Euro (EUR/USD) Analysis and Charts

- EUR/USD stayed in the green despite news that business activity contracted again in Jan

- The Composite PMI has been below the key 50 mark for eight months

- Still, the ECB is expected to stand pat on rates with inflation still above target

January’s initial or ‘flash’ Purchasing Managers Index data for the Eurozone showed both manufacturing and service sector activity well below the fifty mark which separates expansion from contraction. The composite indicator, which marries the two, came in at 47.9. That was below the 48 level markets were expecting but slightly above December’s 47.6.

That Composite measure has been below fifty for eight straight months now. Eurozone data was released just after Germany’s own version of the PMI, which was equally woeful on all counts.

The Eurozone has clearly made a very sluggish start to 2024, which makes the Euro’s apparent resilience to the data surprising. One relative bright spot can be seen in the fact that overall business activity’s contraction came at the slowest pace for six months in January. The contraction in new orders was also the smallest reported by purchasing managers since June 2023.

There were also some signs of a return in pricing power, with inflation rates having accelerated for three months from October’s 32-month low.

A more plausible reason why the Euro has remained in the green on Wednesday might be that these data probably won’t shift many needles at the European Central Bank. It will make its first monetary policy decision of the year on Thursday and is expected to leave rates on hold despite clear signs of economic weakness, perhaps arguing that it needs more time to be sure that overall inflation has been tamed. Eurozone inflation remains above the ECB’s 2% target despite having relaxed considerably from the 10.6% peak of 2022.

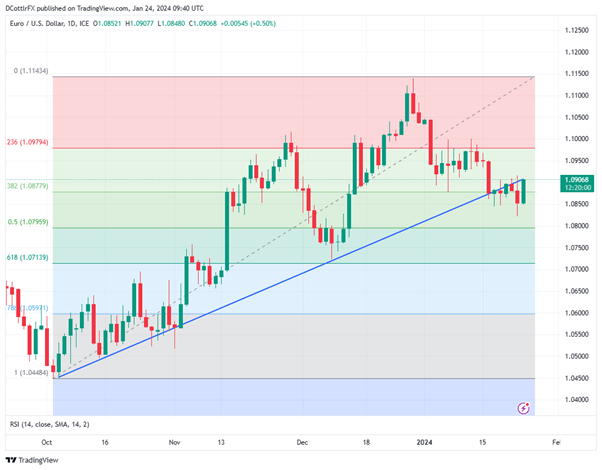

EUR/USD Techincal Analysis

EUR/USD Chart Compiled Using TradingView

Learn how to trade EUR/USD with our free trading guide

EUR/USD trades in a band around the second Fibonacci retracement of the rise up to late December’s highs from the low of early October. That comes in at 1.08779, a level which the market seems reluctant to abandon for long.

Still, bulls have yet to retake the previously dominant uptrend line from those October lows, which now offers resistance at 1.09106.

They may need to retake this in short order if they’re to prevent the sort of ‘head and shoulders’ pattern on the daily chart which typically suggests that the market has topped out. The Euro is also stuck between its 200-day moving average of 1.0925 and its 50-day, at 1.0850. A durable break of either may set near near-term direction for the pair.

--By David Cottle for DailyFX