AUD/USD ANALYSIS & TALKING POINTS

- RBA holds off on rate hike with 4.35% the possible peak.

- US ISM services PMI under the spotlight later today.

- AUD/USD bears testing 200-day MA.

Elevate your trading skills and gain a competitive edge. Get your hands on the AUSTRALIAN DOLLAR Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar was subject to the Reserve Bank of Australia’s (RBA) interest rate decision earlier this morning where the central bank expectedly decided to keep rates on hold at 4.35%. A quick recap to the previous meeting saw the RBA hike rates as inflationary pressures, increasing housing prices and a tight labor market played a key role in the assessment. Since then, softening monthly CPI indicator data and the lagged influence restrictive monetary policy has weighed on housing prices alongside a slightly weaker labor market. Overall, the robust jobs market could be the most concerning variable for the RBA – similar to that of the US economy and the Federal Reserve.

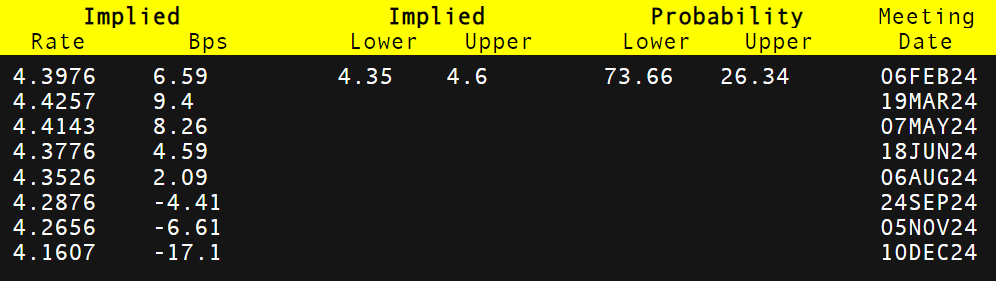

Money markets have added roughly 13bps (refer to table below) of additional cumulative rate cuts by December 2024 in a week but with room for an additional hike should it be required. I forecast the RBA to remain data dependent but we could well be at the peak of the cycle and may look to follow the path of other major central banks in 2024. With many banks looking to cut around mid-2024, the RBA outlook may be ‘dovishly’ repriced once again leaving the AUD vulnerable to the downside.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

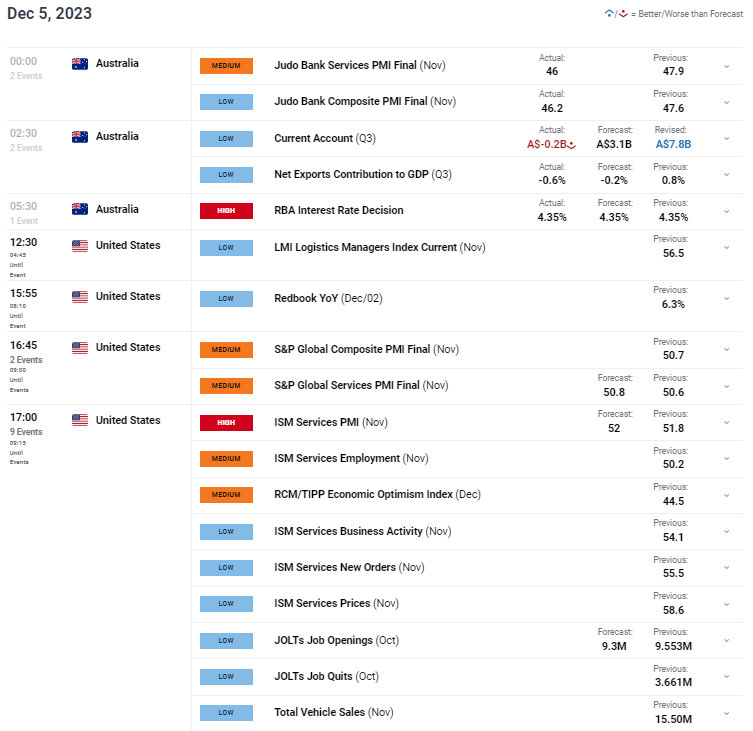

Judo Bank PMI”s were released prior to the rate announcement and highlighted the slowing Australian economy by fading further into contractionary territory reaching yearly lows on both services and composite metrics. The current account for Q3 also moved into negative figures for the first time since Q3 of 2022, once again suggestive depressed growth. Later today, the AUD/USD pair will be firmly focused on US ISM services PMI’s and JOLTs data as markets prepare for Non-Farm Payrolls (NFP) on Friday.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

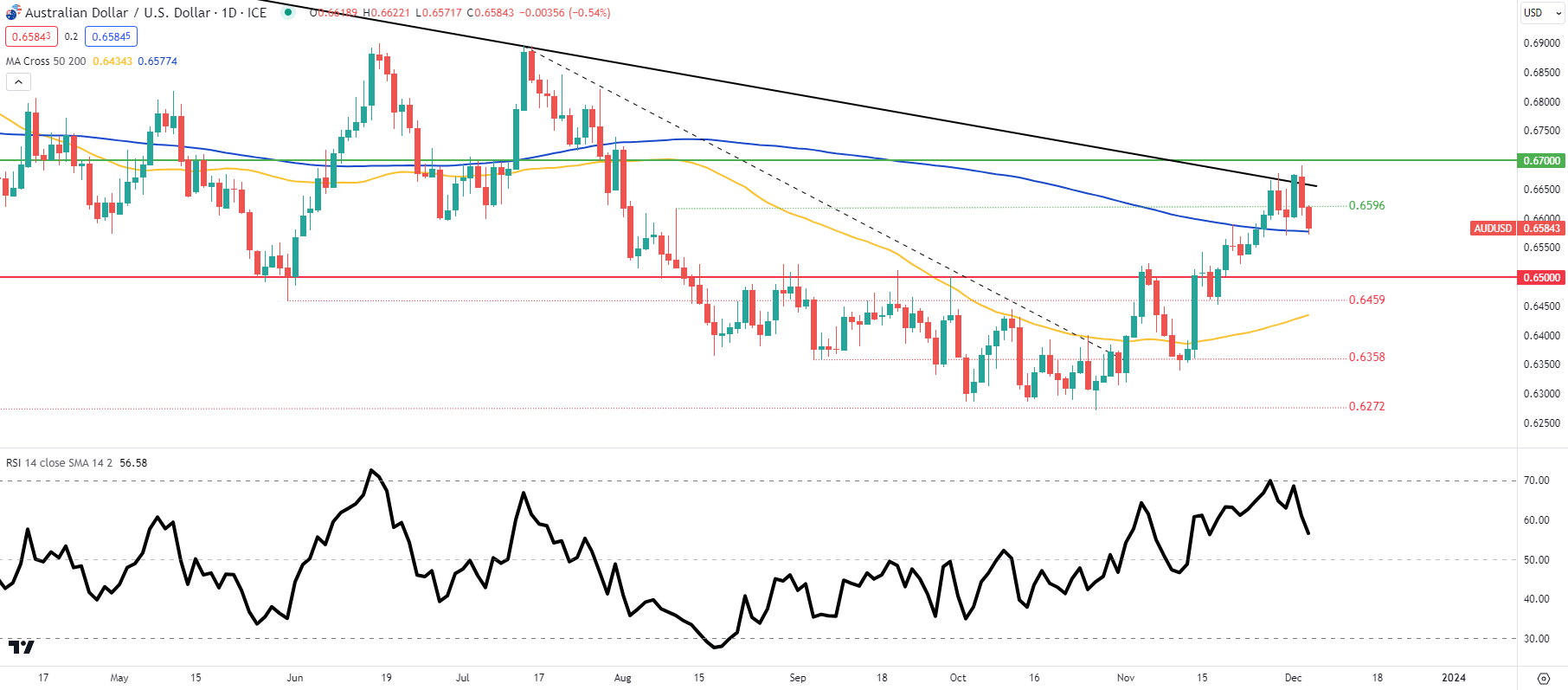

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

AUD/USD daily price action above shows bulls being limited by trendline resistance (black) coinciding with a push off the overbought one on the Relative Strength Index (RSI). Current support now comes from the 200-day moving average (blue) but could easily break below should ISM and JOLTs come in stronger. Remember, escalating tensions in the Middle East have also contributed to souring risk sentiment which could supplement USD upside.

- 0.6700

- Trendline resistance

- 0.6596

Key support levels:

- 200-day MA

- 0.6500

- 0.6459

- 50-day MA

- 0.6358

IG CLIENT SENTIMENT DATA: BEARISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 61% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas