CRUDE OIL ANALYSIS & TALKING POINTS

- Slowdown in Chinese data weighs on crude oil.

- US retail sales to come later today.

- Further downside is possible after key technical break.

CRUDE OIL FUNDAMENTAL BACKDROP

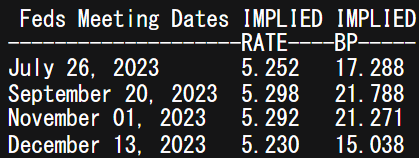

Crude oil remains relatively depressed this Thursday morning after a drop yesterday post-FOMC. The Federal Reserve decided to keep rates on hold; however, central bank guidance was rather hawkish considering the lead up to the announcement was on the bearish side after US CPI and PPI data showed slowing inflationary pressures. The revised dot plot now reflects two further rate hikes for the year but money markets are yet to price this in (refer to table below) with possibly one additional rate hike expected. Incoming data will be required for further clarity around the stat of the US economy.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

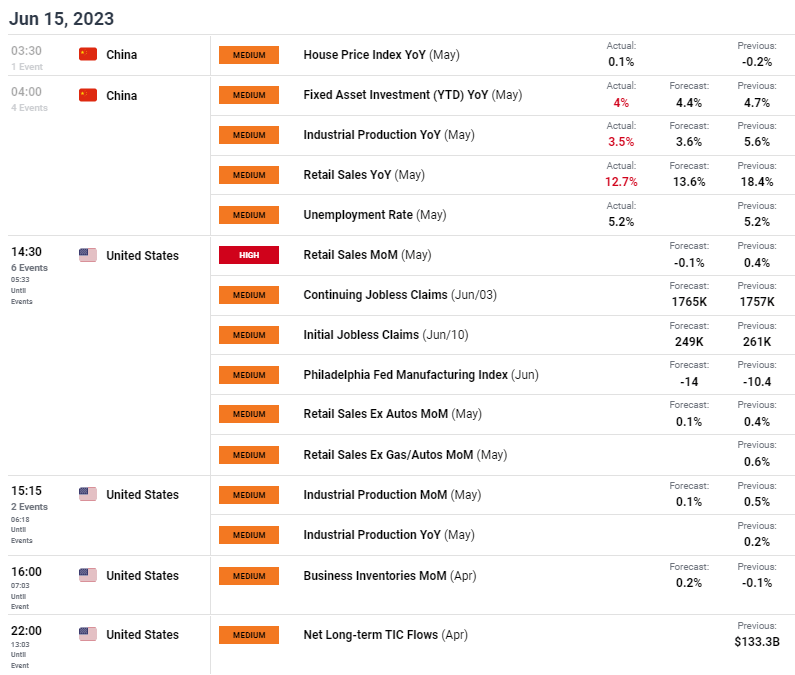

This morning began with the world’s second largest consumer of crude oil (China) releasing key demand-side data including industrial production and retail sales (see economic calendar below). Both metrics missed estimates and heightened fears around a slowing Chinese economy and subsequently less overall demand for crude oil. Similar sentiments could be echoed should US retail sales later today come in lower as expected. That being said, the USD may slip should this come in line or miss estimates potentially providing some support for crude oil prices. Jobless claims data will also be in focus after recent labor data exhibited a slight unwind of the recent very tight and robust environment.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

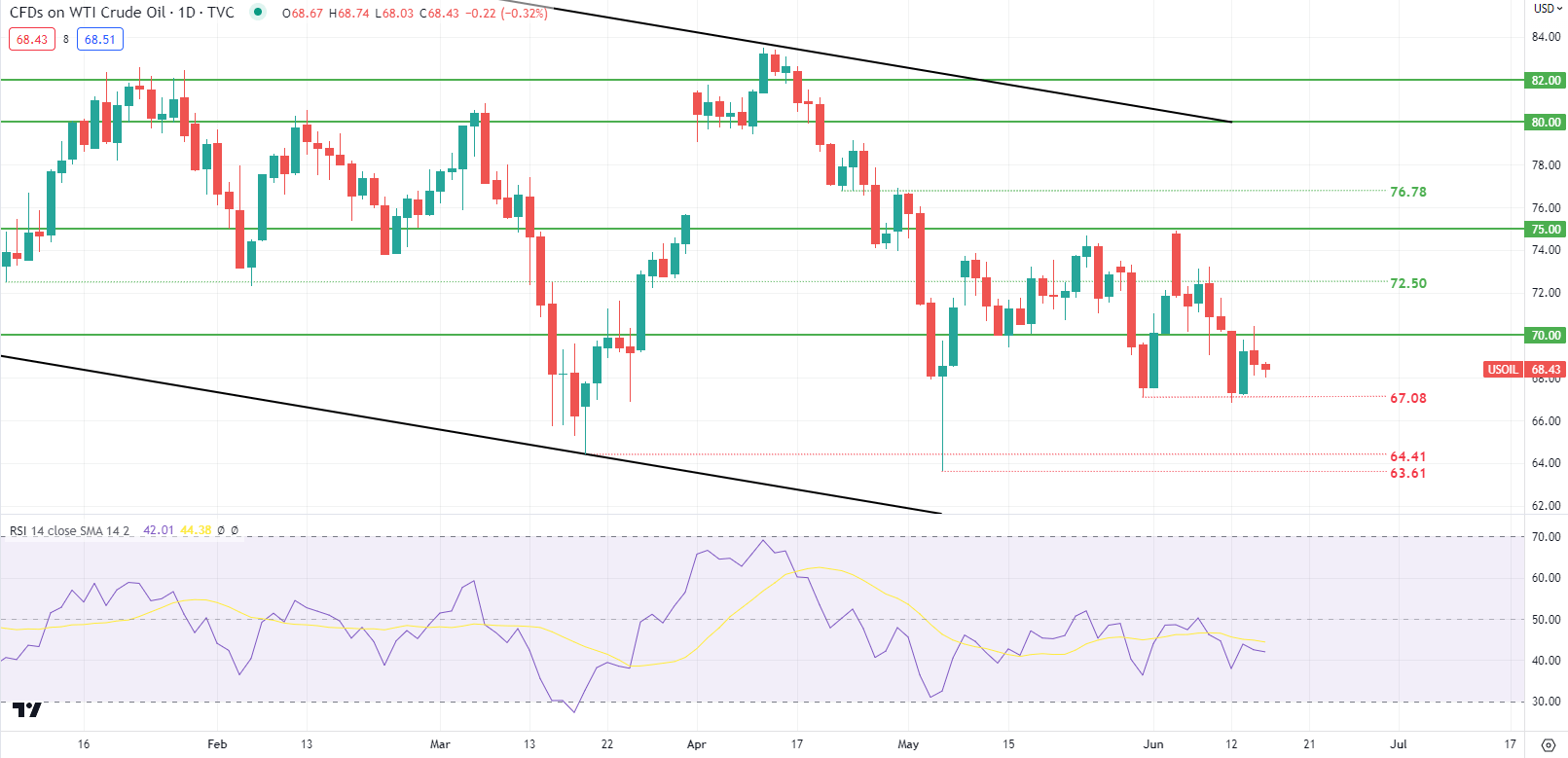

WTI CRUDE OIL DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily WTI crude chart above shows prices below the 70.00 psychological handle but firm support has been shown around the 67.08 swing low. Another test could weaken the structure and see bears breakout and test subsequent support zones.

Key resistance levels:

- $72.50

- $70.00

Key support levels:

- $67.08

- $64.41

- $63.61

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are NET LONG on Crude Oil, with 85% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas