Bank of Canada, Inflation, USD/CAD Talking Points:

- Loonie strength continues, USD/CAD trading at levels not seen since May 2015

- Bank of Canada remains steadfast in their commitment to 2% inflation target

- Bank of Canada’s recent taper of asset purchases was the fuel for the recent move

USD/CAD traders will be looking to Wednesday’s inflation data for clues as to the pair’s next move. Since the Bank of Canada (BoC) announced a taper of asset purchases last month, USD/CAD has fallen to lows not seen since 2015. The buoyancy in the Canadian Dollar has caught the attention of Canada’s central bank, with Governor Tiff Macklem saying continued Loonie strength may create headwinds for investment and exports in the near future.

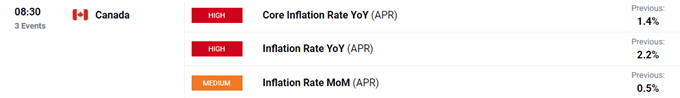

Source: DailyFX Economic Calendar

Loonie outperformance can also be attributed to the rise in the price of oil, as Canada is a large exporter of energy and agricultural products. The Canadian dollar, along with other commodity-linked currencies, has benefitted tremendously from the so-called “commodity supercycle.” But as Gov. Macklem highlighted, a stronger Loonie could drag on export projections, in turn making Canada weaker on a global scale. "If it moves a lot further, that could have a material impact on our outlook and it is something we have to take into account in our setting of monetary policy," Macklem said about the Canadian dollar.

USD/CAD Daily Chart

Chart created with TradingView

Macklem has remained steadfast in his commitment to a 2% inflation target but reiterated at the most recent policy meeting that the country’s benchmark interest rate would remain at 0.25% until inflation targets are met. Despite remaining accommodative in the near-term, policymakers signaled that rate hikes could come as soon as late 2022.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -12% | -6% |

| Weekly | -5% | -5% | -5% |

Despite the success of Canada’s quantitative easing (QE) program in stabilizing the economy, BoC officials have highlighted the role QE has played in widening wealth inequality. Gov. Macklem noted that while the program successfully created jobs and stimulated demand, the value of assets that “aren’t evenly distributed across society” also increased.

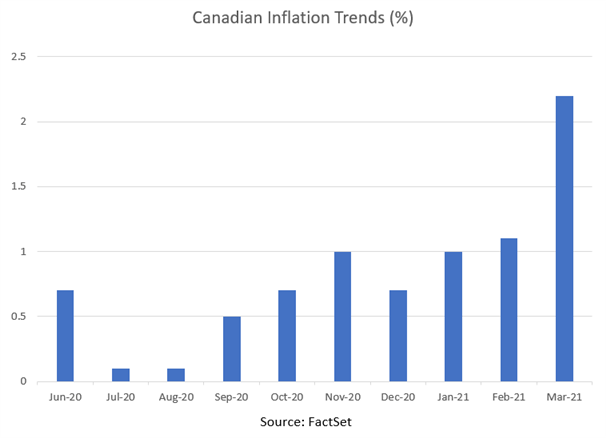

Canadian Inflation Trends

In trimming asset purchases from C$4 billion to C$3 billion per week, the Bank of Canada became the first major central bank to taper its asset purchase program. Should inflation data print above expectations, BoC officials may further revise their monetary policy framework in the form of further tapering or improved economic projections.

--- Written by Brendan Fagan, Intern for DailyFX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter