British Pound (GBP) Analysis and Charts

- A mildly hawkish BoE helps underpin GBP/USD

- Cable pushes back above 1.2200

For all market-moving economic data and events, see the DailyFX Calendar

The Bank of England (BoE) left the Bank Rate unchanged today at 5.25%, for the second meeting in a row. Six members of the MPC voted to keep rates unchanged, while three members voted for a 25 basis point increase. The central bank expects to keep interest rates sufficiently restrictive to bring inflation down to target and will raise interest rates again if it is deemed necessary.

The Bank of England noted signs of weakness in the UK labour market….

‘The MPC continues to consider a wide range of data to inform its view on developments in labour market activity, rather than focusing on a single indicator. The increasing uncertainties surrounding the Labour Force Survey underline the importance of this approach. Against a backdrop of subdued economic activity, employment growth is likely to have softened over the second half of 2023, and to a greater extent than projected in the August Report. Falling vacancies and surveys indicating an easing of recruitment difficulties also point to a loosening in the labour market. Contacts of the Bank’s Agents have similarly reported an easing in hiring constraints, although persistent skills shortages remain in some sectors.’

….while the central bank also expects headline inflation…

‘to continue to fall sharply, to 4¾% in 2023 Q4, 4½% in 2024 Q1 and 3¾% in 2024 Q2. This decline is expected to be accounted for by lower energy, core goods and food price inflation and, beyond January, by some fall in services inflation.’

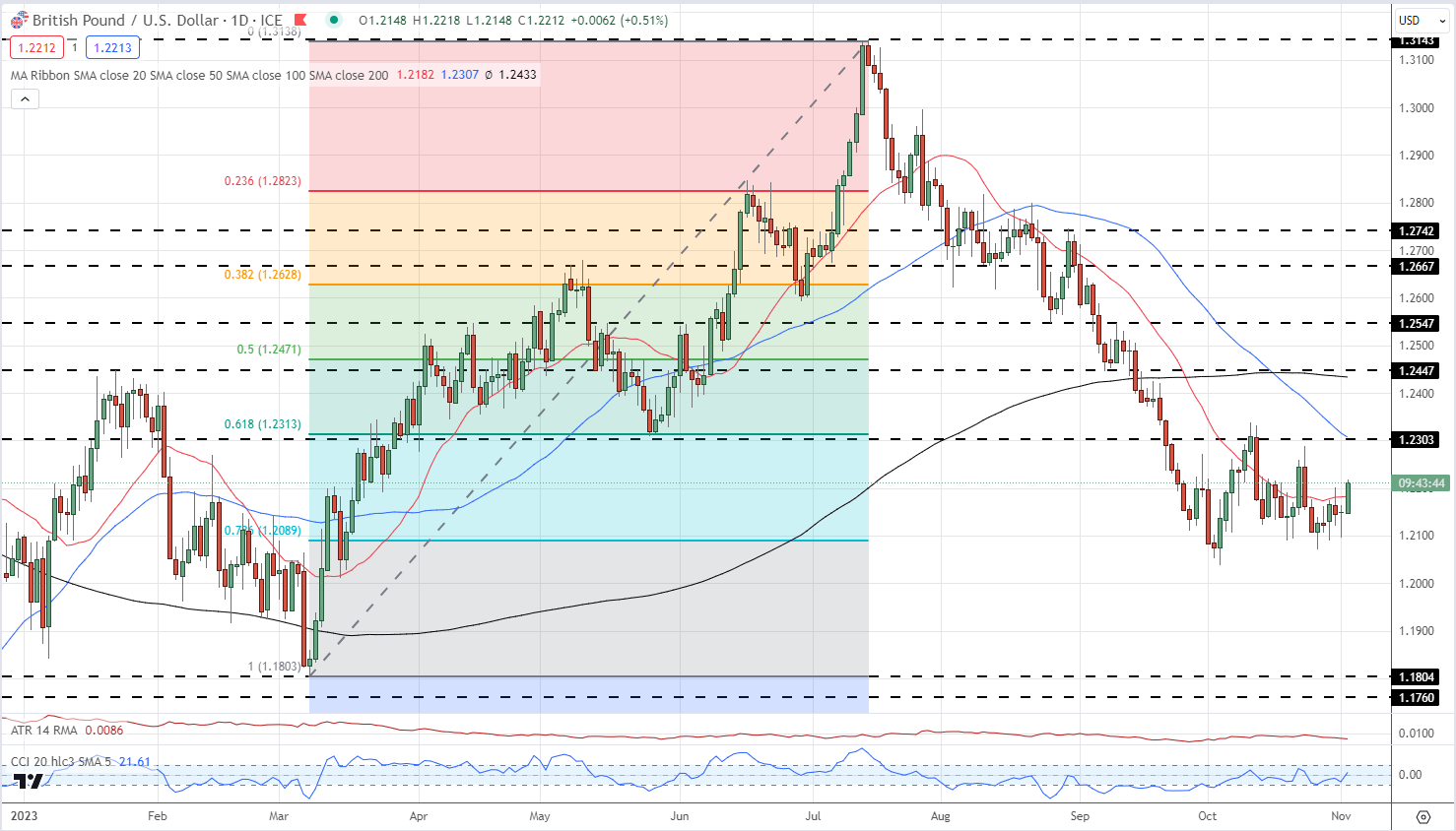

Cable is trading at a fresh one-week high as traders price in a mildly hawkish central bank meeting. The pair are now in the middle of a range defined by the 78.6% Fibonacci retracement at 1.2089 and the 61.8% retracement at 1.2313. The driver of GBP/USD will be Friday’s US Labor Report (NFP) at 12:30 UK.

GBP/USD Daily Price Chart

Chart via TradingView

IG Client Sentiment Shows You How GBP/USD Traders Are Currently Positioned

| Change in | Longs | Shorts | OI |

| Daily | -4% | 1% | -2% |

| Weekly | -30% | 40% | -10% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.