To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

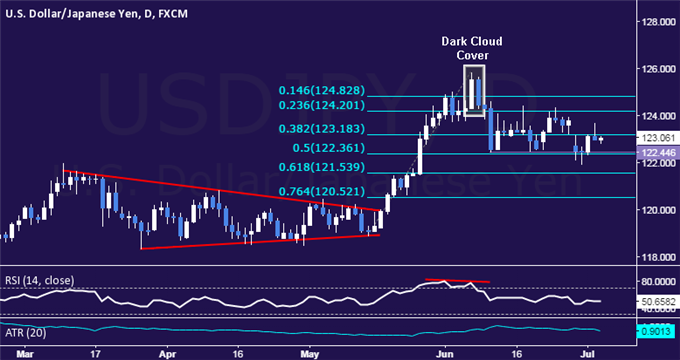

- USD/JPY Technical Strategy: Flat

- Support:122.36, 121.54, 120.52

- Resistance:123.18, 124.20, 124.83

The US Dollar continues to trade sideways in a choppy range above the 122.00 figure against the Japanese having turned lower as expected. A daily close below the 50% Fibonacci retracementat 122.36 exposes the 61.8% level at 121.54. Alternatively, a reversal above the 38.2% Fibat 123.18 opens the door for a test of the 23.6% retracement at 124.20.

Prices are too close to resistance to justify entering long from a risk/reward perspective. On the other hand, the absence of a defined bearish reversal signal suggests that taking up the short side is premature. With that in mind, we will remain flat for now.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com