WTI Crude Oil, EIA, Wheat, Russia, US Dollar, AUD/USD, PBOC, China - Talking Points

- Crude oil went sideways to start the day as the US Dollar drifts lower

- Wheat has rallied after Russia continue to interrupt Ukrainian exports

- Wall Street might have a slow start to their day. Can WTI rally from here?

WTI crude oil is holding ground so far today just below US$ 78.50 after slipping overnight despite the news that crude stockpiles had fallen by less than anticipated.

Other energy products saw notable decreases in demand, particularly for gasoline.

The US Energy Information Agency (EIA) data revealed that crude inventory levels fell by 708k barrels for the week ended July 14th, rather than forecasts of 2.44 million barrels.

Wheat has continued higher into Thursday’s session after large gains in the last few days. It comes after Russia stepped up its rhetoric of taking action to shut Ukrainian ports for grain exports.

They have now said that vessels entering the Black Sea would be considered to be carrying armaments.

Spot gold has nudged higher, trading at its highest level in 7-weeks with the US Dollar generally weaker across the board.

The Australian Dollar got an extra shot in the arm as it shrugged off recent bearishness, sailing over 68 cents after the unemployment rate dropped again to 3.5% in June, below forecasts of 3.6%.

The Peoples Bank of China (PBOC) refrained from cutting the rate on the 1- and 5-year loan prime rate today, keeping them at 3.55% and 4.20% respectively.

Speculation continues to swirl that Beijing will look to do more stimulus measures as they try to reignite their economy. Actions have so far struggled to add any positivity toward the Middle Kingdom.

APAC equities markets are mixed with little movement except for Japanese stocks. They are down on the day with the Nikkei 225 down over 1% at the time of going to print.

Wall Street futures are pointing to a sluggish start to the cash session there after Tesla and Netflix reported mixed results.

Treasury yields have steadied after sliding lower through the early part of this week with the benchmark 10-year bond inching above 3.75%.

Looking ahead, US jobs data will hold the market’s attention as well as home sales figures.

The full economic calendar can be viewed here.

WTI CRUDE OIL TECHNICAL ANALYSIS

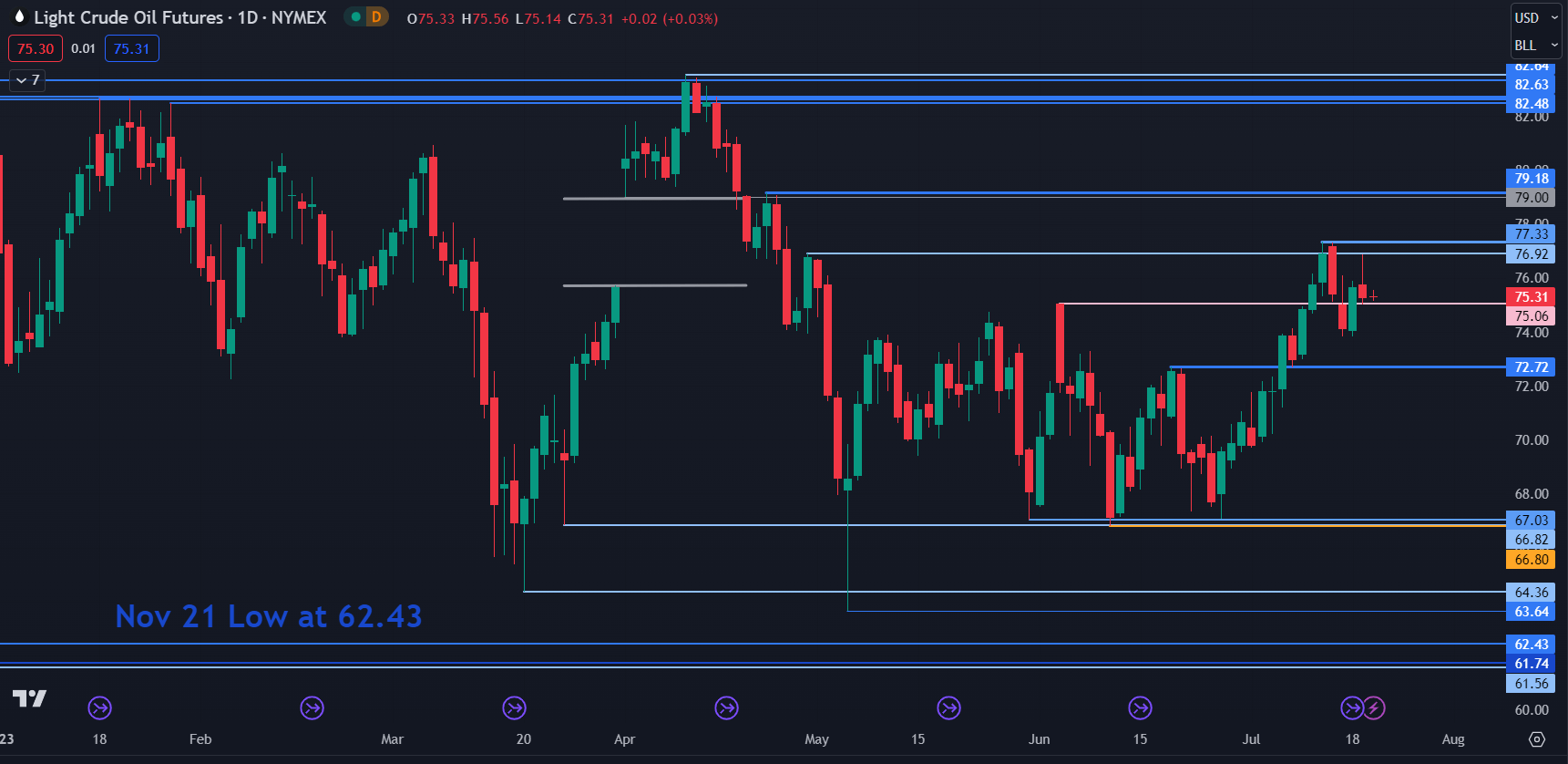

The WTI contract continues to see range trading conditions although there has been some short-term volatility this week.

The price remains contained within 66.80 – 77.33 for 11 weeks. Looking at the bigger picture, it has traded between 63.64 and 83.53 since last November.

With this in mind, previous highs and lows might provide resistance and support respectively.

On the downside, support may lie at the breakpoint near 75.00 and 72.72 or the prior lows of 67.03, 66.82, 66.80, 64.36, 63.64 or at the November 2021 low of 62.43.

On the topside, resistance could be at 76.92 and 79.18 ahead of a cluster of breakpoints and prior peaks in the 82.50 – 83.50 area.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter