JAPANESE YEN FORECAST:

- USD/JPY blasts off and flirts with fresh multi-month highs after Bank of Japan’s monetary policy decision

- BoJ kept interest rates and its yield curve control program unchanged, signaling little appetite to alter course any time soon

- This article looks at key USD/JPY’s levels to watch in the coming days

Most Read: EUR/USD Skyrockets After ECB Decision, EUR/JPY Flies to 15-Year Highs

USD/JPY rallied on Friday, surging past the ¥141.50 level and reaching fresh multi-month highs after Bank of Japan retained an ultra-accommodative stance and U.S. Treasury yields resumed their advance heading into the long weekend.

To provide some context, BoJ held its short-term interest rate target steady at -0.10% and kept its yield curve control program unchanged at the end of its June policy meeting, signaling little intention to alter its posture in the coming months.

The central bank’s stay-the-course approach aimed at protecting the country’s weak recovery and nascent inflation trend after decades of deflation is likely to weigh on the Japanese yen in the near term, especially against high-yielding peers such as the U.S. dollar.

While there is some margin for USD/JPY to push a little higher, traders should begin to exercise more caution, especially if the pair moves above ¥145.00. Last year, Japanese authorities intervened in the market when the exchange rate flirted with 146.00 and 152.00.

If the yen continues to weaken rapidly, the government may start selling U.S. dollars to curb speculative activity in the FX space and prop up the domestic currency. This is something to keep in mind going forward to avoid getting caught on the wrong side of the trade.

USD/JPY TECHNICAL ANALYSIS

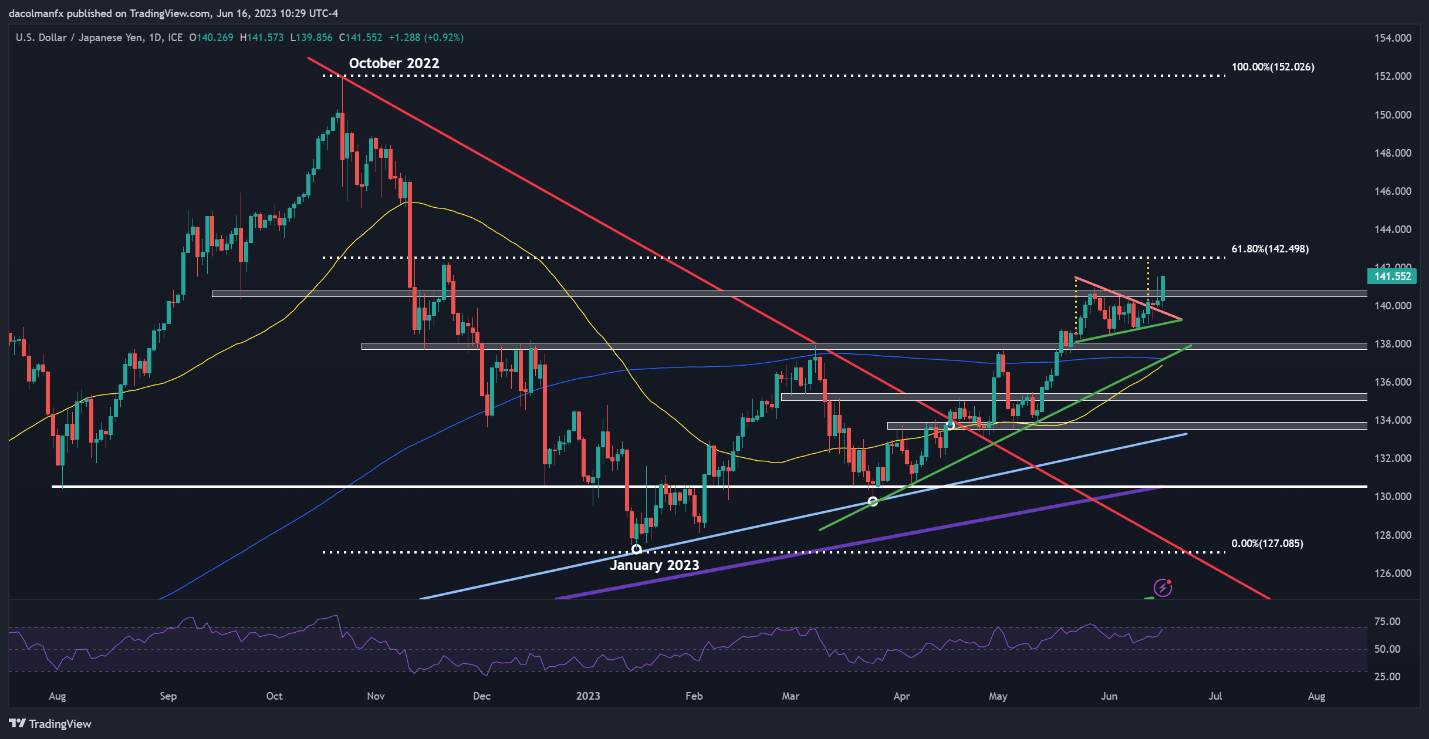

USD/JPY has been coiling inside a symmetrical triangle recently, but broke out of the continuation pattern earlier this week, resolving to the upside, as shown in the daily chart below.

While the breakout has been sustained so far, prices need to stay above 140.40/140 to keep the bullish momentum alive. If this scenario plays out, USD/JPY could gather more strength to challenge 142.50 soon, a key resistance defined by the 50% Fib retracement of the Oct 2022/Jan 2023 sell-off.

Conversely, if sellers regain control of the market and drive the pair below 139.75, we could see a slide toward 139.00. On further weakness, sellers may launch an attack on the psychological 138.00 handle.

USD/JPY TECHNICAL CHART