Indices Highlights:

- Dow Jones looking towards the 30k mark

- DAX still working on achieving a fresh record high

- FTSE trying to play catchup, breaking out

Dow Jones looking towards the 30k mark

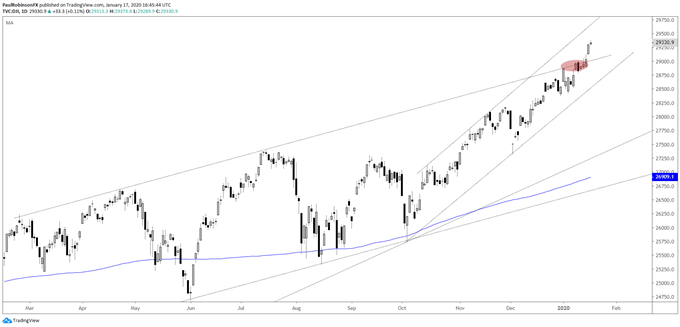

U.S. indices continue their trek into record territory, with the major averages generally starting to have that frothy, overbought look to them. But until we see a break in the price action, and while that could come soon in terms of time, it’s a trend that doesn’t look worth the fight. Strong up-moves like this can get a little crazy before correcting, or putting in a larger top.

For now, the Dow is above all resistance penciled in, with the upper parallel of a channel dating back to early last year having been breached last week. The 30k level may be up next as a big psych level the market ‘wants’ to achieve.

Risk/reward for fresh longs at the moment isn’t particularly attractive, but shorting doesn’t hold much appeal either with momentum clearly pointing the market higher.

Dow Jones Daily Chart (reaching towards 30k soon?)

Dow Jones Chart by TradingView

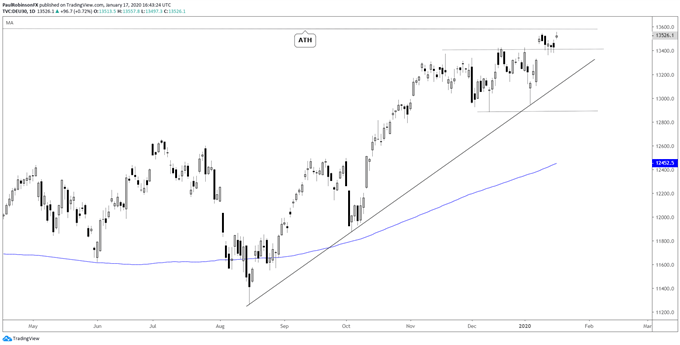

DAX still working on achieving a fresh record high

Last week it looked like the DAX was ready to finally break the 13596 all-time-high, but the index’s struggles to do so continued. Look for a new record high to develop in the week ahead as global risk appetite generally favors higher equity prices. Keep an eye on the ever-extending U.S. markets for signs of an attitude change towards stocks.

DAX Daily Chart (ATH just ahead)

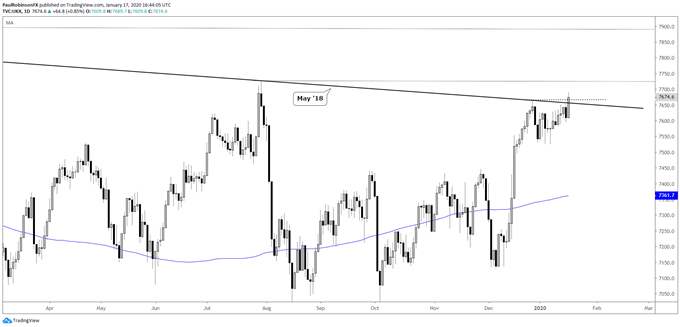

FTSE trying to play catchup, breaking out

The FTSE had been suppressed the past few weeks, digesting the December surge. Friday, the 100 finally broke out above 7665 and the May 2018 trend-line. This sets up for a test and potential break of the 2019 high at 7727. A break above the 2019 levels will then have eyes on the ATH of 7903, created in 2018. The trading bias remains constructive in the absence of any pervasive price action.

FTSE Daily Chart (looking for 2019 highs and then some)

UK 100 Index Chart by TradingView

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX