USD PRICE OUTLOOK: US DOLLAR TURNS HIGHER AFTER RETAIL SALES, CONSUMER SENTIMENT BEAT MARKET EXPECTATIONS

- US Dollar advanced on the back of monthly retail sales and consumer sentiment data

- DXY Index fueled largely by market volatility stemming from fiscal stimulus talks

- USD price action also getting strong-armed by major FX peers like the EUR and GBP

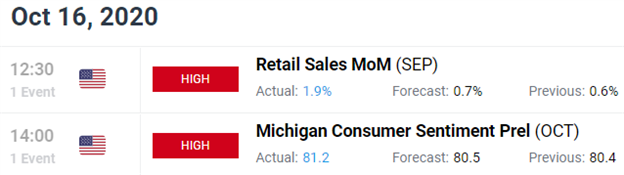

The US Dollar is trying to turn higher with USD price action bouncing off session lows. Monthly US retail sales and consumer sentiment reports just crossed market wires, which both beat market forecast. The broader DXY Index perked up after September retail sales data revealed a 1.9% increase in spending month-on-month. This not only topped economist estimates looking for a 0.7% gain, but it also is a marked acceleration from the 0.6% figure previously reported.

DAILYFX ECONOMIC CALENDAR - US RETAIL SALES (SEP) & CONSUMER SENTIMENT (OCT)

Chart Source: DailyFX Economic Calendar

Preliminary consumer sentiment data increased sequentially from 80.4 to 81.2, which topped market expectations as well. Despite market volatility stemming from fiscal stimulus and election uncertainty, the improvement in consumer sentiment could be boosting the US Dollar against major counterparts like the Euro and Pound Sterling, which have recently faced headwinds due to mounting coronavirus concerns and the latest Brexit drama.

| Change in | Longs | Shorts | OI |

| Daily | -19% | 24% | 0% |

| Weekly | -4% | 4% | 0% |

Nonetheless, USD price action still trades on its back foot today judging by the broader US Dollar Index. The DXY Index has struggled to reclaim the 94.00-price level underpinned by August swing highs and last month’s closing range. A bearish trend line extended through the string of lower highs notched on 19 March, 15 May and 25 September also has potential to keep the US Dollar under pressure.

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (22 APR TO 16 OCT 2020)

Chart by @RichDvorakFX created using TradingView

The 50-day simple moving average and month-to-date lows stand out as possible layers of defense that could stymie USD selling. Breaching this technical support zone could encourage US Dollar bears to push the Greenback toward multi-year lows again near the 92.10-mark. Conversely, eclipsing the 94.00-handle might motivate bulls to have a quick look at last month’s swing high before the 96.00-level comes back into focus.

That all said, it appears that market sentiment, which seems to hinge largely on fiscal stimulus negotiations, is one of the bigger drivers steering the US Dollar. Growing odds of a democratic sweep this November increases the potential for a larger coronavirus aid package early next year. In turn, this might keep USD price action bogged down. On the other hand, a resurgence of investor uncertainty around fiscal stimulus and the upcoming election might send the S&P 500-derived VIX Index snapping higher, which could correspond with a rise by the broader US Dollar.

Keep Reading: S&P 500 Bolstered by VIX Compression as Election Fear Fades

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight