Gold (XAU) Price, Silver (XAG) Price Analysis and Charts

Q3 2019 Gold Forecast and Top Trading Opportunities

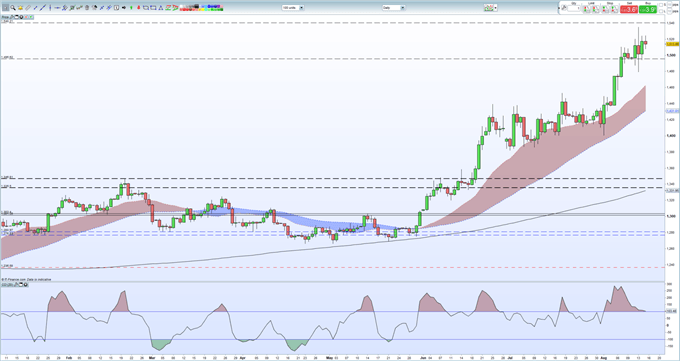

Gold Momentum Remains In-Play

Gold is likely to make a fresh attempt at Tuesday’s $1,535/oz. high in the near-term and may press even further ahead as fundamental positives line-up. Wednesday’s bond market moves re-affirmed market fears of a recession on the horizon, and not just in the US, driving investors back into safe-haven assets including JPY, CHF and gold. While the precious metal sold-off on Tuesday, after US President Trump announced he was delaying some Chinese tariffs, it has pulled back higher and a break above $1.524/oz. opens the way back to $1,535/oz. followed by $1,540/oz. The latter target is a re-fill of a gap on the April 8, 2013 weekly candle. Beyond here the charts point to the $1,617/oz. - $1,622/oz. zone. Support between $1,494/oz. and $1,500/oz. Buying any asset is psychologically difficult when they approach a multi-year high, but it remains the case that bulls continue to control gold.

Gold Price Weekly Forecast: Bullish Breakout Remains In-Play

Gold Price Daily Chart (January - August 15, 2019)

IG Client Sentiment data show that 63.3% of retail traders are net-long of gold, a bearish contrarian indicator. However, recent daily and weekly positional changes give us a mixed trading bias.

How to Trade Gold: Top Gold Trading Strategies and Tips

Silver – Short-Term Volatility

After touching a new 19-month high of $17.50/oz. on Tuesday, silver has sold off, but like gold remains positive. A break of the Tuesday peak brings the January 25, 2018 horizontal high around $17.70/oz. into play before the September 8, 2017 high at $18.21/oz. appears. Support between $16.65/oz. and $16.80/oz. Market volatility has picked up and needs to be monitored.

The gold/silver ratio remains steady around 88.10.

Silver Daily Price Chart (July 2018 – August 15, 2019)

How to Trade Silver: Top Trading Strategies

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.