Australian Dollar Forecast: Neutral

- The Australian Dollar bears have mauled the price action but support may lie ahead

- Commodity markets and growth-linked assets are under the microscope

- With the RBA out of the way, AUD/USD might be vulnerable to sways in sentiment

The Australian Dollar chopped around in the first few days of last week before tumbling to a 2-month low as risk assets were trashed across the board in the wake of Fitch downgrading US sovereign debt.

The credit rating agency downgraded the US to AA+ from AAA on Tuesday for the first time in almost 30 years.

Equity markets and growth-sensitive commodities and associated currencies yielded to pressure as traders and investors reassessed the outlook for high beta exposure in their portfolios.

The ensuing turmoil saw AUD/USD head to a 2-month low near 65 cents before steadying going into the weekend.

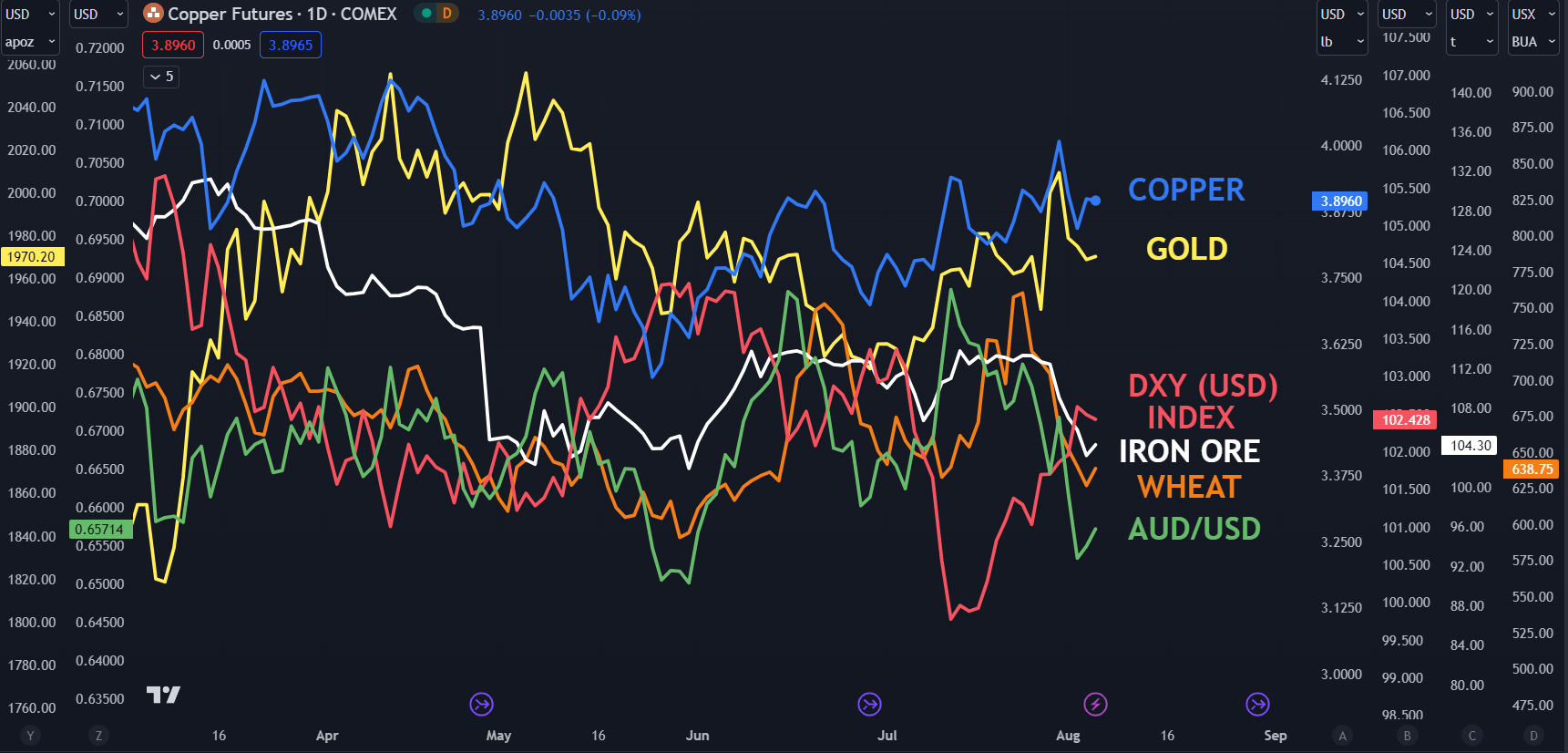

Many of Australia’s major exports, such as iron ore, copper and wheat took a hit but found some footing toward the end of last week.

CHART - AUD/USD, COPPER, GOLD DXY (USD) INDEX, IRON ORE AND WHEAT

On Friday, the RBA released its Statement on Monetary Policy. For markets, it mainly served to reiterate what Governor Philip Lowe said earlier in the week in his Statement following the Monetary Policy decision.

Rates were left unchanged at 4.10% for the second month in a row at that meeting. The interest rate market is not anticipating another hike by the RBA in this tightening cycle.

Similarly, the New Zealand market is not expecting the Reserve Bank of New Zealand (RBNZ) to lift its Official Cash Rate (OCR) again, although they are currently well above the RBA at 5.50%.

Although there is a notable disparity in rates from both lenders of last resort, AUD/NZD remains ensconced in the range environment which the currency often finds itself. It has traded in a 1.0470 – 1.1490 range for twenty-one months.

Looking ahead for the Aussie Dollar, there is not a lot in the way of major economic data in the week ahead now that CPI and the RBA decision are out of the way.

This may lead to broader market sentiment holding sway over the currency.

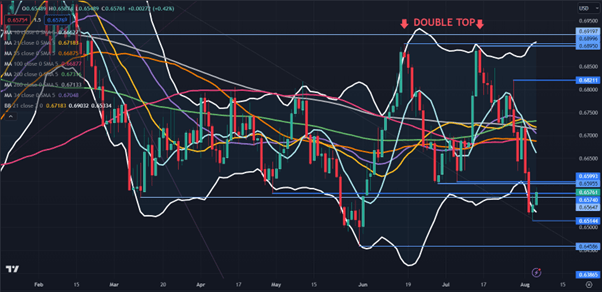

AUD/USD TECHNICAL ANALYSIS

The aggressive selloff in AUD/USD last week saw it break below the lower band of the 21-day simple moving average (SMA) based Bollinger Band.

It has since closed back inside the band and that might signal a pause in the bearish run or a potential reversal.

The price remains below all-period daily SMAs. Until they are overcome, it may indicate that more bearish momentum might unfold at some point.

Overall, AUD/USD remains in the six-month trading range of 0.6459 – 0.6900.

Nearby resistance could be at a cluster of breakpoints in the 0.6595 – 0.6600 area ahead of the SMAs.

On the downside, support might be near the recent lows of 0.6514 and 0.6459.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter