MARKET DEVELOPMENT – GBPUSD Outperforming, US Dollar Bounces on Retail Sales

DailyFX 2019 FX Trading Forecasts

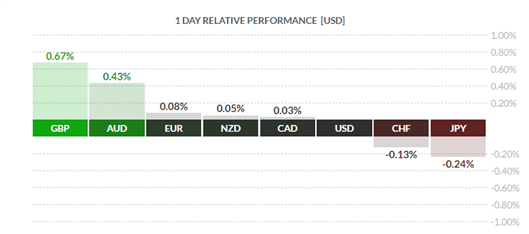

GBP: Outperformance in the Pound this morning following a surprise lift in UK retail sales (headline monthly figure 0.2% vs. Exp. -0.2%). Alongside this, much of the gains in GBPUSD have stemmed from cross related selling seen in EURGBP, which has made a break below the 0.9200 handle. With Brexit uncertainty continuing, gains are likely to be modest at best. Elsewhere, Jeremy Corbyn has called out for leaders and Tory rebels to back his plan for a no-confidence in the government, however, this appears to be a tall order for Corbyn with the Lib Dem leader stating that they will not support his plan.

USD: The US Dollar has pared earlier losses following a strong US retail sales report, potentially reducing some concerns of an imminent recession. US retail sales control group rose 1% above expectations of 0.3%, which in turn is likely to boost various GDP trackers given the sizeable weighting that the retail sales data has.

NOK: The only hawkish central bank in the G10 complex reiterated that ongoing tightening in 2019 is appropriate. However, the Norges Bank did cite increasing downside risks pertaining to the recent trade war escalation, which in turn saw the NOK take a slight hit as the Norges Bank refrained from explicitly mentioning a September rate hike in order to provide some flexibility with the regard to another rate hike.

Source: Finviz

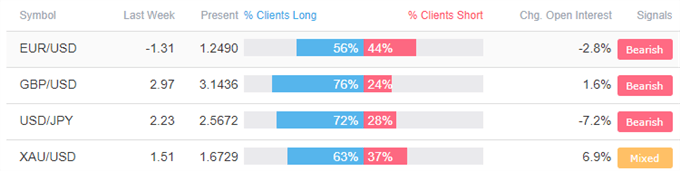

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “FTSE 100 Price Outlook: Test of ’The’ Bull Market T-line May Come Soon” by Paul Robinson, Currency Strategist

- “Gold Price Surveys Multi-Year High, Silver Price Bullish Consolidation” by Nick Cawley, Market Analyst

- “S&P 500, US Dollar, Gold, Emerging Market Outlook: What Happens After US Yield Curve Inverts?” by Justin McQueen, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX