POUND STERLING ANALYSIS & TALKING POINTS

- Souring risk sentiment weighs on GBP.

- Fed Chair Powell speech under the spotlight later today.

- Key technical break could see GBP/USD slip further.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

GBPUSD FUNDAMENTAL BACKDROP

Sticky UK CPI earlier this week was not enough to maintain the pound’s turnaround as geopolitical tensions in the Middle East remains the dominant theme at present. Diplomatic efforts to address the conflict have since been diminished after a hospital explosion, stoking pressures within the region between Israel and Hamas. The safe haven US dollar will draw greater attention in this environment but the address by Fed Chair Jerome Powell later today (see economic calendar below) will be the focus for cable.

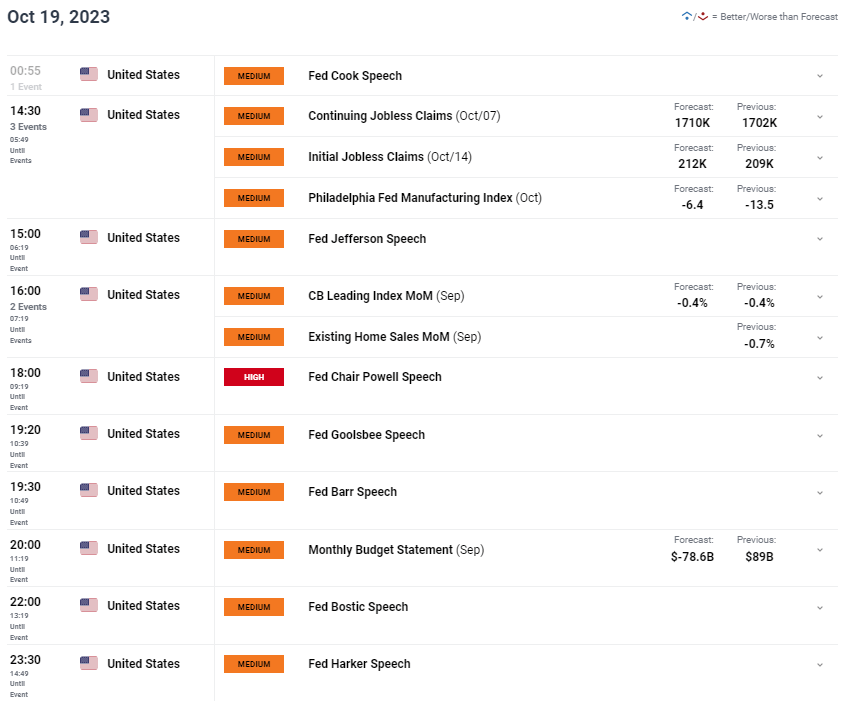

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

With the aforementioned uncertainty taking place, mixed US economic data including better than expected retail sales and a large uptick in US Treasury yields could see Jerome Powell adopt a ‘wait and see’ approach before making any definitive moves. The November meeting is likely to result in no interest rate hike from the Fed and I do not foresee a shift towards something more hawkish. The Fed will look to gather more economic data and with the blackout period of Fed communication around the corner, the Fed Chair’s speech will be closely monitored ahead of the rate announcement in early November. With no economic data scheduled from a UK perspective, US specific factors will be the driving force for GBP/USD.

TECHNICAL ANALYSIS

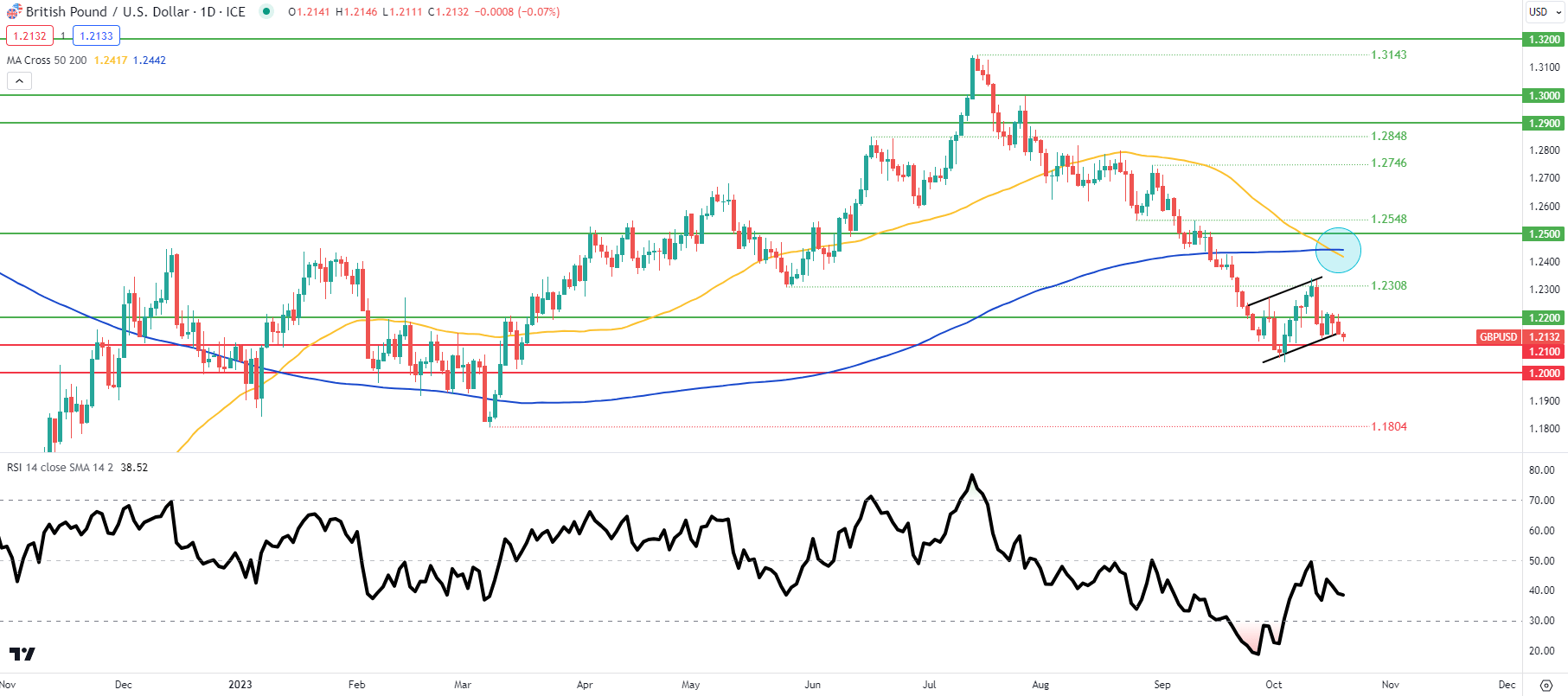

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above sees the death cross (blue) coinciding with pound weakness as the pair breaks below bear flag (black) support. Today’s candle close will be crucial as a close below support could spark a move lower towards the 1.2200 psychological level and beyond.

Key resistance levels:

- 50-day MA (yellow)/200-day MA (blue)

- Flag resistance

- 1.2308

- 1.2200

Key support levels:

- Flag support

- 1.2100

- 1.2000

- 1.1804

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 72% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas