Market Minutes Overview:

- There are 16 Fed speakers competing for attention on the calendar this week, but one message has been clear: the market overreacted to the shift in the dot plot.

- Fed Chair Powell’s testimony yesterday had an underlying tone of ‘lower for longer,’ helping rekindle risk appetite to a degree.

- Markets are quiet overall as measures of volatility pull back; FX markets are basically flat.

Toothpaste Back in the Tube

It's been a week since the Federal Reserve's June policy meeting, but it seems that policymakers are working to put the proverbial toothpaste back in the tube. Fed Chair Jerome Powell spoke yesterday at a US Congressional testimony, and the commentary that he issued suggested that there was a tone of ‘lower for longer’ underlying last week's FOMC meeting.

But that wasn't initially understood by markets, which dragged forward rate expectations sending the US Dollar higher, provoking a flattening of the yield curve while intermediate rates rose. Much of those initial reactions are being unwound. The long end of the US yield curve is starting to steepen again, the short end of the yield curve is flattening out, the DXYIndex has pulled back, and stocks are once again on the rise.

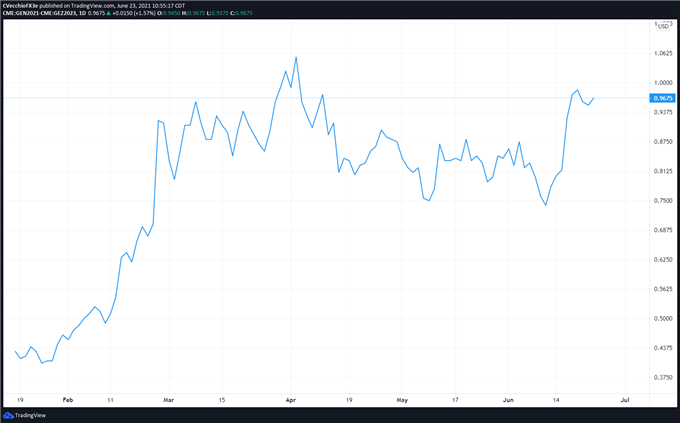

Are the Fed’s efforts to control the narrative working? We can measure whether a rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the July 2021 and December 2023 contracts, in order to gauge where interest rates are headed in the interim period between July 2021 and December 2023.

Eurodollar Futures Contract Spread (July 2021-December 2023): Daily Rate Chart (March to June 23, 2021) (Chart 1)

Relative to last week, we can see that markets have taken a less hawkish interpretation of the Federal Reserve’s June meeting, thanks in part to wave after wave of policymakers hitting the news wire this week (16 in total). Based on the Eurodollar contract spreads, there are now less than 100-bps worth of rate hikes discounted by December 2023; 96-bps in all which is down from the peak at 106-bps post-Fed.

Indeed, it would seem that the Fed policymakers are doing a decent job at damage control.

Video Technical Notes: DXY Index

- The DXY Index experienced a bullish breakout when it overcame both short-term bear flag resistance and the multi-month bear flag support that defined price action beginning in late-November 2020. The reversal within the multi-month consolidation suggests that more upside may be possible. However, bulls need to be concerned: the DXY Index has already failed to hold above either the 23.6% Fibonacci retracement of the 2018 low/2020 high range and the 38.2% Fibonacci retracement of the 2011 low/2020 high range at 91.93. Dating back to last summer, efforts to climb through this area have been rejected; another failure here would suggest longer-term bearish technical forces have yet to abate.

Busy but Quiet Calendar

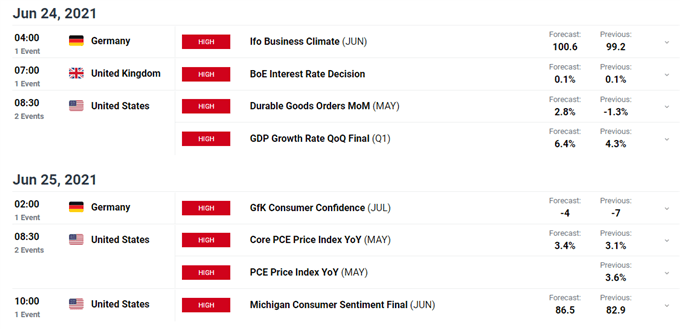

The economic calendar for the next 48-hours is both busy and quiet. It’s busy in the sense that we have a Bank of England rate decision on Thursday as well as another US inflation report due out on Friday. Despite the smattering of high rated event risk, it appears that markets are poised to remain quiet.

None of the high rated events seem to stand out in context of the onslaught of Federal Reserve speakers, who have been hammering markets with commentary this week to control the narrative. It remains the case that with each passing Fed speaker over the next few days, those remarks will carry more import than any day to release through the end of the week.

DailyFX Economic Calendar, ‘High’ Rate Events, Next 48-hours (Table 1)

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist