To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

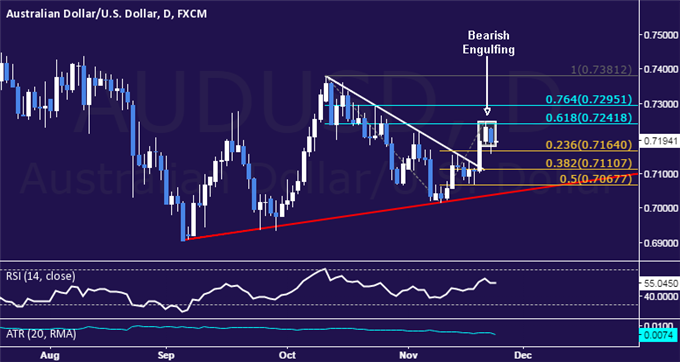

- Bearish Engulfing Candle Pattern Hints Aussie Dollar May Turn Lower vs. USD

- Proximity to Chart Support Argues Against Taking Short on Risk/Reward Grounds

The Australian Dollar ran into resistance below the 0.73 figure after recovering to the highest level in a month against its US namesake. A Bearish Engulfing candlestick pattern now hints another push to the downside may be in the cards ahead.

Near-term support is at 0.7164, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis opening the door for a challenge of the 38.2% level at 0.7111. Alternatively, a push above resistance marked by the 61.8% Fib retracement at 0.7242 sees the next upside inflection point at 0.7295, the 76.4% mark.

The overall AUD/USD trend bias continues to favor the downside and we are keen to re-enter short. However, current positioning puts prices too close to support to justify entering a trade from a risk/reward perspective. We will stand aside for now, waiting for a better-defined opportunity to present itself.

Losing Money Trading Forex? This Might Be Why.