Crude Oil Technical Outlook:

- WTI crude oil weekly candlestick suggests turnaround

- Counter-trend rally may be all we get, bigger picture still in doubt

Check out the DailyFX Trading Guides page for intermediate-term forecasts, educational content aimed all experience levels, and more.

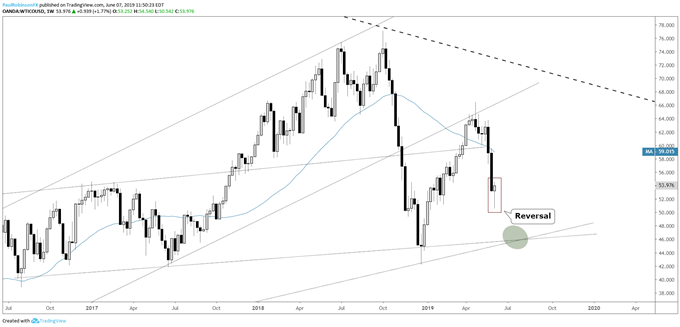

WTI crude oil weekly candlestick suggests turnaround

Last week, oil found itself in an ugly position again, but was able to find support via the low-end of a range created during Jan/Feb. The bounce on Thursday brought with it limited follow-through to end the week, however; the price action for the week resolved in the form of a reversal candle that could set into motion some more buying in the days ahead.

Next week might not bring with it rip-roaring power, as oil is already failing to follow stocks higher in the same manner in which it did on the down-side. (This may be a symptom of a broader problem on the macro-front, a story for another day.) This relative weakness could change, of course, should the ‘risk-on’ theme mature.

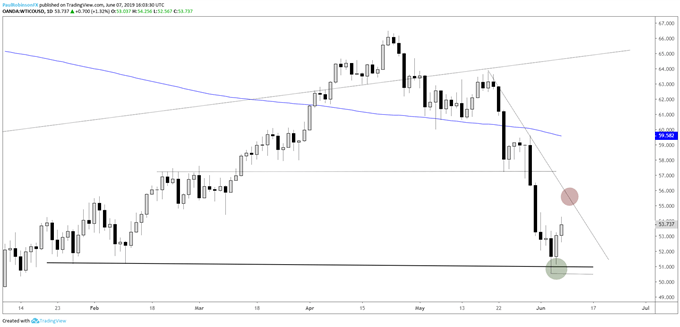

Looking at the near-term technical landscape, the trend-line running lower from three weeks ago is first up as resistance. This may only prove to be minor resistance, but given how crude has acted thus far that might be all that is needed to keep a lid on a bounce.

Trade above the trend-line will bring in the prospect of higher prices (57+), but without seeing further evidence the initial thrust off the low wants to hold up it can’t be ruled out that it won’t simply amount to a choppy grind higher that eventually leads to another dive lower.

To get things moving lower, a break below last week’s low at 50.54 will lend to extending a slide. If a solid-looking consolidation pattern is built over the course of a few days or longer, then it might offer a decent-looking continuation trade as a fresh group of sellers get anxious in the absence of strength from oversold conditions.

All-in-all, the outlook for next week leans in favor of the long-side, but only tentatively-so at the moment.

Check out the IG Client Sentiment page to find out how changes in positioning in major markets could signal the next price move.

Crude Oil Weekly Chart (Reversal candle)

Crude Oil Daily Chart (Support, resistance to watch)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX