To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- EUR/JPY Technical Strategy: Flat.

- EUR/JPY continues to run higher with a recent higher-low point of support established at ~125.00

- If you’re looking for additional trade ideas, check out our Trading Guide and if you’re looking for shorter-term ideas, check out our SSI indicator.

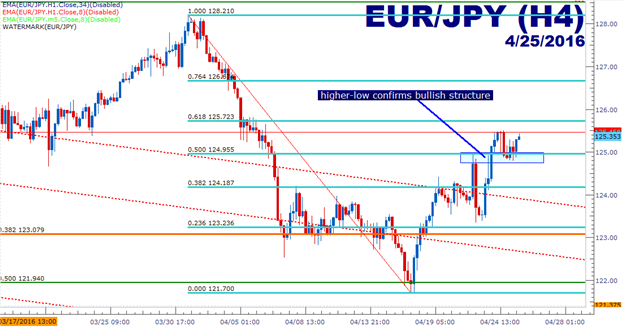

In our last article, we looked at the continued retracement in EUR/JPY as yet another downward sloping trend-line faced a test from bullish price action. Since that article was published, EUR/JPY has continued its bullish run, showing additional iterations of higher-highs and higher-lows. With a widely anticipated Bank of Japan meeting set for later in the week, traders will want to be cautious chasing any short-term trends; but given recent support and resistance structure, traders may be able to line up setups on both sides of EUR/JPY.

The near-term move in EUR/JPY has been markedly bullish as seen on the 4-hour chart below. This morning saw confirmation of the most recent higher low, which took place at an interesting level of 125, which is a major psychological level while also being the 50% retracement of the most recent major move. This price had also functioned as prior resistance, so we have an example of old resistance becoming new support, and that can further solidify the bull thesis with near-term price action in EUR/JPY.

Traders looking to act on the near-term structure of EUR/JPY could look at long positions with stops below the recent batch of higher-lows (denoted with a blue box on the below chart), and targets set to 125.50 (recent price action swing high), 126.67 (76.4% of the most recent major move), and then 127.50 (major psychological level).

On the short side, traders would likely want to wait for this recent batch of support at 125 to be violated before embarking on a bearish thesis. This could, at the very least, indicate that bears may be able to continue pushing prices lower. At that point, traders looking to get short could look for resistance on the hourly or 4-hour chart; but until 125 yields, be careful of pushing the short-side of EUR/JPY.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX