EUR/USD Price, Chart, and Analysis

The weakness in the US dollar, and ongoing Euro strength, is pushing EUR/USD ever higher as markets continue to price a closing of interest rate differentials between the two major currencies. While the US may well have finished hiking interest rates, the ECB remains on course to hike again as inflation remains doggedly high in the Euro Area. Looking further ahead, market expectations are for the Federal Reserve to start lowering interest rates in September this year while the ECB is likely to be on hold, closing the rate differential further.

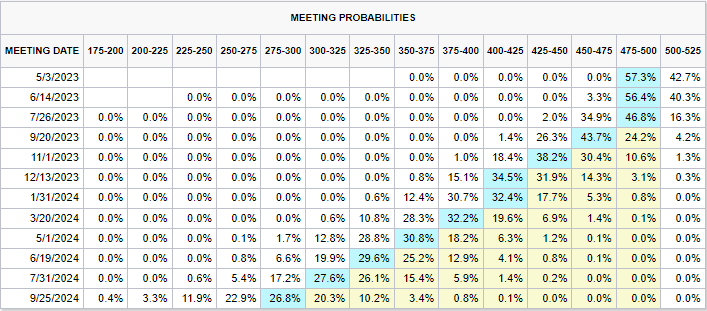

US Interest Rate Probabilities

Later today we have the final US non-manufacturing PMI reading with the market forecasting a fall to 54.5 in March from a prior month’s 55.1. The service sector contributes around 78% of US GDP. On Bank Holiday Friday the latest US Jobs Report (NFP) is released into what will be a quiet market. This report has the potential to move the US dollar and will gather more interest than usual after this week’s JOLTs report showed job openings falling by more than expected to 9.931 million in February compared to a revised 10.563 million in January.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

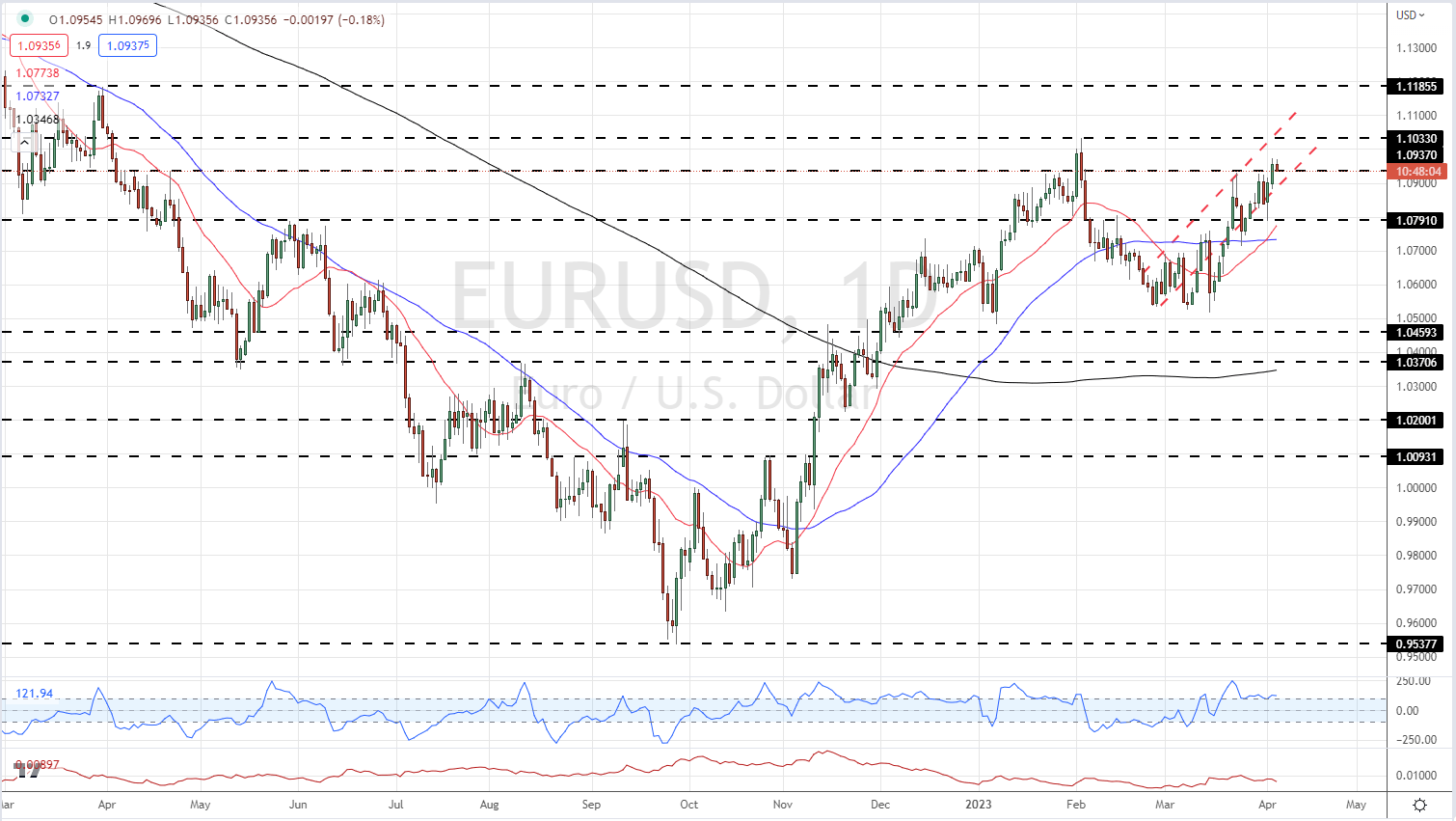

EUR/USD is trading in a tight range today, with the upcoming long weekend likely to weigh on turnover. The pair are back in an upward channel and close to the 1.10330, multi-month high that was made on February 2nd. Above here there is little in the way of resistance before the March 31st, 2022 high comes into focus at 1.11855.

EURUSD Daily Price Chart – April 5, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -20% | 21% | -1% |

| Weekly | -9% | 6% | -1% |

Retail Traders are Short EUR/USD

Retail trader data show 34.12% of traders are net-long with the ratio of traders short to long at 1.93 to 1.The number of traders net-long is 1.24% higher than yesterday and 17.16% lower from last week, while the number of traders net-short is 1.28% higher than yesterday and 7.90% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.