POUND STERLING ANALYSIS & TALKING POINTS

- UK employment change and unemployment smash estimates.

- US CPI in focus.

- 0.5% hike gains traction for BoE.

- Initial reaction = GBP/USD 0.35% higher.

NO LET UP FOR UK LABOR MARKET, POUND BID!

The British pound rallied on stellar jobs data (see economic calendar below. All metrics showed improvement which is not a good sign for Bank of England (BoE) doves. Concerns around sticky core inflation from the BoE’s Mann and aggressive monetary policy comments from Haskel yesterday will surely be heightened with today’s data and the fact that several other BoE speakers are scheduled for today (Greene, Governor Bailey and Dhingra) could augment the hawkish bias.

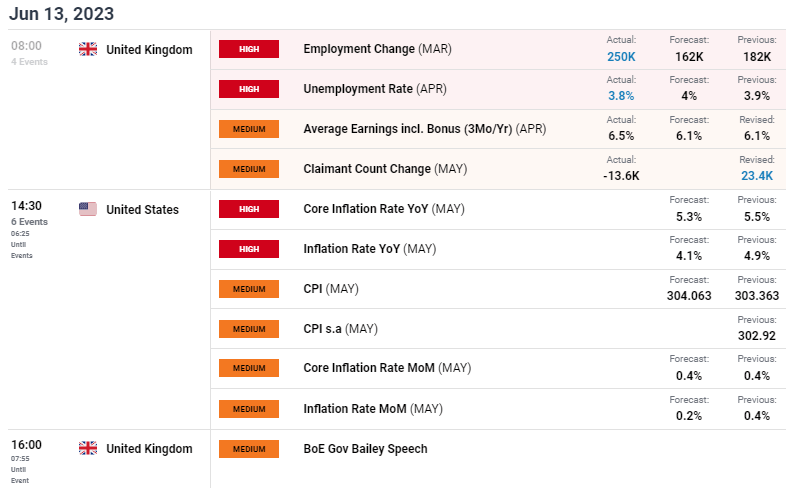

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

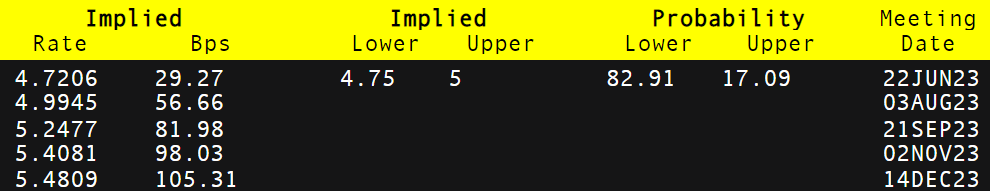

The average earnings metric is of particular concern as it reached fresh yearly highs (6.5%) and should contribute to elevated inflation pressures. Money markets now expect roughly 105bps of rate hikes by December 2023 (refer to table below) with an 82% probability of a 25bps (down from 93% a few days ago) increment for the June meeting. Should impending UK economic data release in the same fashion, projections may shift further in favor of a 50bps hike.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

While the pound is bid this morning, market may not get behind the data as forcefully as usual due to market hesitancy around the upcoming US CPI report that could shape the short-term directional bias for cable.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

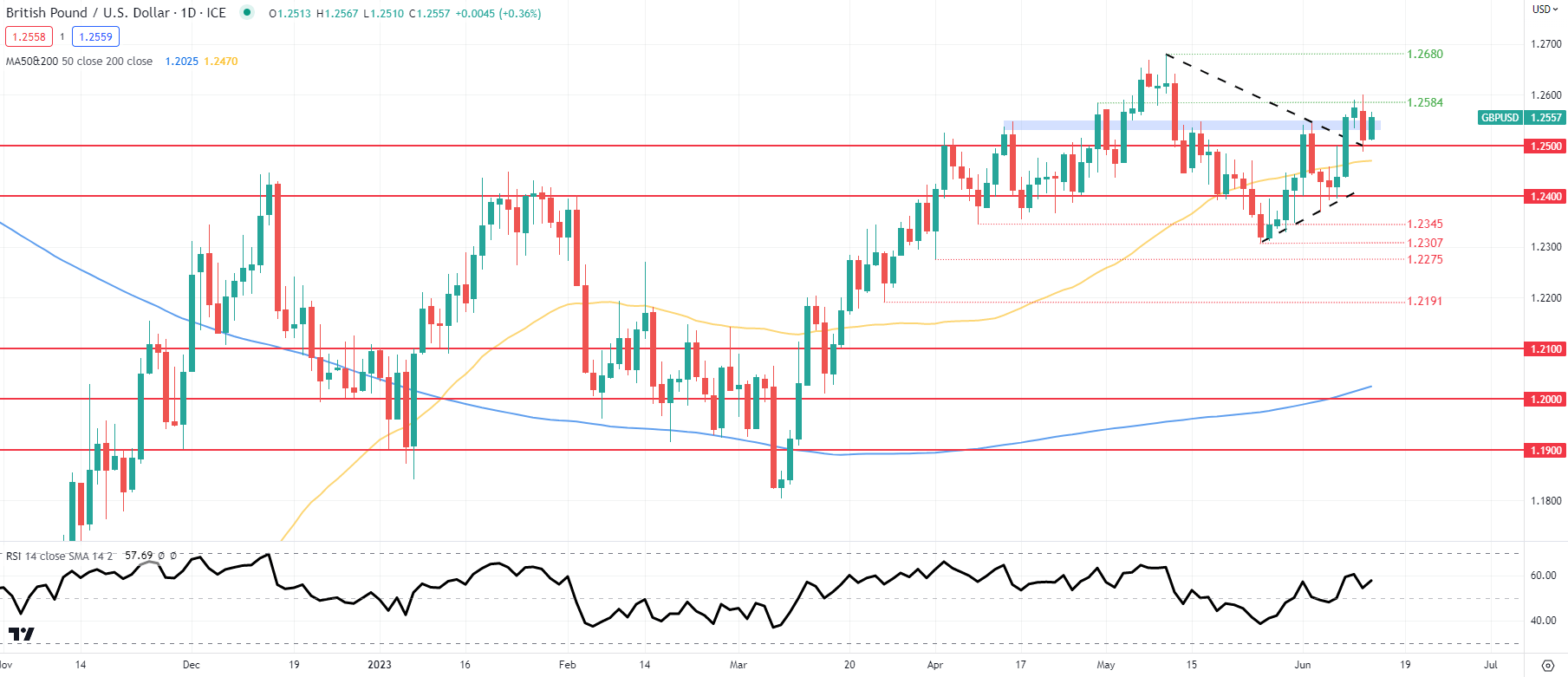

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart is firmly above the 1.2500 psychological handle after breaking through the symmetrical triangle chart pattern (black). A full bullish breakout could be spurred on by fading US inflation later today thus exposing subsequent resistance zones.

Key resistance levels:

- 1.2680

- 1.2584

Key support levels:

- 1.2545 (blue zone)

- 1.2500

- 50-day MA (yellow)

- 1.2400

MIXED IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently net SHORT on GBP/USD with 54% of traders holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas