What’s inside:

- The DAX holding strong

- But facing down a confluence of resistance

- Might not be the beginning of a major decline, but pullback from here is expected

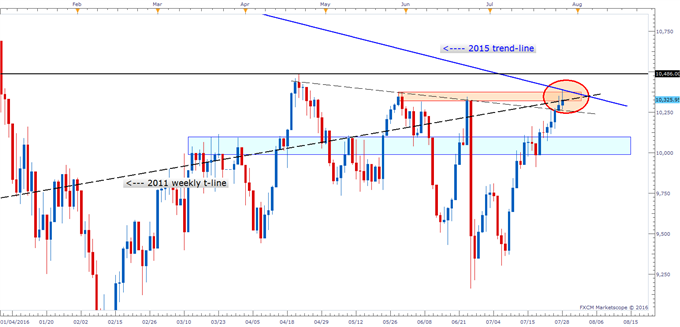

In Wednesday’s commentary, we discussed the intersection of multiple angles of resistance the DAX is currently facing, and so far it has yet to matter. To recap: This area consists of a back-side retest of the 2011 trend-line, horizontal resistance from peaks created in May and June, as well as the all-important downtrend line off the 2015 record highs (possible top of macro bull-flag). We also noted that in the vicinity the neckline of what could be an inverse H&S pattern as a part of the giant bull-flag. The pattern considerations are some picture stuff. Let’s dial in and look at what is immediately in front of us.

The intersection of the previously mentioned lines of resistance should prove to be formidable in the near-term. We stress should because thus far no bearish signaling we have seen has played out as one might expect. However, the strength of resistance is coming in numbers, and the 2015 down-trend line really helps reinforce the area between ~10300/10400 as being a big one.

What to watch for: A turn in daily momentum and undercut of the prior day low; that would be a good start for a decline.

What to expect on a turnaround: A move back towards the 10000 level we were previously focused on as resistance would be reasonable to expect.

What will change our mind? A break above the prior before mentioned zone and the April peak at 10486. At that juncture the macro-tech patterns discussed yesterday will start to unfold. But at this time, given the huge climb since the EU referendum and multiple inflection points, a pullback prior to a further advance looks like the more likely scenario.

DAX Daily: Jan '16 to Present

Looking to hone your skills in technical analysis? Check out one of our many free trading guides designed for traders of all experience levels.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX.

You can email him at instructor@dailyfx.com with any questions or comments.