USD/CAD, Oil Price, USD/JPY Analysis & News

- Canadian Dollar Remains Skewed to the Downside as Oil Link Converges

- CAD/JPY Offers Value after Japanese Fiscal Year End

- Easing US Rates Call for Lower USD/JPY

Canadian Dollar Remains Skewed to the Downside as Oil Link Converges

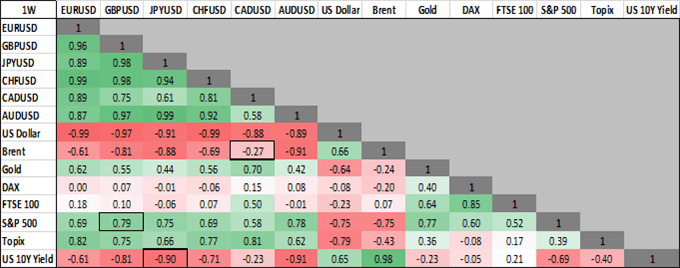

In our previous note we highlighted that the positive relationship between oil prices and the Canadian Dollar had temporarily broken down, this came amid a correction lower in USD/CAD following the Federal Reserve’s QE announcement. Alongside this, the central bank had also addressed concerns over USD funding via swap lines. However, we are starting to see a convergence between the relationship of CAD and oil prices with the 1-week correlation at -0.27 from -0.45. Therefore, with oil prices remaining downbeat we maintain a bearish bias on Canadian Dollar, particularly against a more defensive currency such as the Japanese Yen after the Japanese fiscal year end.

| Change in | Longs | Shorts | OI |

| Daily | -12% | -11% | -11% |

| Weekly | 13% | -10% | 0% |

Easing US Rates Call for Lower USD/JPY

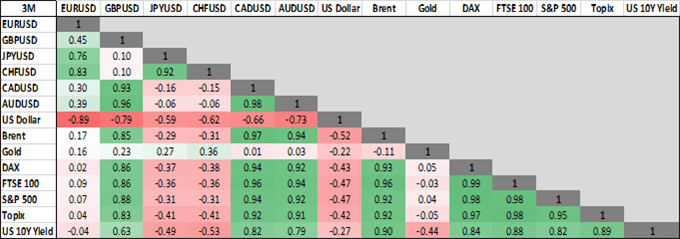

It is also worth noting that the Japanese Yen has had an increasingly negative relationship with US 10yr yields. As such, with the latter continuing to ease in recent sessions we feel USD/JPY is relatively elevated at current levels and thus expect the Yen to strengthen in the near term. Of note, today may see somewhat of a choppy session as we head to the London fix (4pm), particularly after the mini-flash crash at the Tokyo fix overnight.

How to Invest During a Recession: Investments & Strategy

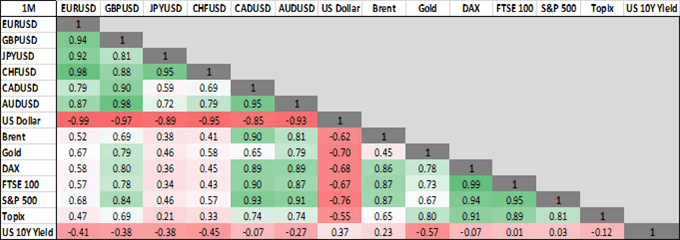

Figure 1. Cross-Asset Correlation (1 Week, 1 Month & 3 Month Timeframe)

Source: Refinitiv, DailyFX. The Topix is used a proxy for the Nikkei 225.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX