Canadian Dollar Rate Forecast Talking Points:

- USD/CAD Price Forecast: downside favored below 100-DMA (1.2589)

- Bank of Canada rate hike expectations close to 90%. Failure to hike could bring volatility

- Sentiment Highlight: net-bullish bias in retail positioning provides ST bearish outlook

After recently trading at the highest level in three months, the Canadian Dollar is falling back ahead of a Bank of Canada rate meeting on January 17 that could lead to the next big move in FX markets. The latest boost for the Canadian Dollar came from a blockbuster jobs report that dropped the unemployment rate from 6.0% to 5.7% and saw a 78.6k increase in net employment against 2k expected.

The combination of positive CA employment data against the backdrop of disappointing US employment data took the USD/CAD pair to 1.2356, and has since rebounded, but remains below multiple levels of resistance that keep the focus lower.

Bank of Canada’s Great Rate Expectations

After the incredible jump in Canadian employment on January 5, the expectations for a January 17 rate hike jumped from ~40% to nearly 90% by the Bank of Canada. The jump in hike expectations also lifted the CA 2-year yield and reduced the premium that US 2-year yields held over CA 2-year yields. The yield relationship between the sovereign front-end debt has been a key driver and explanatory factor in USD/CAD spot rate.

Unlock our Q1 forecast to learn what will drive trends for the US Dollar through the 2018 open!

Now, the key thing traders should watch for is either a no-hike, which would see the CAD rate drop aggressively or a dovish hike, were as the Bank of Canada discourages confidence in multiple hikes. Either no-hike scenario would be a significant development in USD/CAD rate. However, should the rate hike come as expected, traders should look for relatively weak currencies to sell against the Canadian Dollar that could remain strong.

USD/CAD Chart: Looking Heavy below Key Resistance

The breakout level that could indicate the amount of selling was overdone and a USD rally is on its way would be a break above 1.2630-1.2705. This 75-pip range includes a large range of technical significance that includes the 50% retracement of the H2 2017 to the current 2018 low after the impressive Canadian employment report at 1.2351. The bottom of the range also includes the 20- & 100-DMA whereas the top of the range would mark the 61.8% retracement of the same range.

Should the price continue to find a ceiling of resistance in the 1.2630/2705 range, a breakdown below 1.2350 would anticipate a move toward the 2017 low of 1.2061. A close above the 1.2630/2705 range would materially alter the immediately bearish technical forecast.

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

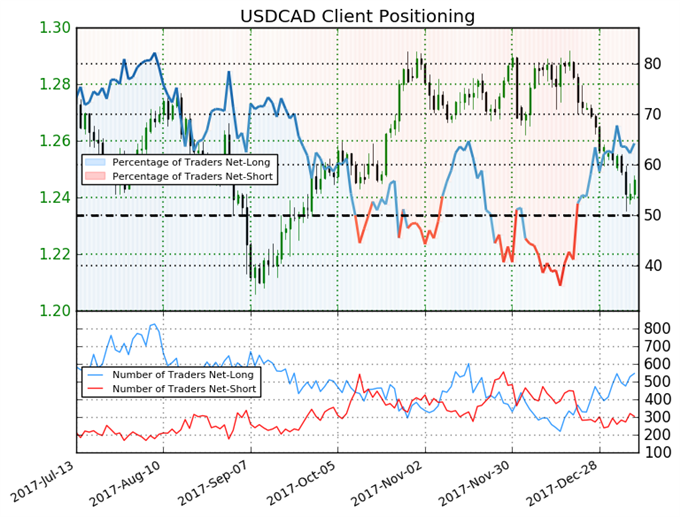

Valuable Insight from IG Client Positioning for USD/CAD: Retail buying favors further weakness

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell