POUND STERLING ANALYSIS & TALKING POINTS

- Israel/Palestine conflict war favors US dollar.

- Fed and BoE speakers under the spotlight later today.

- GBP/USD slips but some positive technical signals keep bulls hopeful.

GBPUSD FUNDAMENTAL BACKDROP

The British pound opened lower this Monday morning as conflict in the Middle East saw global markets adopt a risk off approach. Naturally, the US dollar received support being a safe haven currency in addition to Friday’s Non-Farm Payroll (NFP) report which beat forecasts highlighting a very robust labor market within the US. That being said, money market expectations for a November interest rate hike from the Fed was little changed and with US CPI scheduled later this week, only a significant upside surprise may shift the needle.

China has returned to market activity after their Golden Week holiday but spending during this period underwhelmed, reinforcing the need for additional stimulus by the Chinese government. This weaker outlook weighs negatively on the pound and will be closely monitored moving forward.

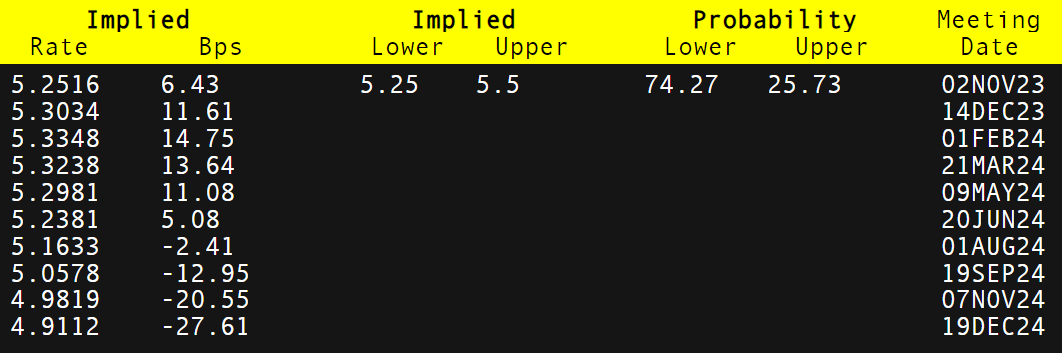

Bank of England (BoE) prospects (refer to table below) remain in favor of a rate pause in November but the upcoming UK GDP (Thursday) could may add to hawkish bets as forecasts reveal a healthy growth report.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

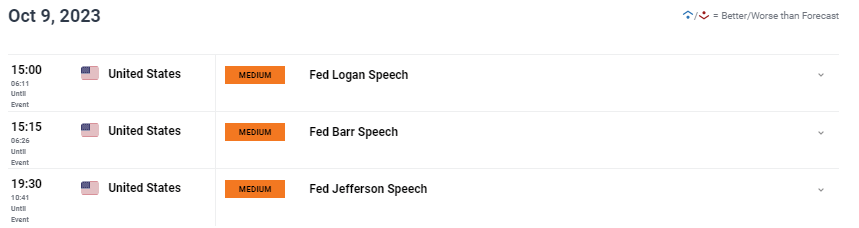

The economic calendar for today is relatively light but could stoke some volatility via Fed and BoE (Mann) later in the trading session.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

TECHNICAL ANALYSIS

GBP/USD WEEKLY CHART

Chart prepared by Warren Venketas, IG

The longer-term weekly chart above shows last week’s long lower wick close (blue) and could hint at subsequent upside to come despite risk aversion today.

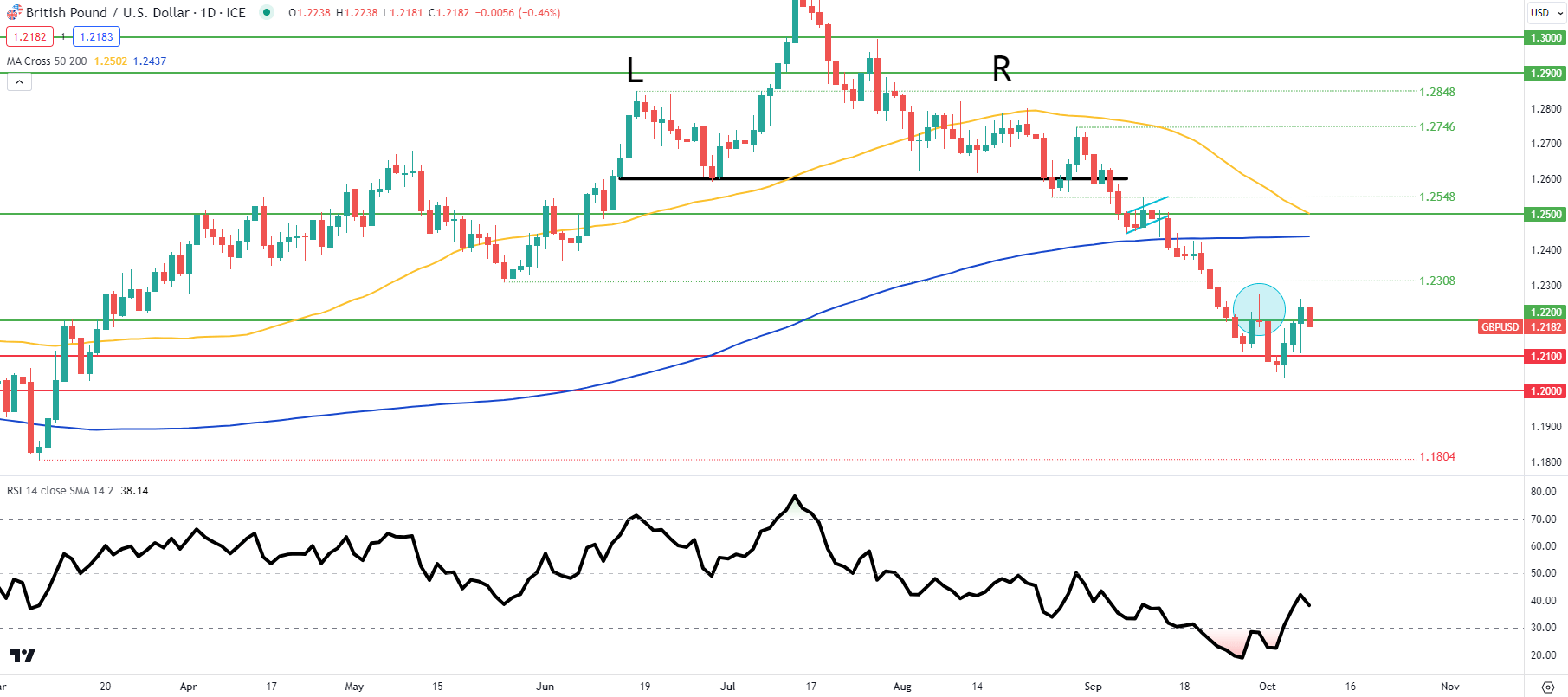

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart sees the pair peering out of the oversold zone on the Relative Strength Index (RSI) after the bullish/positive divergence mentioned in my prior analysis unfolded. Moving forward this week, US and UK GDP data will be key in terms of short-term directional guidance as well as the developments in the Middle East.

Key resistance levels:

- 1.2308

- 1.2200

Key support levels:

- 1.2100

- 1.2000

- 1.1804

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 70% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas