US Dollar and Consumer Sentiment - Talking Points

- The June UofM Consumer Sentiment reading of 97.9 slightly missed expectations of 98.0

- US Dollar continues reverse higher on the back of upbeat retail sales data overshadowing Fed rate cut bets

- Tariffs weigh on sentiment as trade war worries linger, cited by 40% of respondents in survey

The University of Michigan Consumer Sentiment Index’s June update printed a reading of 97.9 Friday morning, missing expectations as consumer angst increases over the ongoing trade tensions. While the data was collected before the US and Mexico landed a deal to avoid tariffs, the majority of consumer concerns lied with the trade war between the US and China which has shown no signs of a deal being reached in the near future.

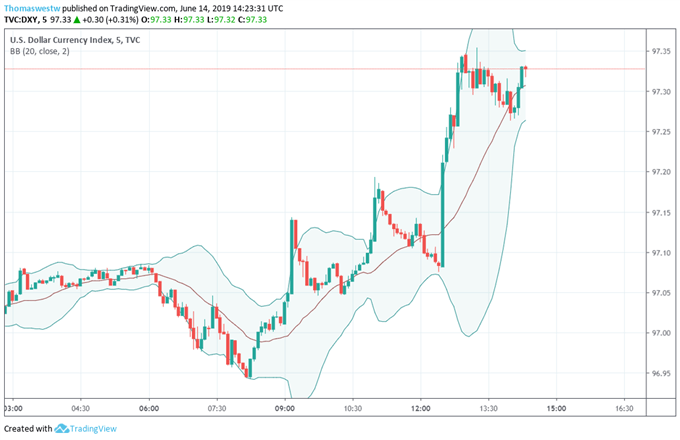

The US Dollar had a muted reaction to the UofM report, likely overshadowed by this morning’s retail sales, which indicated that consumer spending remains robust. The DXY Index made a move from $97.08 to $97.35 on the retail data release before starting to slightly ease to $97.27. Although, the UofM consumer sentiment data did seem to bolster the index up to 97.33.

DXY US DOLLAR INDEX PRICE CHART: 5-MINUTE TIME FRAME (JUNE 14, 2019 INTRADAY)

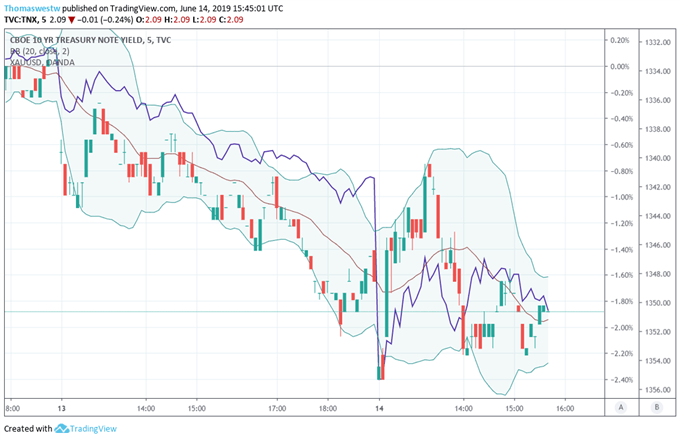

Treasury yields dipped slightly on the report, continuing an early morning move with the 10-year dipping from 2.11 to 2.08. The UofMich survey revealed that long-run consumer inflation expectations of 2.2% touched its lowest on record in the 40 years the survey data has been collected. Consequently, investors worry that falling inflation expectations could push the Fed to cut rates.

The US trade war with China – one of the dominating macro themes impacting consumer sentiment – is reinforced in today’s report with negative mentions of tariffs being made by 40% of respondents which compares to only 21% last month. Gold continues to gain ground on the back of rising safe-haven demand and expectations for a Fed rate cut bet. Overnight swaps are currently pricing a 97.7% chance that the FOMC will lower its policy interest rate by year end.

TNXCBOE 10 YR Treasury Note Yield, XAUUSD (Inverted) PRICE CHART: 5-MINUTE TIME FRAME (JUNE 14, 2019 INTRADAY)