Key Talking Points:

- GBP/USD tightens its range but is lacking a clear direction ahead of FOMC and BOE

- UK retail sales drop unexpectedly in August

GBP/USD continues to struggle to gain a meaningful breakout as anticipation grows for next week’s FOMC decision. The pair pulled back towards the lower bound of its recent range on Thursday as US retail sales came in above consensus for the month of August, sparking some volatility in markets and boosting the US Dollar to a 3-week high.

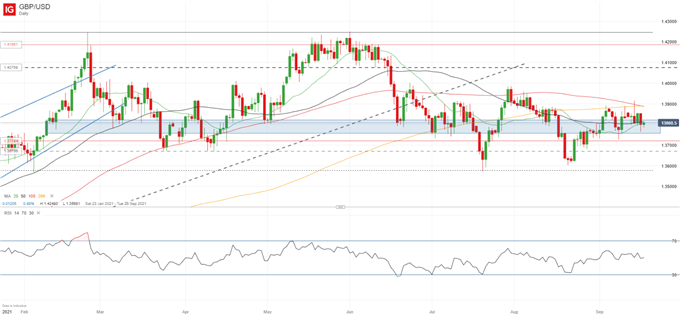

GBP/USD Daily Chart

The current range in GBP/USD in not new, having been touched on in many occasions since the pair crossed the 1.36 line back in February. The bullish impulse of the last few weeks has waned off and the pair is looking rather dull at its current levels, with the RSI confirming a lack of momentum as it stagnates around its mid-point.

The placement of its moving averages suggest some short-term bullishness but the longer-term outlook remains pretty flat and slightly tilted to the downside. GBP/USD price action is going to be largely dependent on the FOMC decision next week, with Dollar pairs expected to be volatile heading into the decision on Wednesday evening. A hawkish Fed would likely see rates pick up, followed by a stronger Dollar, leaving GBP/USD exposed to a bearish reversal towards 1.3720.

UK RETAIL SALES DROP

The UK Office for National Statistics reported this morning that the value of inflation-adjusted sales at the retail level unexpectedly fell 0.9% in August. Sales have been falling since peaking in April when restrictions on shops were lifting, showcasing that spending has lost momentum in the third quarter, raising questions as to whether the Bank of England will start reducing its bond purchases at its meeting next week.

Retail trader data shows 54.36% of traders are net-long with the ratio of traders long to short at 1.19 to 1. The number of traders net-long is 5.79% higher than yesterday and 10.01% higher from last week, while the number of traders net-short is 6.74% lower than yesterday and 15.19% lower from last week.

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin