike in September, down from 25% before the inflation data.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

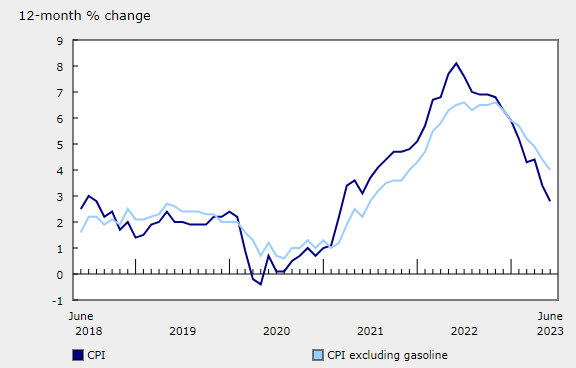

Canadian headline inflation YoY in June declined to 2.8% beating estimates of 3%. The drop in inflation was fairly broad-based with gas prices leading the way. Excluding gasoline, headline inflation would have been4.0% in June, following a4.4% increase in May. Food prices remain a concern, something we are seeing over much of the developed world with the UK in particular struggling with elevated food prices.

Customize and filter live economic data via our DailyFX economic calendar

On a monthly basis, the CPI edged up 0.1% in June, following a 0.4% gain in May. After contributing to the increase in May, travel tours put downward pressure on the monthly all-items index in June. On a seasonally adjusted monthly basis, the CPI also rose0.1%.

Canadian annual core inflation, which excludes food and energy costs, eased to a 2-year low of 3.2% in June 2023, down from 3.7% in May and below market forecasts of 3.5%. In another positive for the Bank of Canada (BoC) PPI MoM also fell by some distance coming in at -0.6% which hints that further easing of price pressures remain on the horizon. The result of the data has seen money markets price in a 22% chance of a Bank of Canada rate hike in September, down from 25% before the inflation data.

Source: Statistics Canada

LOOKING AHEAD BoC AND US FEDERAL RESERVE

Heading into the July 12 meeting all eyes were on the Bank of Canada (BoC) as the Central Bank led the way for Central Banks in the tightening cycle. Having surprised at the previous meeting the 25bps hike at the July meeting was merely a formality with market participants largely pricing it in prior to the meeting. Given today's inflation data have we seen a peak in rates from the BoC? That is a complicated question particularly in response to the warning issued by Governor Macklem who felt that a slowdown in inflation may begin to stall and take longer than initially anticipated. Today's print is likely to be met with a smile from the Governor and could signal an end to rate hikes from the BoC.

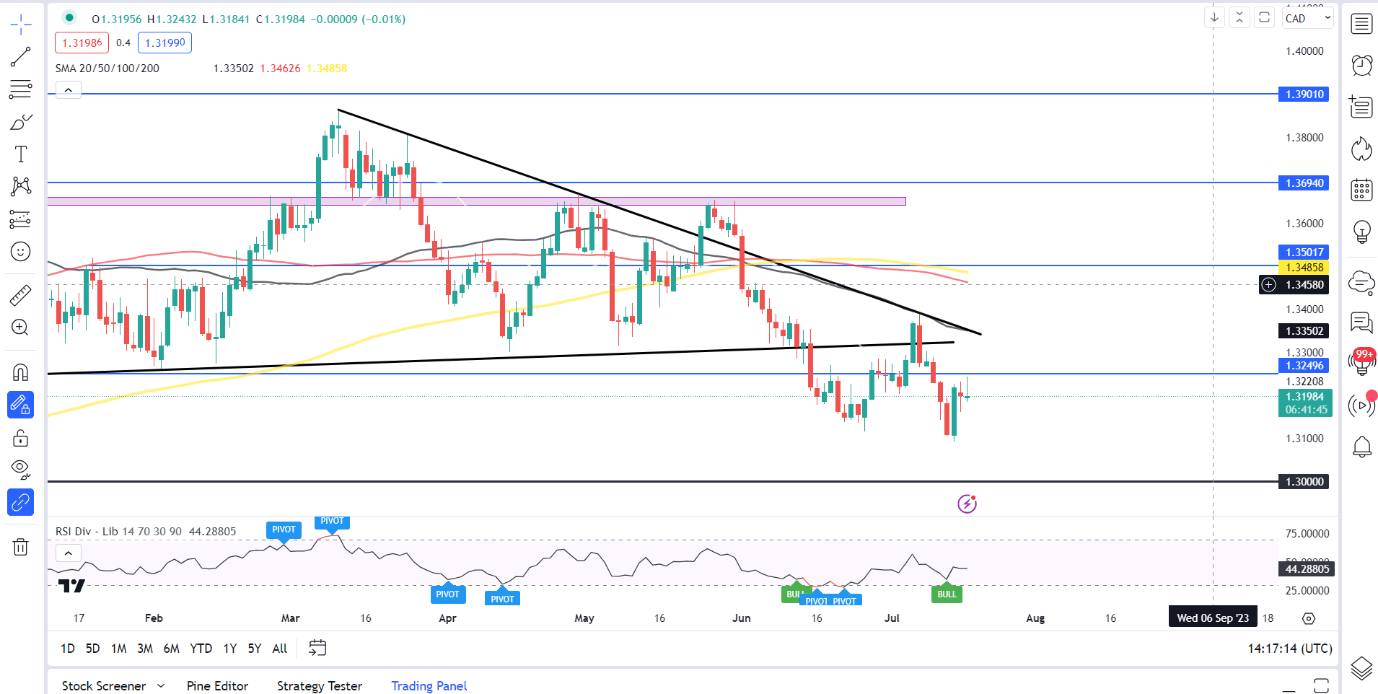

Federal Reserve policymakers remain rather hawkish despite positive disinflation signs. Markets do seem to think that a hike at the upcoming FOMC meeting on July 26 could be the end from the Fed as well. In the short-term with the Fed expected to hike later this month USDCAD could be in for some short-term gains before selling pressure returns and looks toward a breach of the key 1.3000 support handle.

MARKET REACTION AND TECHNICAL OUTLOOK

USDCAD Daily Chart

Source: TradingView, prepared by Zain Vawda

The initial reaction saw USDCAD rise toward the 1.3250 resistance area with the pair surrendering those as we entered the US session. Downside pressure remains in play on USDCAD, however a lot of that will rest on whether the DXY is able to push higher in the coming days.

USDCAD should see some upside if not this week, then next week’s potential hike by the FOMC could provide a bit of USD support in the short-term which could prop up USDCAD as well.

Looking briefly at IG Client Sentiment Data and we can see that 62% of traders are currently long on USDCAD. At DailyFX we typically take a contrarian view to crowd sentiment and the fact that 62% of traders are long suggests that we could continue to fall after a short retracement.

--- Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda