Japanese Yen (USD/JPY), BoJ News and Analysis

- Japanese CPI eased in April as record wage rises fail to show up in general prices

- The BoJ’s challenge: Hiking into weakness as inflation path remains uncertain

- USD/JPY edges higher once more but advances have been contained

- Learn the ins and outs of trading USD/JPY - a pair crucial to international trade and a well-known facilitator of the carry trade

Japanese CPI Eased in April as Record Wage Increases Fail to Show up in Prices

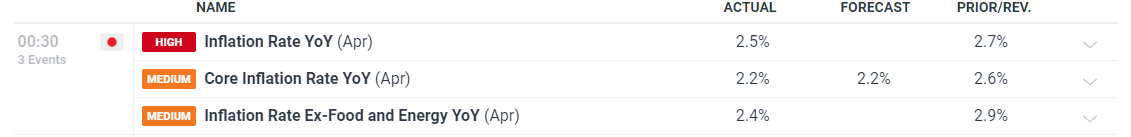

Headline inflation in Japan dropped to 2.5% when compared to April last year, down from 2.7% in March. Additionally, the core measure (excluding fresh food) dropped from 2.6% to 2.2% as expected. The reading that strips out volatile items like fresh food and energy also noted a decline from 2.9% to 2.4% as a lack of consumer activity appears to be taking its toll on the “virtuous relationship” between wages and prices in Japan.

Customize and filter live economic data via our DailyFX economic calendar

Ahead of Japan’s first rate hike since 2007, the Bank of Japan (BoJ) communicated preconditions for a movement in the interest rate which depended on the board attaining the necessary confidence that inflation would remain above 2% in a stable and sustained manner, often referring to a virtuous relationship between wages and prices. The Bank also specified that demand driven inflation needs to be observed instead of ‘cost push inflation’ which had been brought about by supply disruptions leading to surging oil prices.

Since then, Japanese wages rose at the highest annual rate in the past 33 years in response to higher prices but inflation has failed to advance in a consistent manner. Instead, inflation data has been inconsistent and the higher cost of labour has not yet passed through to higher prices for consumers which ought to stoke inflation higher over time.

The BoJ’s challenge: Hiking into Weakness amid Uncertain Inflation Path

Japanese GDP contracted 0.5% in the first quarter to follow up a flat reading in Q4 (0%) of last year to narrowly avoid a technical recession. One major concern observed in the weak data has been local consumer spending and general consumption.

Economic activity is relied upon to stimulate growth and pave the way towards another rate hike but if consumers are retreating it becomes very difficult to tighten financial conditions. Therefore, it may be a while longer before the BoJ attain the necessary confidence to hike interest rates again with the market pricing in a potential 10 basis point hike in July with a total of 25 basis points for the year.

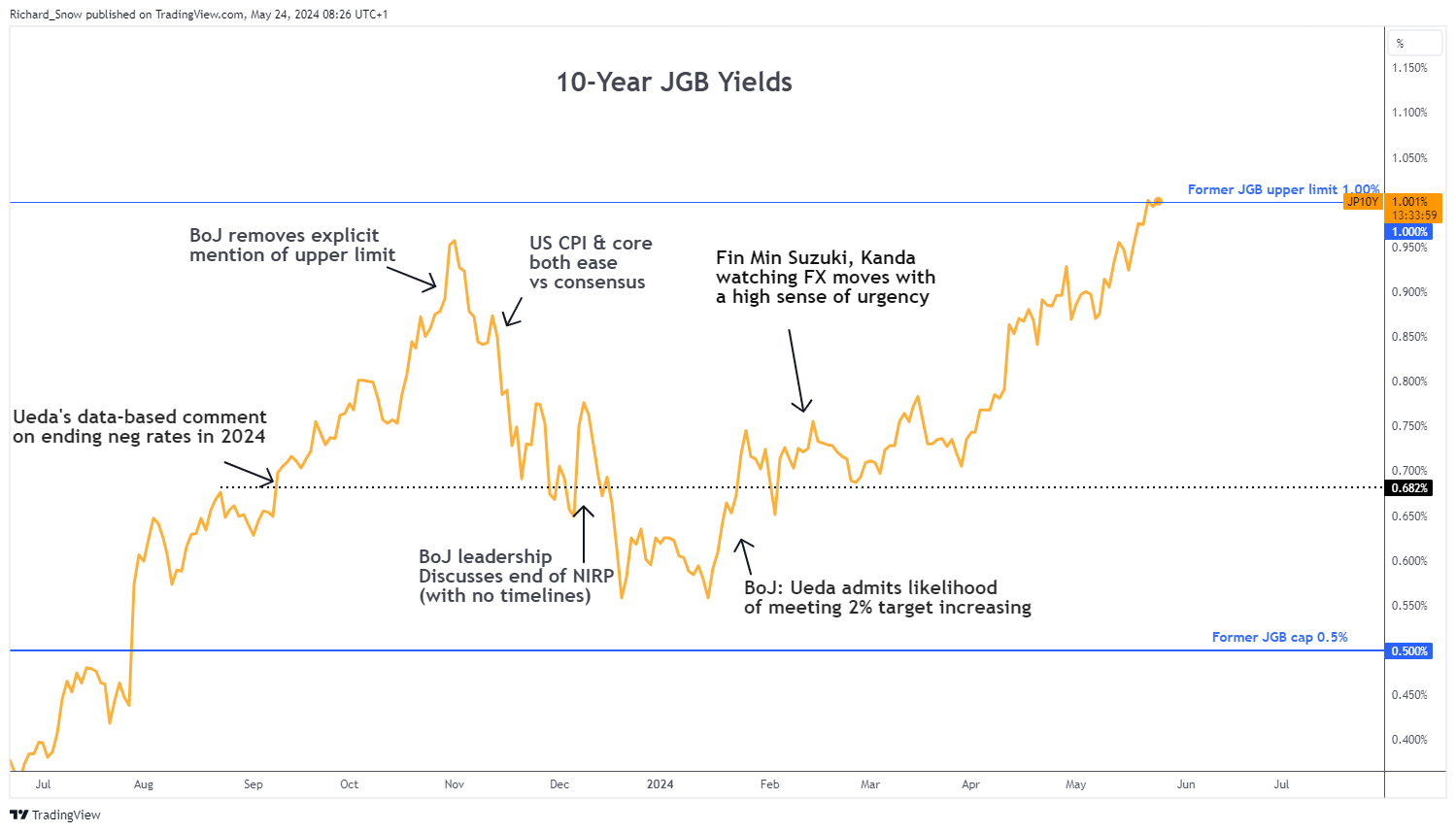

In the meantime, sellers of Japanese Government bonds (JGBs) appear to be waning, allowing the 10-year yield to breach 1% recently. The rise in yields suggests an acceptance in the market that rates and yields are on an upward trajectory and that the BoJ may be able to reduce future bond purchases. Higher yields have done little to strengthen the yen though, as US yields have also been on the up since a return to the ‘higher for longer’ narrative from prominent Fed officials in recent days alongside the hawkish FOMC minutes.

Japanese Government Bond Yields (10-Year)

Source: TradingView, prepared by Richard Snow

USD/JPY Edges Higher Once More but Moves Remain Measured

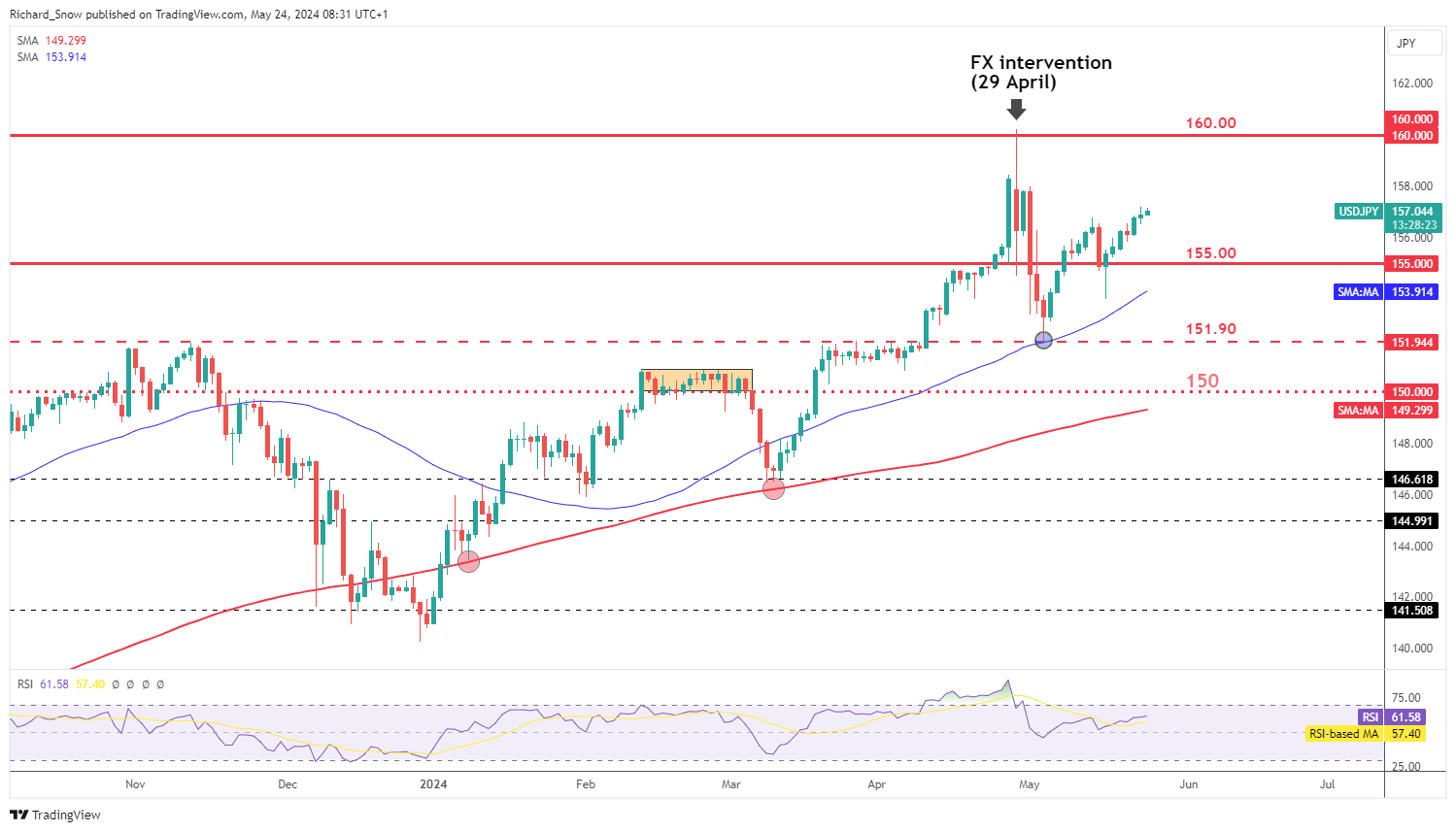

Less than one month after it was suspected that Japanese officials intervened in the FX market, USD/JPY now trades closer to the 160 marker that set the process into action. However, the grind higher has been gradual, not exhibiting the same volatility that prompted officials into action.

In a quieter week for top tier US data, it was largely expected that the dollar would shine – accommodating a market preference for higher yielding currencies during times of lower observed volatility.

The pair trades above 157.00 after bouncing sharply higher off the 50-day simple moving average (SMA) back in the early stages of May, followed by a rise above 155.00. The problem is likely to persist as long as the interest rate differential between the two nations remains wide. The carry trade remains strong.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Are you new to FX trading? The team at DailyFX has curated a collection of guides to help you understand the key fundamentals of the FX market to accelerate your learning

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX