To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

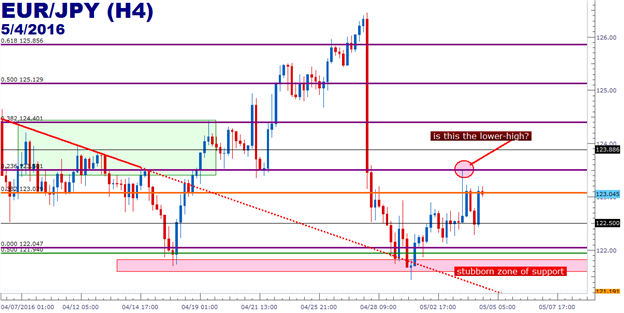

- EUR/JPY Technical Strategy: Flat. Aggressive short setup identified.

- EUR/JPY staged a strong break lower after the BoJ’s ‘no move’ at their last policy meeting.

- If you’re looking for additional trade ideas, check out our Trading Guide and if you’re looking for shorter-term ideas, check out our SSI indicator.

In our last article, we looked at the young but bullish structure that had begun to build in EUR/JPY; but as we advised, traders would likely wanted to approach with caution given the Bank of Japan meeting on the docket for later in the week. And that meeting did not disappoint. Nothing really happened; no new policies were unleashed and no new announcements were made, but that was somewhat of the issue. Markets were looking for some kind of extension or increase to Japanese QE and after the incredibly salient report had made the rounds a week earlier, it looked like something new would be announced.

But when no additional information was unveiled by the Bank of Japan at that April rate meeting, that bullish structure in EUR/JPY was smashed by a surging Yen.

Price action made some very interesting moves around this theme, and these levels can certainly become usable again. The low on Friday and again on Monday of this week was but a few pips below the previous swing low at 121.70. Sellers tried to take the pair lower yesterday but, again, support came into play to offset the selling pressure, and now EUR/JPY is catching resistance off of another familiar level at 123.08, which is the 38.2% Fibonacci retracement of the ‘secondary’ move in EUR/JPY, which takes the 2008 high to the 2012 low).

This could open the door for aggressive continuation setups with stops placed above today’s high of 123.50 (such as 123.65-123.70), and targets cast towards that previous zone of support below 122. Traders can also break up the exit by removing a portion of the position should 122 come-in, moving stops to break-even and looking for more profit on the remainder of the lot. Should Non-Farm payrolls bring on even more risk aversion, traders could cast deeper targets towards the 120 psychological zone with a scale-out approach.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX